Our Accessibility and Inclusion Strategy 2024–2026 (PDF) sets out our goal to design inclusive products, services, experiences and workplaces that provide equitable access and dignity for all our customers, people and communities. We call this ‘dignity by design’.

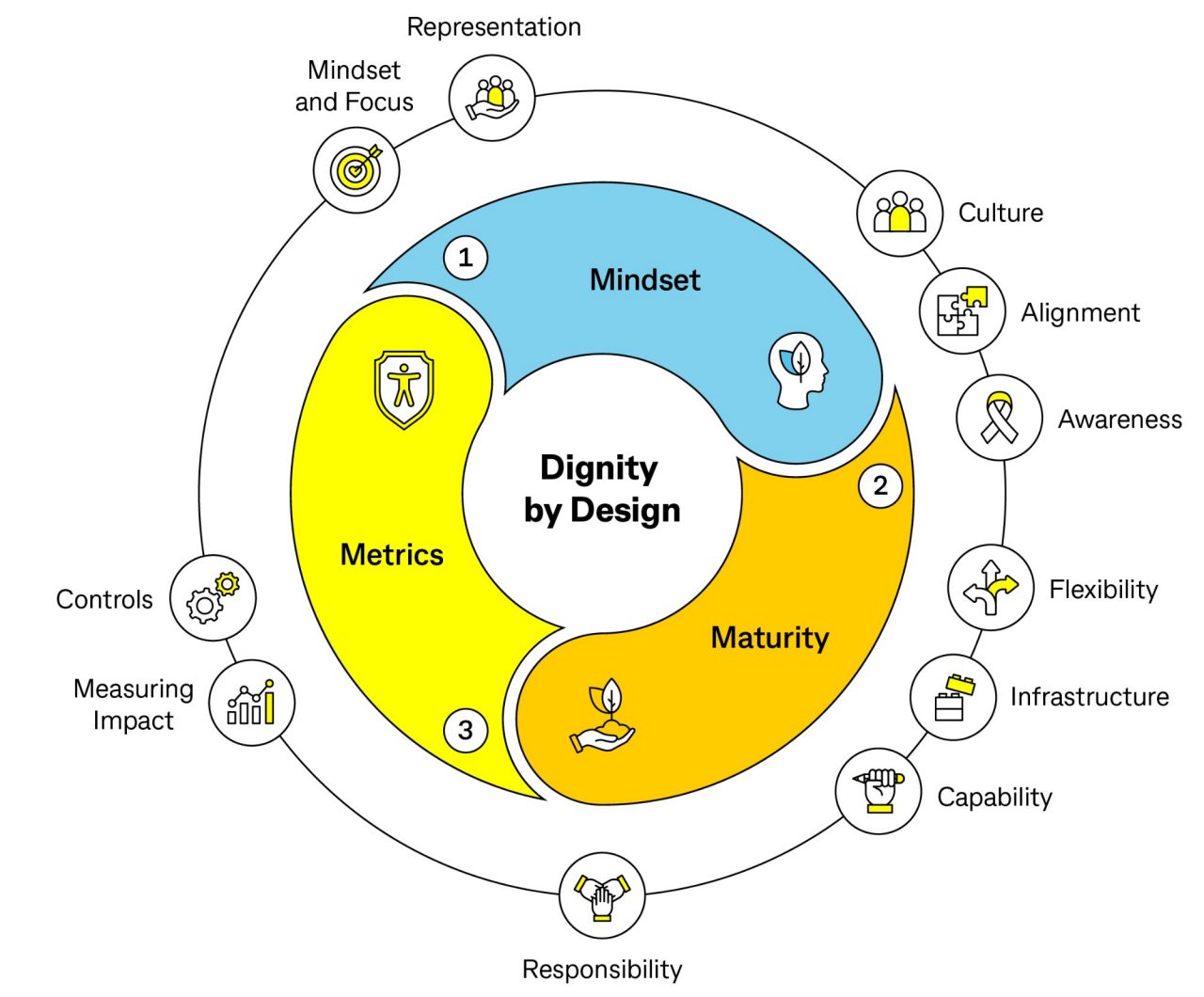

To guide us, we have developed a strategic ecosystem with three core pillars – mindset, maturity and metrics:

- Mindset: foster an environment that embodies genuine inclusivity and disability confidence

- Maturity: enable and expect our people to integrate accessibility principles into their work

- Metrics: have appropriate controls and measures in place to safeguard our commitment to accessibility and inclusion.

11 strategic focus areas connect to each core pillar. Each of these areas describe where we focus our efforts and help guide the initiatives we are delivering over 2024–2026.