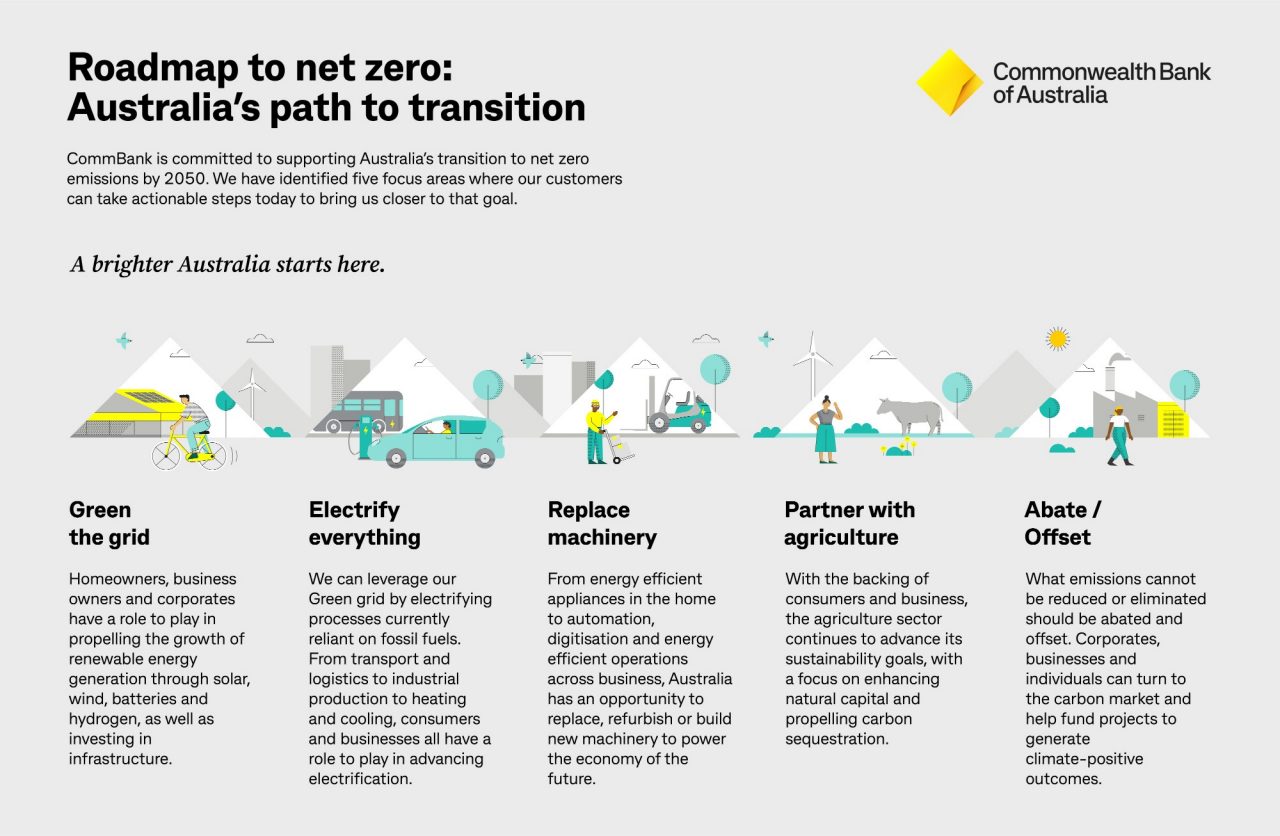

A greener grid is crucial to a greener future. Federal government data show that nearly a quarter of Australia’s electricity was generated from renewable sources in 2020 – but our sunburnt, windswept country can do better. This is why we are supporting customers at the retail, business and institutional level in their pursuit of renewable power generation - whether putting solar panels on your home, purchasing a battery for your business or developing utility-scale renewable generation infrastructure.

Alongside that effort needs to come a wholesale push to electrify absolutely everything. The investment in low-cost renewables pays dividends only when we use that cheap, green power to drive processes currently reliant on fossil fuels. From the bus that takes you to work, to the forklift at the warehouse, electrifying these everyday tools and processes will rebase the cost of our economy and give us a massive advantage.

To make better-informed decisions, everyone from consumers and businesses to institutions needs the ability to reliably and inexpensively measure their emissions profile. We at CBA are tackling this challenge by partnering with leading Australian institutions and companies to deliver solutions for our clients. This includes our partnership with CoGo providing retail customers with the opportunity to measure their carbon footprint.

Understanding the size of our carbon footprint, as well as what’s driving it, can help us find opportunities to reduce emissions. One area that’s ripe for the taking is the machinery that powers our economy. Replacing outdated equipment with more efficient, automated, digitised machinery and processes presents a meaningful opportunity to make our country both greener and more productive. This can be done at all levels, whether upgrading your clothes dryer or the office elevator.

We also have an opportunity to review our land-use mix and continue to support the agriculture sector with its sustainability goals, particularly around natural capital enhancement and carbon sequestration. This transition is already underway with the backing of consumers, farmers, and business. We’re working closely with our regional and agribusiness customers to understand their needs and transition plans, and support them with sustainable finance products that help achieve those goals.

Once we’ve worked out what can be stopped, what can be substituted, and what can be reduced, we’re left with emissions that need to be abated and offset. Here, a liquid and transparent carbon credit market is crucial. This is why we’ve partnered with leading commodities marketplace Xpansiv to help develop Australia’s carbon market.

It will absolutely take coordinated, collaborative action to help Australia achieve its net-zero commitment. We hope our system-wide approach captures how everyone from individuals, businesses, industry and government can participate in the climate transition.

As we look to COP27 and beyond, we look forward to working with all of you on advancing Australia’s transition to ensure our nation can capitalise on the immense opportunities a net-zero world will bring.

This article was originally published in The Australian Financial Review (Nine Publishing) on 8th March 2022.

Sally Reid is Executive General Manager, Global Client Solutions in our institutional bank. She is responsible for the management of the global client coverage teams, sustainable finance team and the transaction banking solutions team.

We’re here to support your sustainability journey

Discover our tools and tailored solutions to help you and your business towards a more sustainable future.

Visit sustainability hub