Help & support

CommSec has been awarded Money magazine’s Best-Value Feature-Packed Bank Online Share Broker for the 17th year in a row.

Whether you’re starting out or an experienced investor, see how you can get more value from trading with us. Take advantage of our great range of benefits, including our mobile app so you can trade on the go and cutting-edge research for investment ideas.

Get up-to-date market, industry and economic commentary from the CommSec experts, products to help you diversify and support if you need it.

CommSec is Australia's No.1 online broker and has been helping investors reach their goals for more than 20 years. Sign up for access to the tools and support you need to trade with confidence.

CommSec's online platform makes information quicker and easier to understand and the mobile and tablet apps let you trade on the go.

Commonwealth Bank customers can be trading with CommSec in just minutes using their NetBank log on.

Link a Commonwealth Direct Investment Account (CDIA) to your CommSec Trading Account to benefit from low brokerage costs and settle your trades with ease.

Whether you’re just starting your investment journey or looking to brush up on your skills, CommSec Learn will help build your investment knowledge for free.

Whether you’re just starting your investment journey or looking to brush up on your skills, CommSec Learn will help build your investment knowledge for free.

Simply log in, tap the ‘Investing’ tile from your app dashboard or Library and select CommSec Australian Shares.

Want to start investing but not sure where or how to start?

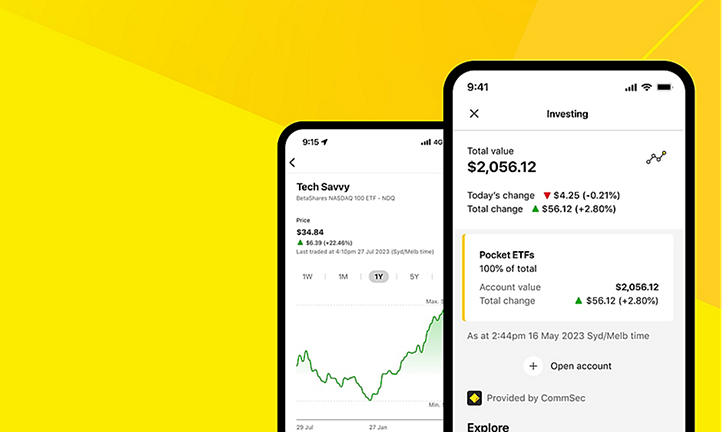

Invest anywhere, anytime with CommSec Pocket. Start with as little as $50 and choose from 10 themed Exchange Traded Funds (ETFs).

Under 30 and looking to build your investing confidence?

Access CommSec Stock’d for tips and tools on where to start, like choosing a stock, understanding the market and investing in a way that works for you.

CommSec’s expert team keeps you up to date with live share market news and reports, videos, stock prices and trends.

Get daily economic insights and find out what’s moving markets.

Take me to CommSec market news

CommSec Learn is intended to provide general information of an educational nature only. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice. Investors should consult a range of resources, and if necessary, seek professional advice, before making investment decisions in regard to their objectives, financial and taxation situations and needs because these have not been taken into account. Any securities or prices used in the examples given are for illustrative purposes only and should not be considered as a recommendation to buy, sell or hold. You can view the CommSec Share Trading Terms and Conditions our Financial Services Guide and should consider them before making any decision about these products and services. Past performance is not indicative of future performance.

* ”$0 brokerage on your first 10 trades” offer only available to new CommSec customers opening a new individual Australian Share Trading Account & Commonwealth Direct Investment Account (CDIA) between 1 February 2024 to 30 April 2024 via the ‘Join now’ link at www.commsec.com.au/offer or through the CommBank App. Offer applies if you trade online, are CHESS-sponsored by CommSec and settle your trade through your CDIA. This offer does not apply to CommSec Pocket trades, International Share trades, Exchange Traded Options or Margin Lending. Offer not valid in conjunction with any other offer and not open to existing CommSec customers. As part of the offer, you will receive $0 brokerage on your first 10 Australian equity trades, up to a maximum trade value of $50,000 each for orders placed on or before 31 July 2024. Standard CommSec brokerage charges apply for orders placed or amended after 31 July 2024. Trades above $50,000 will incur brokerage charges. For CommSec standard brokerage charges, see the CommSec Financial Service Guide. No brokerage fee will be shown on the CommSec Confirmation Contract Note issued in respect of applicable trades under this offer. This offer is not redeemable for cash and is not transferable. CommSec Share Trading Terms and Conditions apply unless otherwise specified here. Applicants must be 18 years or over. We reserve the right to terminate this offer or amend these terms and conditions at any time without notice. For any queries on this offer, please contact us on 13 15 19.

© Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited (formerly CHI-X Australia Pty Limited), a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited. Commonwealth Direct Investment Account is a product of the Bank and is marketed by CommSec. As this information has been prepared without taking into account your objectives, financial situation or needs you should, before acting on this information, consider its appropriateness for your circumstances. Please consider the full terms and conditions which are available on request. Fees and charges apply.