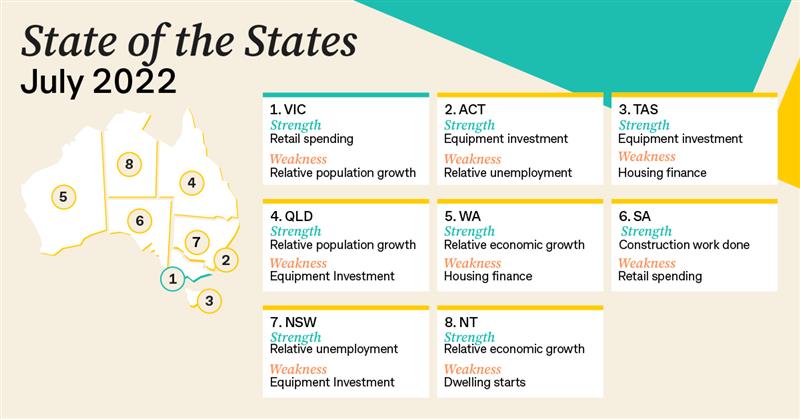

Strong retail spending and a strong job market has set Victoria up as the best performing economy in the nation , unseating Tasmania which has held the crown for the past nine consecutive quarters. The ACT has jumped from equal fifth spot to second on the back of increased equipment investment and Tasmania is now ranked third.

In terms of overall economic growth, Western Australia is the clear leader in large part to a strong resources sector. Economic activity in Western Australia was more than 35% above the decade average. The NT came in second with economic activity up 28.1% on normal and Tasmania was third with a 27.9% rise. South Australia trailed the pack with a 19.9% rise in economic activity above the decade average.

CommSec Chief Economist Craig James said that despite the change in the leader board, very little separates the top four economies. “When looking at annual growth to get a guide on economic momentum, Queensland had annual growth rates that exceeded the national average on all eight of the indicators,” James said.

The CommSec State of the States report uses the latest available information to provide an economic snapshot of each region by comparing annual growth rates for eight key indicators including: economic growth, retail spending, equipment investment, unemployment, construction work done, population growth, housing finance and dwelling commencements.

Growth across a variety of sectors

Victoria has the strongest job market in the country with an unemployment rate at a record low of 3.2%, that’s 43.2% below the decade-average. Next best is WA, with its jobless rate near a 13 ½-year low of 3.4%, and down 38% on the decade average.

In the year to June, Queensland saw the biggest growth in employment with jobs up by 4.6%, followed by WA which was up 4.2%. Low unemployment drives demand for consumer goods and thus overall retail spending.

South Australia is strongest in relative construction work while Queensland remains the leader in relative population growth despite strict border and immigration controls through the COVID pandemic.