Help & support

Banking products and services, tailored industry solutions and powerful tools to help your business thrive.

We have a range of solutions and initiatives tailored for kids, teens, students and young adults.

Whether it's a permanent move or a working holiday, we have products, teams, guidance and tools to make your move easier.

Travel essentials to help make your holiday a once-in-a-lifetime experience.

Get instant help from Ceba in the CommBank app or connect with a specialist who can message you back. You’ll need CommBank app notifications turned on so you know when you’ve received a reply.

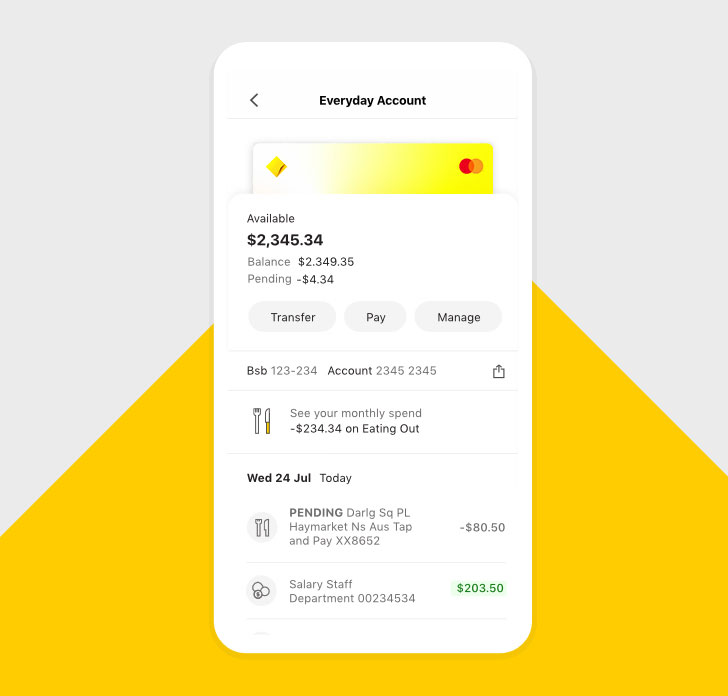

With the CommBank app, you’ll have access to a range of features to help you manage your money:

Manage your money and cards, set savings goals, check your balance, manage bills, schedule payments and check your online statements plus more.

Use the CommBank app to tap and pay, or choose from our range of digital wallets -

Apple Pay, Google Pay or Samsung Pay. Link your eligible CommBank debit or credit card.

Deposit, withdraw and transfer money instantly from any CommBank ATM and branch across Australia, or message us in the CommBank app.

Enjoy exclusive partnership offers

Available for CommBank customers only, you can save on property management, utilities, mobile plans and internet for your home, as well as other everyday purchases.

Track and manage your spending with Spend Tracker

Stay on-track with your debit and credit card spending in the CommBank app.

Goal Tracker. With you when you want to save.

In the CommBank app with a NetBank Saver or GoalSaver account in your name only.

The target market for these products will be found within the product’s Target Market Determination, available here.

As the advice on this page has been prepared without considering your objectives, financial situation or needs, you should, before acting on the advice, consider its appropriateness to your circumstances. Terms and conditions are available here and should be considered before making any decision. Fees and charges may apply.