Help & support

Here are some of our top banking tools designed to set you up for success, created with the needs of our neurodiverse customers in mind.

These tools are available to our customers. As we all process information in different ways, feel free to try them if you think they might help you.

Our goal is to deliver dignity by design with inclusive products, services, experiences and workplaces that provide equitable access and dignity for all our customers, people and communities.

Check this page regularly for the latest updates on tools and other services designed to support neurodiverse people.

Our branches are equipped to welcome you and support your needs.

What we can offer:

We’ve prepared some information to help you feel at ease when visiting one of our branches.

What we can offer to help you bank more comfortably.

Use our Customer Preference Card or tell our branch staff so we can support your specific needs.

What we can offer:

Practical tools that can help with needs such as motor and visual processing challenges.

Some of our tools:

The Hidden Disabilities Sunflower is an easy way to voluntarily share a disability or condition that isn’t immediately visible.

CommBank staff can assist customers wearing a Sunflower symbol.

Hear from our customers who experience neurodivergence in different ways as they share their banking journeys. Their stories show the supports that help them feel confident and how inclusion can make a positive difference.

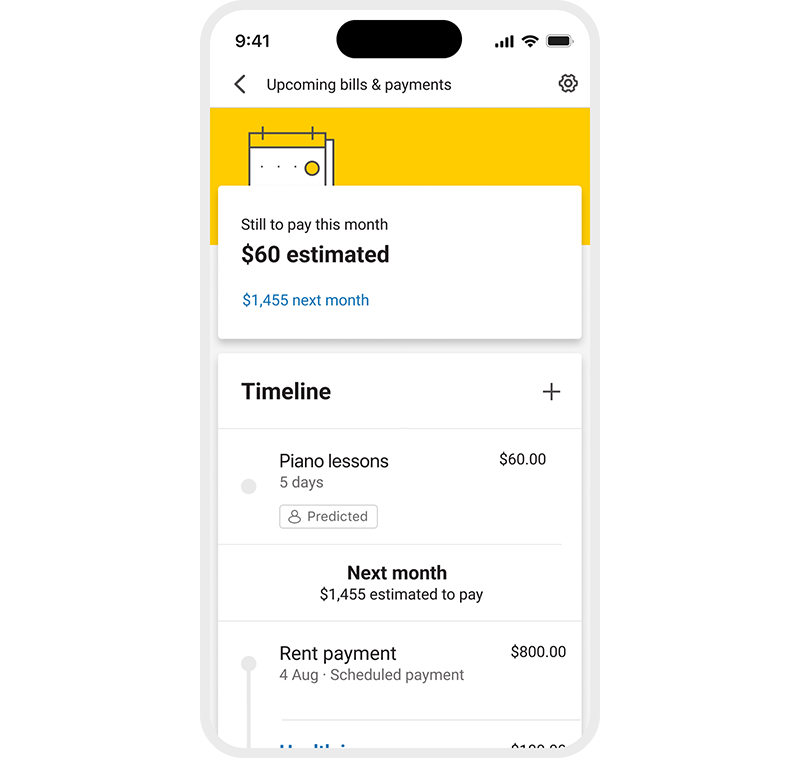

Tom shares how setting up systems helps him stay on top of his payments.

(video length 3 mins)

Dani talks about how wearing a Hidden Disability Sunflower helps reduce her anxiety in branch.

(video length 3 mins 41 secs)

Esther explains how the Equal Access Toolkit supports her during branch visits.

(video length 4 mins 11 secs)

Jason shares how CommBank app features help him keep track of spending.

(video length 1 min 31 secs)

Discover how we’re making it easier to bank with us.

When a customer visited one of our branches seeking an easier way to manage their finances, Nicola stepped in to help. Nicola provided a safe and supportive experience by guiding the customer through the CommBank app.

Together they activated transaction notifications, a handy feature that sends real-time updates on account activity. This simple step gave the customer greater visibility and confidence in managing their day-to-day finances.

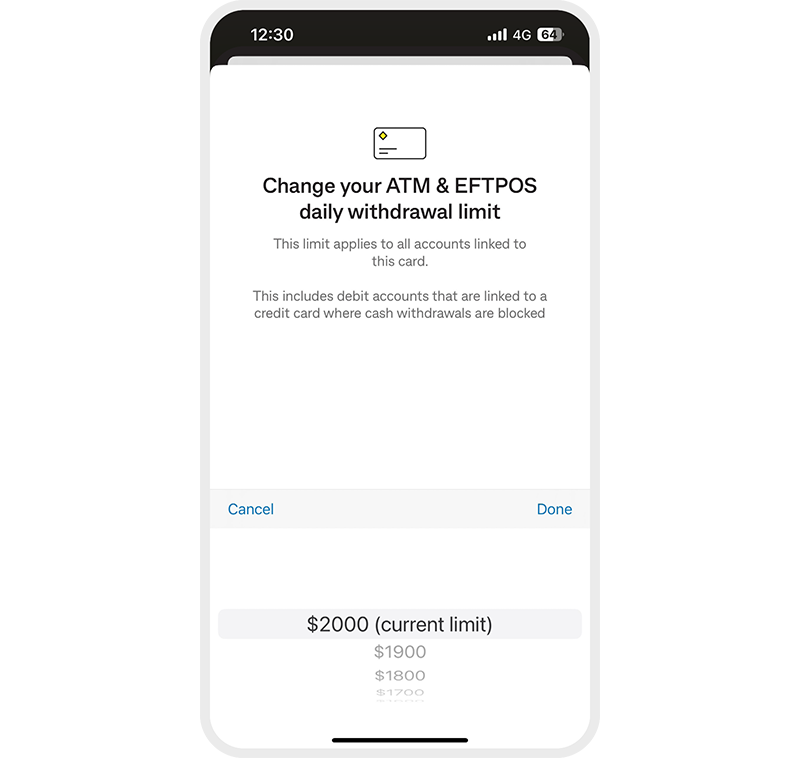

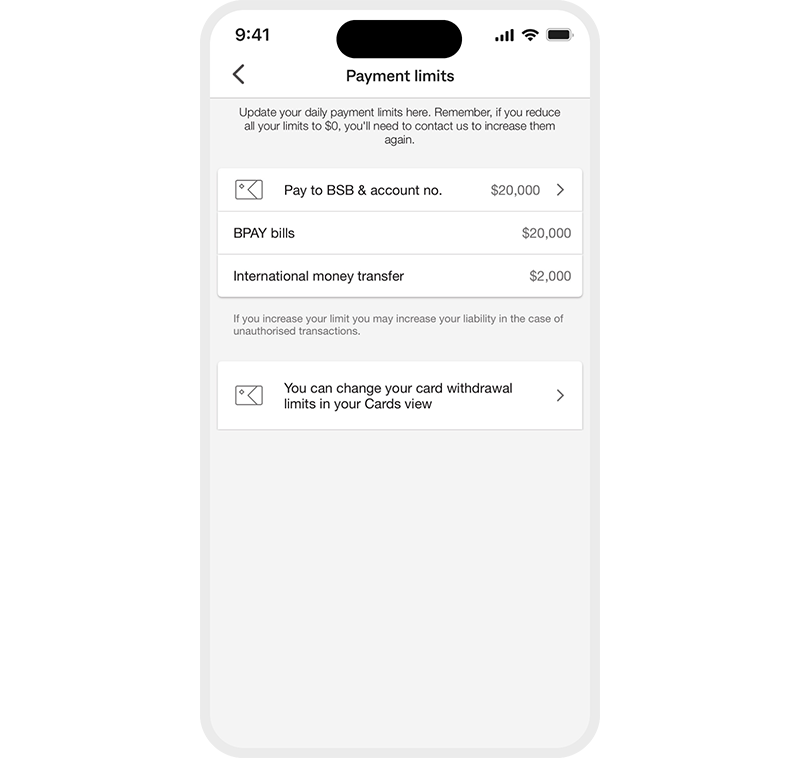

Jasmine supported a customer who finds it difficult to communicate with the bank over the phone and in person. With patience and understanding, Jasmine guided the customer through increasing their daily payment limits using the CommBank app.

By walking through each step clearly, Jasmine helped the customer gain the confidence to manage this task independently. The customer was pleased to have a way to manage this part of their banking on their own. It was a small moment that made a big difference in supporting the customer’s independence and dignity.

When a customer visited one of our branches with their brother, they shared that they were autistic and found banks overwhelming. Recognising the customer’s needs, Gabi created a safe and supportive experience by inviting the customer into a private space to reduce sensory distractions and communicated in clear, simple language. By addressing the customer directly and using their name during the conversation, Gabi ensured they felt respected and at ease.

Gabi introduced the Customer Preference Card from the Equal Access Toolkit, explaining how it would offer the customer consistent support without the need to retell their story. In doing so, this would help to make future visits easier and more comfortable.

Caitlin noticed a customer wearing a sunflower lanyard—an indicator of a hidden disability or condition. The customer appeared nervous while preparing a cash deposit.

Caitlin asked if there was anything she could do to make the experience easier. The customer asked if Caitlin could count their cash for them. This small offer of support made a big difference. The customer felt more at ease, highlighting how awareness and empathy can help create a more inclusive banking experience.

1 There may be certain circumstances where we won’t send you a notification letting you know your account has been overdrawn (e.g. due to a technical failure). Please contact us if you’d like further information about this.

Disclaimer: These stories represent opinions and views of customers’ personal experiences only and has been prepared without considering your objectives, financial situation or needs. Minor details have been modified to protect their privacy. Before acting on this information, consider its appropriateness to your circumstances.

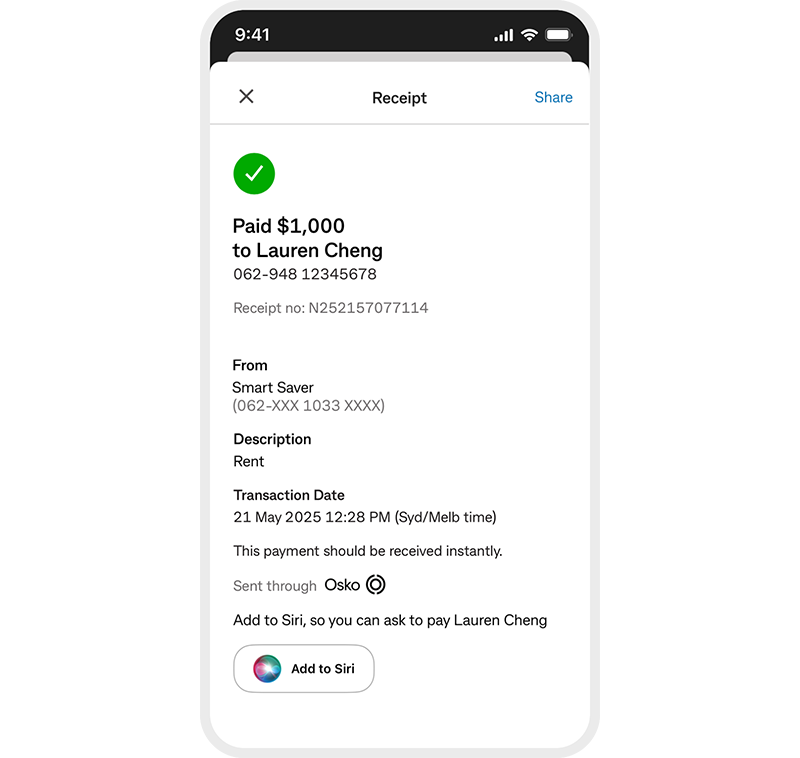

Siri Shortcuts is only available for transfers between your accounts or payments using someone’s bank account details. Not currently available for payments to mobile numbers or for International Money Transfers.

Siri Shortcuts is available on iPhone devices with iOS 15 or later.

We aren’t responsible for any issues with Siri Shortcuts or if Apple make any changes to technology that impacts the way you access the CommBank app.

The target market for this product will be found within the product’s Target Market Determination.

Full terms and conditions available on the CommBank app. The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Terms and conditions are available on the app. NetBank access with NetCode SMS is required.

Apple, the Apple logo, Apple Pay, Apple Watch, Face ID, iPad, iPhone, Safari, and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries.

The advice on this website has been prepared without considering your objectives, financial situation or needs. Because of that, you should, before acting on the advice, consider its appropriateness to your circumstances.

Please view our Financial Services Guide (PDF). Full terms and conditions for the transaction and savings accounts (PDF) mentioned and Electronic Banking (PDF) are available here or from any branch of the Commonwealth Bank.