Businesses large and small, infrastructure, agriculture and housing feature in fiscal measures designed to lift the economy out of the coronavirus-induced recession

More resources

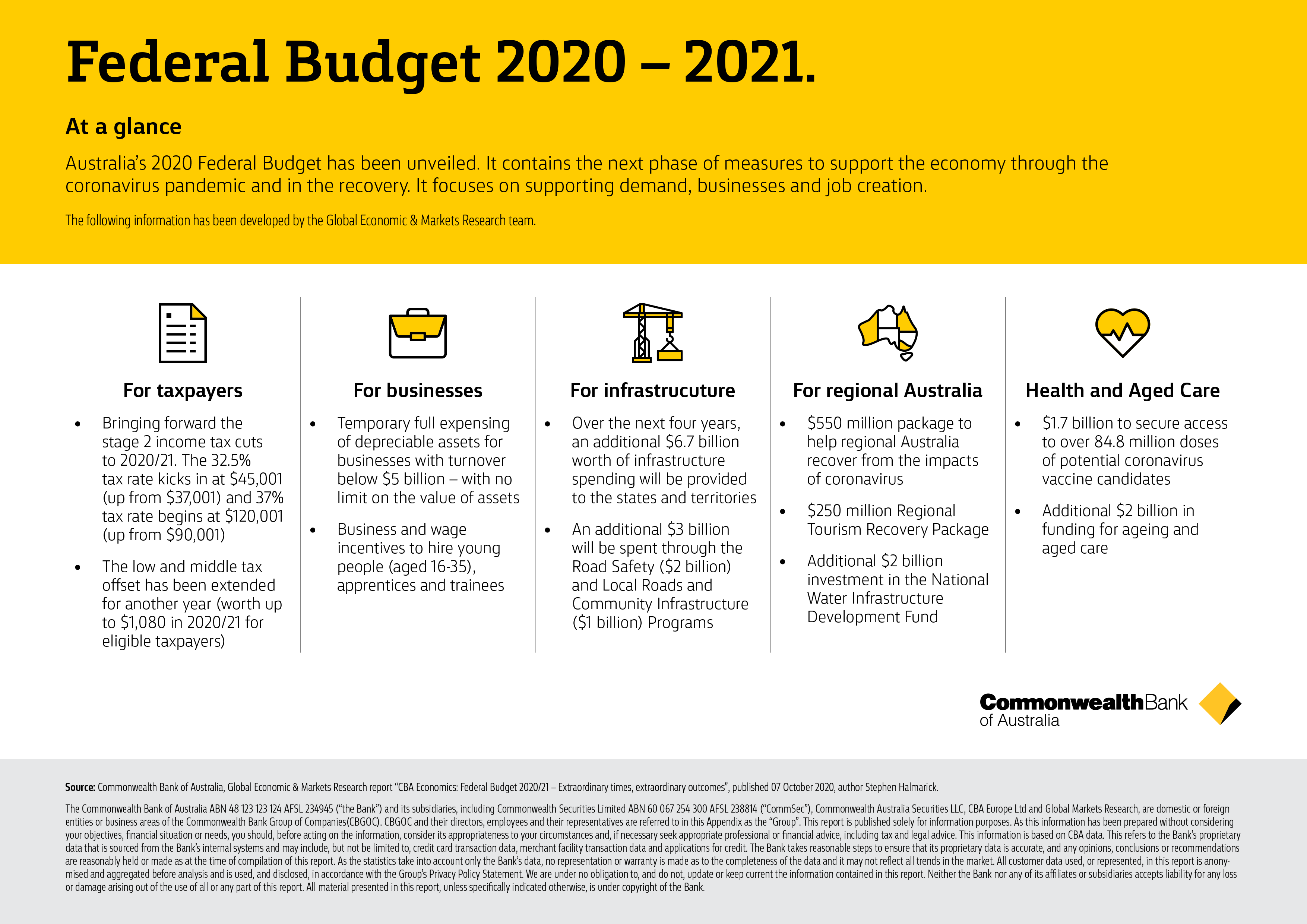

- Infographic: Budget at a glance

- Listen: Stephen Halmarick, Chief Economist and Belinda Allen, Senior Economist discuss the Federal Budget

- Gareth Aird's pre-budget predictions

With a forecast deficit of $213 billion, described as the largest in Australia since the end of World War II, it was little wonder that the 2020 federal budget had economists reaching for their dictionaries to describe the history-making moment.

“Extraordinary” said CBA’s Chief Economist Stephen Halmarick. But then, as he added: “Extraordinary times lead to extraordinary outcomes”.

While the macro figures and income tax cuts grabbed the immediate headlines, behind the numbers were some big ticket measures targeted at key sectors of the economy – all designed to combat the impacts of the pandemic-inspired recession and underwrite growth through a jobs-led re-bound.

According to Mr Halmarick and the CBA Global Markets and Economic Research team in their Federal Budget 2020/21 Update (“Federal Budget 2020/21 – Extraordinary times, extraordinary outcomes”), published today (7 October 2020), it is the economic support provided by such fiscal policy efforts that is a vital part of the path to recovery.

“This support has been enhanced in the Budget through a combination of income support programs, health related spending, income tax cuts, employment support programs, infrastructure spending and a focus on regional spending,” the team states.

Download this infographic in high-resolution

Here, in a summary of the main changes, CBA Newsroom looks at some of the key initiatives that are aimed at supporting and creating jobs across the economy.

Small Business

A central plank of the Budget and a core part of the new “Jobmaker” measures is the ability of almost all Australian business (those with an aggregated annual turnover of less than $5 billion) to deduct the full cost of eligible capital assets. This is a significant extension of the previous asset write-off provisions designed to kick start business investment. The new scheme kicks in immediately (as at 7.30pm on 6 October 2020) and covers a period through to 30 June 2022. The details include:

- Full expensing in the year of first use for new depreciable assets and the cost of improvements to existing eligible assets. For small and medium sized businesses (with aggregated annual turnover of less than $50 million), full expensing also applies to second-hand assets;

- Businesses with aggregated annual turnover between $50 million and $500 million can still deduct the full cost of eligible second-hand assets costing less than $150,000 which are purchased by 31 December 2020 under the enhanced instant asset write-off;

- Businesses that hold assets eligible for the enhanced $150,000 instant asset write-off will have an extra six months, until 30 June 2021, to first use or install those assets;

- Small businesses (with aggregated annual turnover of less than $10 million) can deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies. The provisions which prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended.

Businesses will also able to offset losses incurred up to June 2022 against prior profits made in or after the 2018‑19 financial year. This will apply to those entities with an aggregated turnover of less than $5 billion, enabling them to generate a refundable tax offset in the year in which the loss is made. Currently, companies are required to carry losses forward to offset profits in future years. Companies that do not elect to carry back losses under this measure can still carry losses forward as normal.

Other business support measures include:

- Current tax concessions which are available to SMEs with a turnover of $10 million will be extended to those businesses with a turnover of up to $50 million;

- A “JobMaker” wage subsidy or hiring credit to encourage companies to hire younger Australians, aged 16 to 35. Businesses will be able to pay those aged under 30 $200 a week for a year and $100 a week for those aged between 30 and 35. People hired under the scheme have to work at least 20 hours a week to be eligible;

- As previously announced, the SME Loans Guarantee Scheme has been expanded to allow eligible businesses to apply for secured loans of up to $1 million and unsecured loans of up to $250,000 with repayments to be made over five years. CBA, which provided more than half of the loans to SMEs under the first version of the scheme, will be offering credit under the latest version;

- An additional $1.2 billion to create 100,000 new apprenticeships and traineeships, with a 50 per cent wage subsidy for businesses who employ them;

- Also as previously flagged, the continuance of the Jobkeeper payment to applicable businesses at a reduced level for another six months to 28 March 2021.

CBA Economists’ view: The Government is expecting the [full expensing of depreciable assets] initiative to reduce business tax by $26.7b over four years.[The] temporary loss carry-back initiative is expected to cost $4.9 billion over the forward estimates. The JobMaker Hiring Credit is a new policy initiative aimed at increasing employment for young people who don’t have a job. This policy is estimated to cost $4b with the bulk of cost expected to be incurred in 2021/22. [The] extension [JobKeeper] is estimated to cost $15.6b in 2021 and is the largest initiative on the expenses side of the Budget. This will take the total cost of the program to an estimated $101.3b. Around 3.5 million people are currently receiving the JobKeeper payment.

Infrastructure

Like the other main Budget measures, the planned investment in new infrastructure is designed to support existing and create new jobs, particularly through projects that can start almost immediately. In his speech the Treasurer said that $14 billion would be set aside for new and accelerated infrastructure such as roads, rail and bridges to underpin 40,000 jobs.

For example, NSW is set to receive $2.7 billion from 2020-21 for priority road and rail projects while across the nation $2 billion will be provided over two years from now onwards to pay for small scale road safety projects as part of a short term economic stimulus.

Other measures include:

- $1 billion for local councils to immediately upgrade local roads, footpaths and street lighting;

- $102 million in community development grants over three years to support local communities across Australia;

- $184 million over 10 years from 2020-21 to support research and evaluation, including the development of national guidelines and model specifications for the use of recycled materials in road construction and annual analytical assessments of infrastructure market capacity by Infrastructure Australia.

CBA Economists’ view: To get a full view of the bulk of infrastructure spending, over the next month the state governments will release their 2020/21 Budgets and infrastructure spending is likely to be a key feature. Infrastructure boosts jobs and GDP in the short term and productivity in the medium to longer term.

Agribusiness and Regional Support

Following the drought and the knock-on effects of last summer’s bushfires and subsequently the coronavirus pandemic on regional tourism, the Budget includes a number of measures designed to alleviate the impacts of all three on rural and regional Australia. These include:

- $2 billion in concessional loans to help farmers overcome the drought;

- $350 million to help attract domestic visitors back to the regions and support a further round of the Building Better Regions Fund. This money is focused on community and tourism-related infrastructure projects;

- $317 million for exporters to access global supply chains;

- $2 billion in new funding over ten years to build water infrastructure such as dams, weirs and pipelines.

Housing and home-owners

In a previously flagged measure, the First Home Loan Guarantee Scheme, which was launched at the start of 2020, has been extended by a further 10,000 places with a focus on new homes and an increase in the prices that first time buyers will be able to purchase a property. CBA, which has helped more than 3,000 buyers in the first and second stages of the scheme, will be participating in the third round.

CBA Economists’ view: [The scheme] allows first home buyers to buy a residential property with a deposit as small at 5% with the Government guaranteeing up to 15% of the loan. The last three years has seen lending to first home buyers increase as a share of total home lending. The government has allowed the National Housing Finance and Investment Corporation1 to issue an additional $1b worth of bonds to increase the supply of affordable housing.

Superannuation

Further reforms were announced to the superannuation industry which currently holds $3 trillion on behalf of Australians, according to the Budget papers. The changes are designed to reduce duplication of accounts particularly where new ones are automatically created every time a worker changes job as at present. They are also designed to cut the payment of unnecessary fees which the government puts the cost at $450 million a year.

Other steps include:

- As initial steps, superannuation funds offering “My Super” products will be required to meet an annual performance test under the guidance of the prudential regulator, with under-performing funds required to notify their members as a consequence;

- Super fund members will able to compare fund performances through a new online comparison tool called ‘Your Super’.

Source: Commonwealth Bank of Australia, Global Economic & Markets Research report “CBA Economics: Federal Budget 2020/21 – Extraordinary times, extraordinary outcomes”, published 7 October 2020, author Stephen Halmarick.

Disclaimer: This report is published solely for information purposes. As this report has been prepared without considering your objectives, financial situation or needs, you should before acting on the information in this report, consider its appropriateness to your circumstances and if necessary seek the appropriate professional advice. The information in this report and any opinions, conclusions or recommendations are reasonably held or made, based on the information available at the time of its publication but no representation or warranty, either expressed or implied, is made or provided as to the accuracy, reliability or completeness of any statement made in this report. Commonwealth Bank of Australia ABN 48 123 123 124. AFSL and Australian credit licence 234945. Full Global Economic & Markets Research disclaimers can be found at www.commbankresearch.com.au.

1On 12 October 2023 the National Housing Finance Corporation (NHFIC) changed its name to Housing Australia.