Help & support

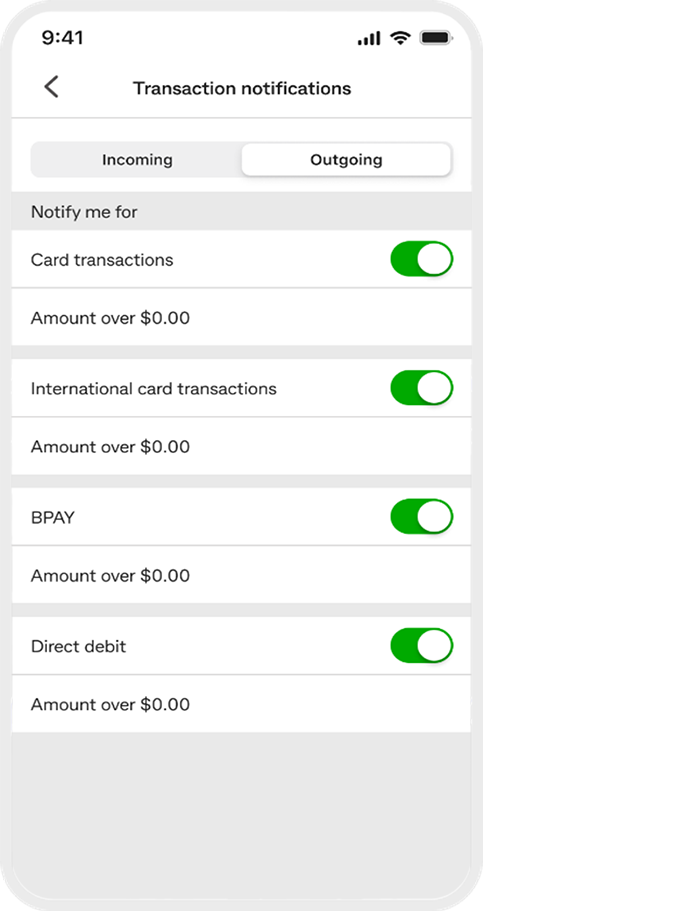

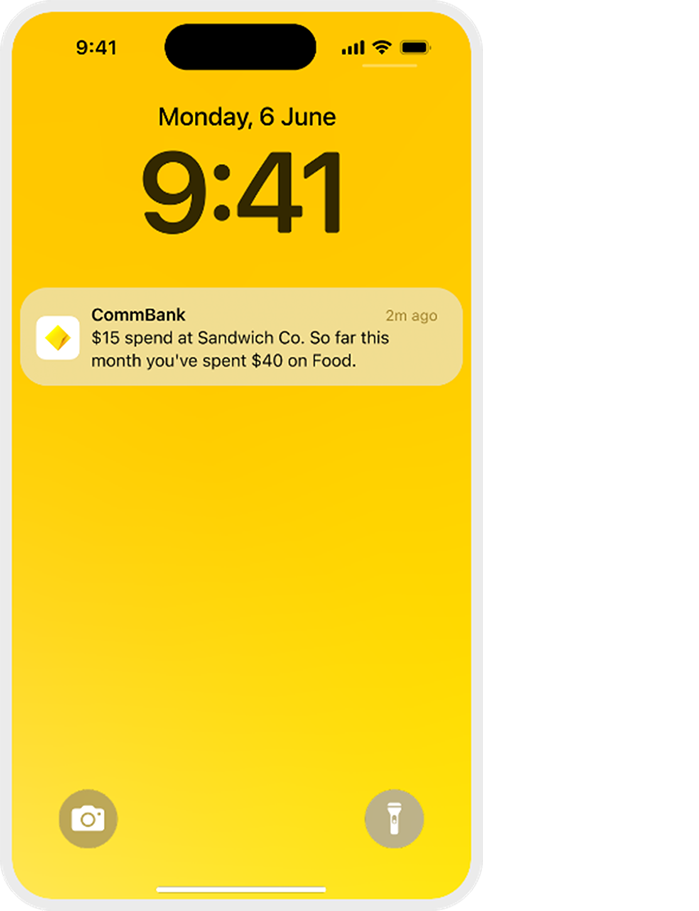

It’s easy to spend money without thinking – in person, online or by direct debit – like that monthly gym membership you’ve forgotten about. Here's how Transaction Notifications work:

Great if you:

New to CommBank? Open an everyday bank account and/or apply for a credit card to start using Transaction Notifications.

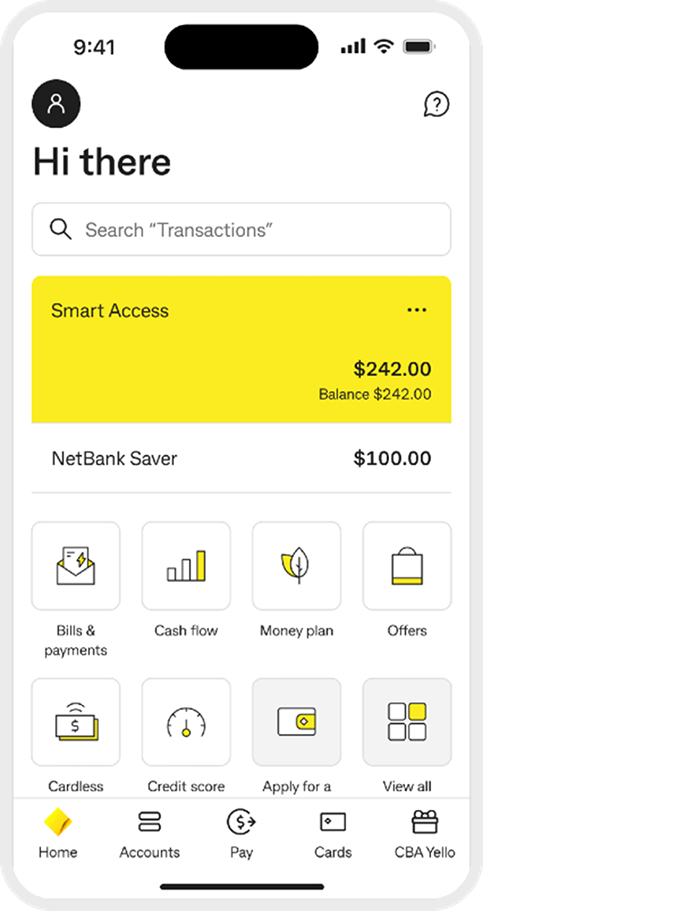

1. Log on to the CommBank app

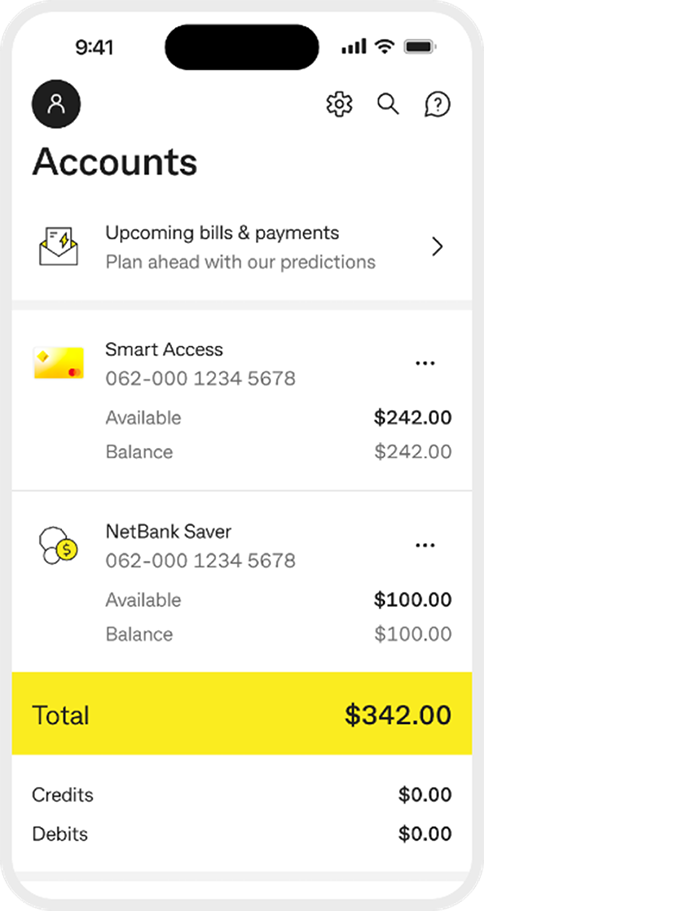

2. Tap ‘Accounts’

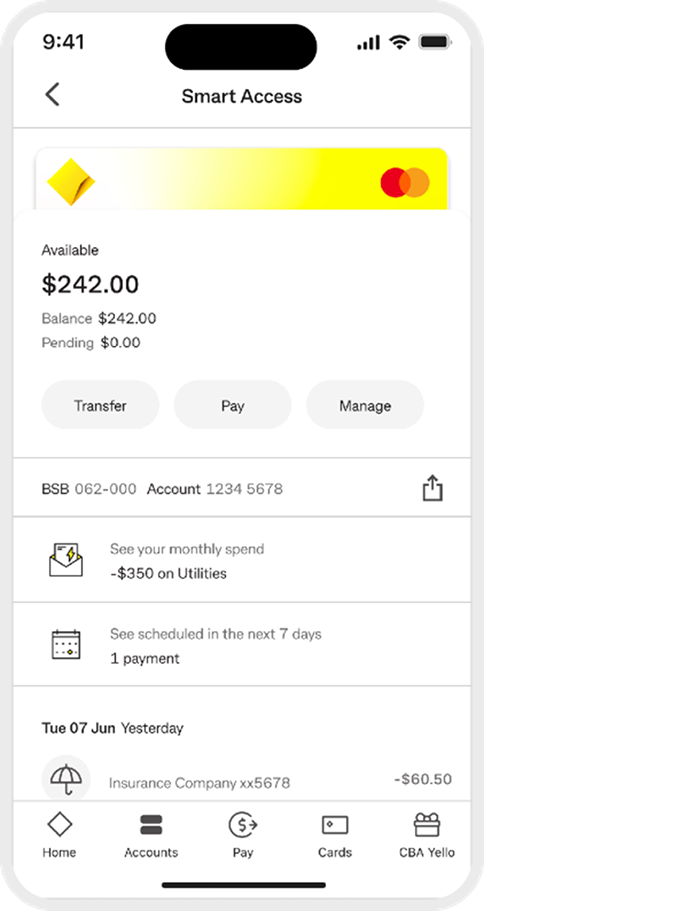

3. Tap your debit or credit card account

4. Tap ‘Manage’

5. Tap ‘Transaction Notifications’

6. Select your notification preferences

You’ll then receive an alert on your phone every time you use your card.

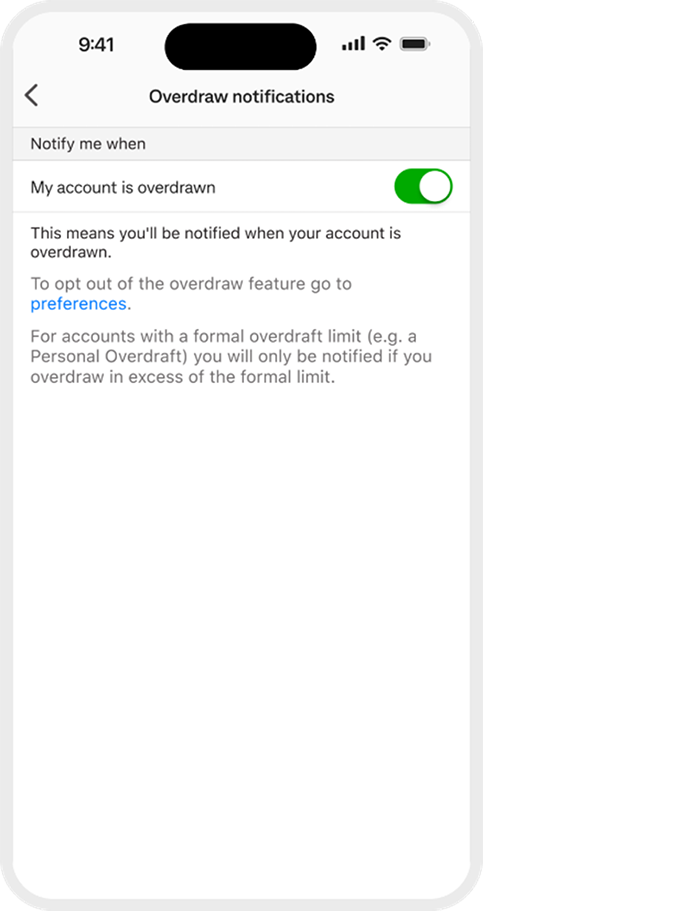

You can also set up a billing and an overdraw alert in NetBank. Log on to NetBank, choose Settings then Notification settings under Profile (you can switch them off in Message preferences under Settings).

Great if you:

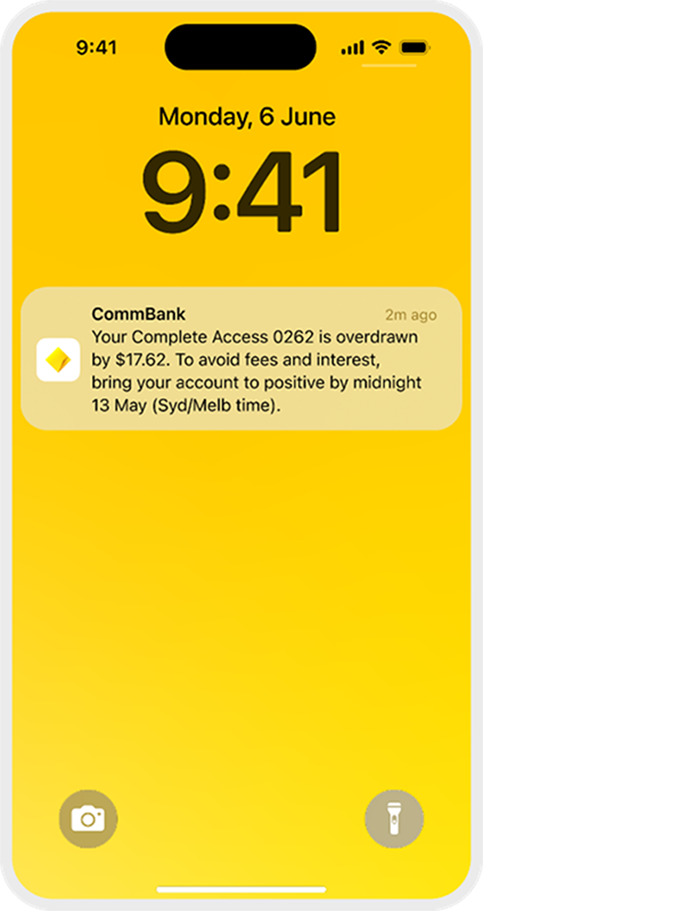

We’ll usually send you an SMS or notification in the CommBank app when your account is overdrawn.1

You just need to choose which account(s) you want to be notified about.

1 There may be certain circumstances where we won’t send you a notification letting you know your account has been overdrawn (e.g. due to a technical failure). Please contact us if you’d like further information about this.

Transaction Notifications are only available in the CommBank app to debit card cardholders of Smart Access, Complete Access, Streamline Basic and Everyday Offset accounts, CommBank credit cardholders with no additional cardholder and Corporate Credit and Charge cards.

The CommBank app is free to download however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Terms and conditions are available on the app. NetBank access with NetCode SMS is required.