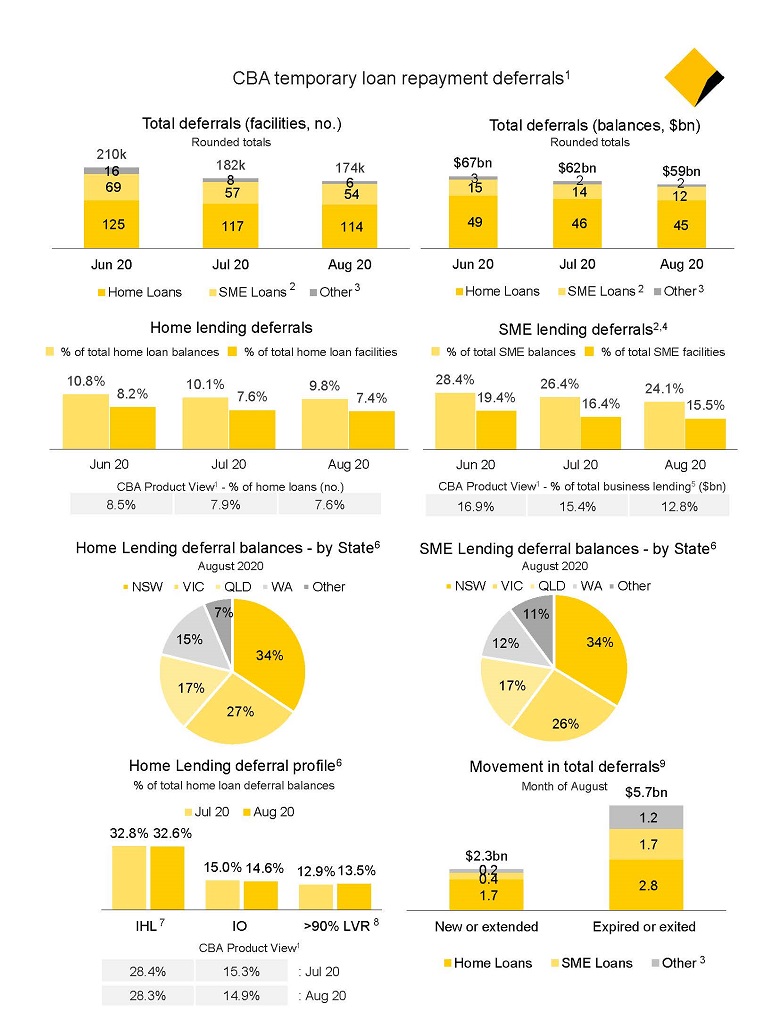

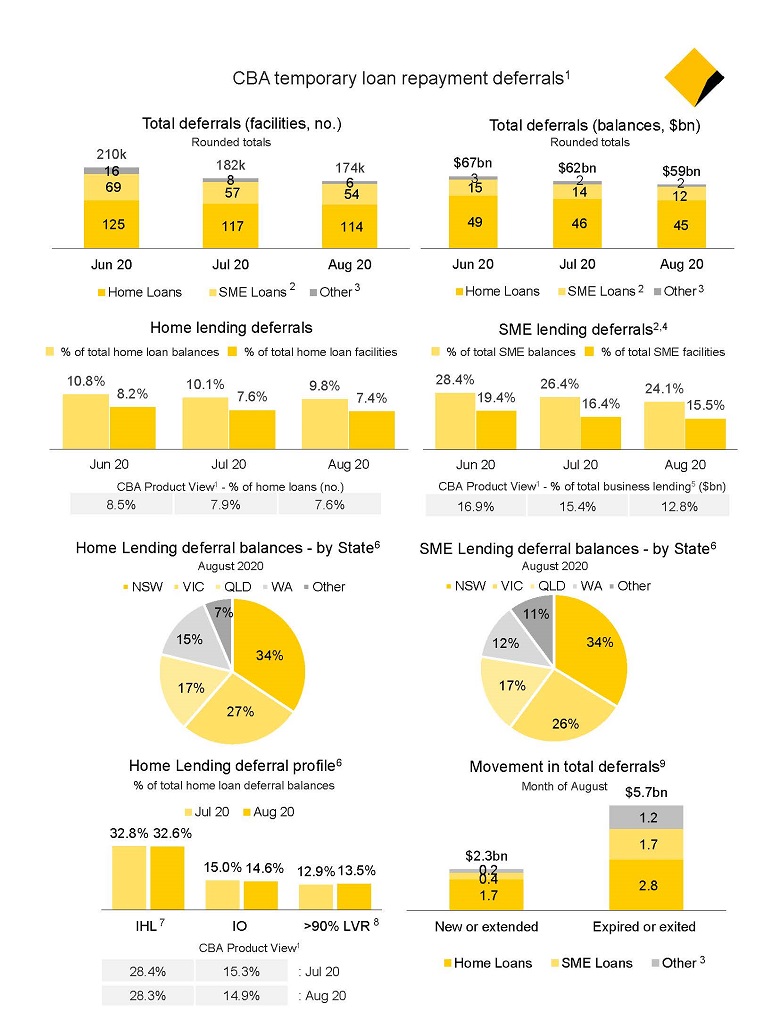

- Total loan deferrals (no.) of 174,000, down from 182,000 in July and 210,000 in June

- Total loan deferrals (balances) of $59bn, down from $62bn in July and $67bn in June

- Home loan deferrals (no.) 7.4% of the portfolio, down from 7.6% in July and 8.2% in June

- Home loan deferrals (balances) 9.8% of the portfolio, down from 10.1% in July and 10.8% in June

- SME loan deferrals (no.) 15.5% of the portfolio, down from 16.4% in July and 19.4% in June

- SME loan deferrals (balances) 24.1% of the portfolio, down from 26.4% in July and 28.4% in June

- For home loan deferrals (that receive capital concession), 32.6% are investment loans, 14.6% are interest only and 13.5% have an LVR >90%

- Expired or exited loan deferrals of $5.7bn in the month of August

- New approved or extended loan deferrals of $2.3bn in August, with $1.7bn of these an extension of an existing deferral

Commenting on the Bank’s temporary loan repayment deferrals, Commonwealth Bank CEO, Matt Comyn said: “Since the onset of the pandemic, our priority has been to do what we can to assist our customers in managing the challenges of COVID-19, including providing temporary loan repayment deferrals on approximately 250,000 home, personal and business loans. As we approach the end of the initial deferral periods, we have been contacting all customers with deferred loans to talk with them about their options, including returning to full or part payment, or converting their loans to interest only. Many of those contacted will be able to recommence their repayments. For customers who are facing financial hardship, we are reaching out to offer solutions tailored to their individual needs.”

Footnotes

- COVID-19 temporary loan repayment deferral data reported to APRA is based on the domestic lending book with segmented reporting for housing and SME lending (defined as lending to clients with total loan facilities up to $10m). Data is categorised and reported based on predominant loan purpose, which differs to a product-based categorisation (‘Product View’) used in the preparation of the Group’s financial results. Together with other definitional and classification differences noted against specific metrics and as outlined in footnotes below, this results in some differences in reported deferral numbers relative to APRA reporting. For reference, key metrics under both APRA reporting definitions and the CBA “Product View” are shown where relevant.

- SME Government Guarantee loans are excluded from SME loan deferral totals from July 2020.

- ‘Other’ includes home loans with a predominant personal purpose and non-SME business loans (>$10m).

- CBA’s relatively high proportion of SME loans in deferral reflects the Bank’s pro-active auto-deferral of SME loans where customers had borrowing limits up to $5m.

- Total business lending deferral balances as a percentage of total business lending balances (including exposures >$10m, ex Institutional Lending).

- Excludes loan deferrals that do not receive capital concession.

- Per APRA’s EFS data collection, ‘Investment housing loan’ refers to a loan to a household for the purpose of housing where the funds are used for a residential property that is not owner-occupied and is not the principal place of residence.

- Current LVR as per APS112 definition. This differs from Dynamic LVR numbers reported in the Group’s financial results, which reflect collateral values updated monthly. August increase reflects limited exits from deferrals from the higher LVR segment.

- New or extended loan deferrals include deferrals where an extension has been granted in the month. Expired or exited deferrals include deferrals exited in the month or where an extension has been granted in the month.

Important information

The material in this announcement is general background information about the Group and its activities current as at the date of the announcement, 01 October 2020. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. Investors should consult with their own legal, tax, business and/or financial advisors in connection with any investment decision.