Help & support

Understand the goals and strategies behind successful property investment.

Buying and managing two or more investment properties may be easier than you think.

There are important costs to consider outside of your deposit and home loan repayments.

Take a look at your current financial situation and work out what you may be able to afford to borrow for an investment property.

We’ve created a webinar to take you through the foundations of investing in property, helping you take the first step.

Your complimentary Property & Suburb Reports provide the latest information on new listings, auctions, recent sales and suburb profiles to help you make informed property decisions. You can access them for free when you book an appointment with one of our Home Lending Specialists.

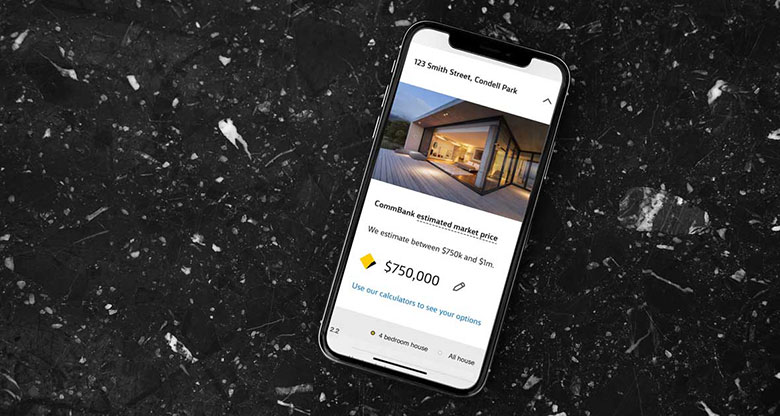

The CommBank My Property experience in NetBank and the CommBank app provides personalised property insights that change dynamically over time, allowing you to track and manage your property portfolio, explore your options and plan for the future

Understand your equity position and how it’s determined based on your property’s value and home loan balance, and work out what you can afford with our home loan calculators.

If you’re already a home owner, you may be able to use equity to invest in a second home.

Understand what negative gearing is, the benefits and risks that come with it.

Your rental income strategy will play an important role in choosing a property.

CommBank Property and Suburb Reports can help you make more informed property decisions.

CommBank has partnered with Home-in, your personal home buying concierge to help simplify your property investment purchase. Helping you at every step, from pre-approval to shortlisting properties, conveyancing and settling on your loan.

Find your perfect property sooner with market estimates and affordability snapshots.

There are different types of investment loans that can help you achieve different results.

Whether it’s your first investment property or your fourth, we’ve got a wide choice of loan products and different repayment options to suit your individual needs.

Get instant help from Ceba in the CommBank app or connect with a specialist who can message you back. You’ll need CommBank app notifications turned on so you know when you’ve received a reply.

Book instantly to speak to a Home Loan Specialist at a time that suits you.

Redraw, change your repayments or loan type to better meet your needs and more.

Fast-track your call, see expected wait times and connect with a specialist in the CommBank app.

Get instant help from our virtual assistant or chat to a specialist.

Subject to credit approval. Fees, charges, terms and conditions apply. As this advice has been prepared without considering your objectives, financial situation or needs, you should consider its appropriateness to your circumstances before acting on the advice.