Each quarter, CommSec looks at eight key indicators to determine how each state and territory is faring. The current value for each indicator is compared with the decade average, or “normal” level of activity. The eight indicators are:

- Economic growth

- Retail spending

- Equipment investment

- Unemployment

- Construction work done

- Population growth

- Housing finance

- Dwelling commencements

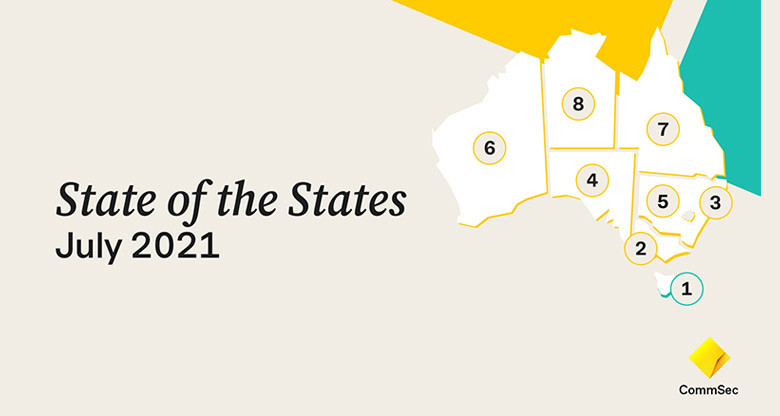

Here’s how the July 2021 quarter turned out

All state and territories have been well supported by highly stimulative fiscal and monetary policies, says CommSec Chief Economist Craig James. Economic activity is solid, especially in construction, while job markets continue to improve.

In relative performance, Tasmania has consolidated its top position well ahead of other economies for the sixth consecutive quarter.

- The success in supressing the Covid-19 virus has meant Tasmania hasn’t been forced to lock down its economy to the same extent as other states, although it has had to close borders.

- There are few signs of Tasmania giving up the position as top performing economy in the next six months.

- There is little to separate the other states and territories, although there remains a gap between seventh position and the Northern Territory economy.

- Tasmania is ranked first on relative population growth, equipment investment, relative unemployment and dwelling starts. It ranks second on retail trade and third on relative economic growth.

- Identifying a challenger to Tasmania’s top position isn’t easy. Queensland is well supported by internal migration that is driving retail spending, plus demand for houses and cars. Its jobless rate stands at a 12-year low.

- Looking ahead, Covid case numbers and vaccination rates, particularly the latter, hold the key to restoring a sense of “normality” and reducing both uncertainty and volatility.

So how did each state and territory fare?

- Tasmania

Strength: Retail trade

Weakness: Relative unemployment - Victoria

Strength: Construction work done

Weakness: Relative population growth - ACT

Strength: Retail trade

Weakness: Relative unemployment - South Australia

Strength: Dwelling starts

Weakness: Retail trade - New South Wales

Strength: Housing finance

Weakness: Relative population growth - Western Australia

Strength: Relative economic growth

Weakness: Construction work - Queensland

Strength: Relative population growth

Weakness: Equipment investment - Northern Territory

Strength: Relative population growth

Weakness: Equipment investment