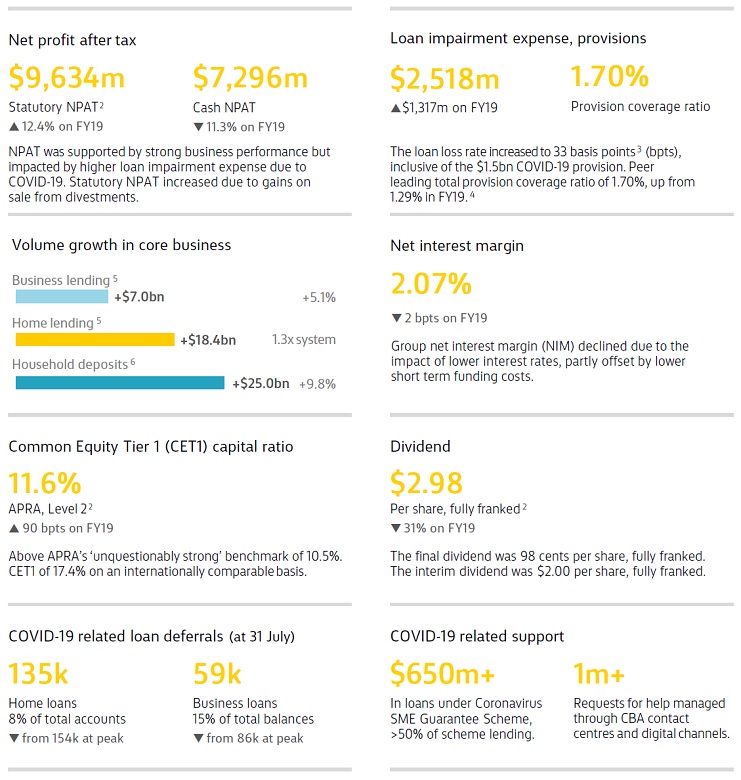

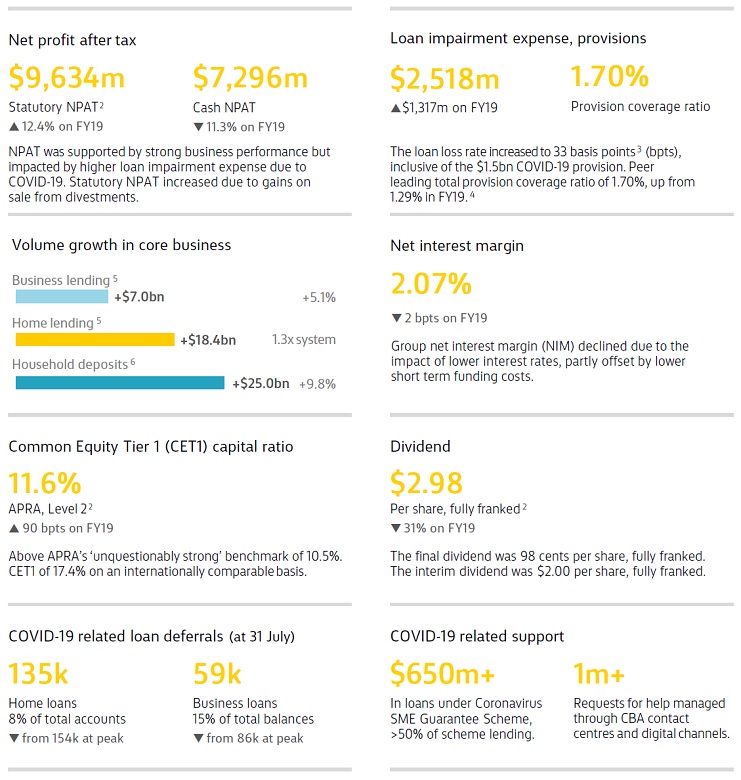

The Group’s Common Equity Tier 1 (CET1) capital ratio – the measurement used by the Australian Prudential Regulation Authority (APRA), the banking regulator, to gauge the financial strength of the country’s banks – came in at 11.6%, 90 basis points higher than a year ago.

At 11.6%, the ratio was above APRA’s “unquestionably strong” benchmark of 10.5%. On an internationally comparable basis, CBA’s CET1 ratio stands at 17.4%, placing the Group amongst the top quartile of international peer banks.

For shareholders, the Board has declared a final dividend of 98c a share which, added to the interim payout of $2.00 a share, makes a total of $2.98 for the full year.

The adjustment is line with the guidance on dividends issued at the end of July by APRA which limited payouts to 50% or less of statutory earnings. CBA will have paid out $5.3 billion in dividends this year.

Matt Comyn, CBA’s Chief Executive Officer, said the last financial year underlined the Bank’s core strengths particularly at a time of unprecedented constraints brought on by the pandemic, low interest rates, low credit growth, and the consequential impacts on the economy and the country as a whole.

CBA had used its position to provide significant support to customers during the pandemic including a range of household and business loan deferrals and additional lending, particularly to SMEs.

“The strength of our core banking businesses, combined with strong operational performance, has delivered good outcomes for our customers and shareholders –despite the challenges presented by lower interest rates and COVID-19,” said Mr Comyn.

The immediate priority for the group was to help customers and support the broader economy through the pandemic to recovery, he added. CBA was prepared for a range of economic scenarios and had provisioned accordingly.

Tailored support is being offered to customers and the Group is using its digital capabilities and assets to monitor its lending portfolio as the situation continues to evolve. Despite the constraints brought about by the pandemic and the effects of lower growth, CBA was continuing to invest in its banking franchise thanks to its operational performance, balance sheet strength and capital position.

Mr Comyn added: “The next few months will be critical and some sectors will take longer to recover than others, however, we remain positive about Australia’s long-term prospects. We will also continue to work with government, regulators and our industry peers to support initiatives that stimulate economic activity and jobs.”

Other Key Financial Highlights of FY20

- Operating income – $23.8 billion, up 0.8% with volume growth in lending and deposits offset by a decline in net interest margin and non-interest income.

- Net interest margin – 2.07%, down 2 basis points, due to the impact of lower interest rates.

- Operating expenses – $10.9 billion, up 0.7%, due to higher staff and IT costs partly offset by lower customer remediation costs.

- Loan impairment expense – $2.5 billion, up $1.3 billion, inclusive of the $1.5 billion COVID-19 provision.

- Deposit funding – 74%, up five percentage points due to continued strength in deposit volumes.

Footnotes

- Comparative information has been restated to conform to presentation in the current period. Unless otherwise stated: all figures relate to the full year ended 30 June 2020 and comparisons are to the prior comparative period, the full year ended 30 June 2019; financials are presented on a continuing operations basis.

- Statutory NPAT, CET1 and dividend per share include discontinued operations. Discontinued operations includes Colonial First State (CFS), the Bank’s Australian and New Zealand life insurance businesses (CommInsure Life and Sovereign), BoCommLife, TymeDigital SA, Colonial First State Global Asset Management (CFSGAM) and PT Commonwealth Life. Includes non-controlling interests related to discontinued operations.

- Cash loan impairment expense as a percentage of average gross loans and acceptances.

- Total provisions as a percentage of credit risk weighted assets.

- As reported in RBA Lending and Credit Aggregates (Home lending and Business lending). RBA collection data was aligned to the new regulatory definitions set by APRA from July 2019, therefore the home lending system multiple has been calculated for the 11 months to June 2020 annualised. Business lending includes Business and Private Banking, Bankwest and Institutional Banking and Markets (ex. CMPF) and growth is calculated for 12 months.

- As reported in APRA Monthly ADI Statistics (MADIS) (Household deposits).