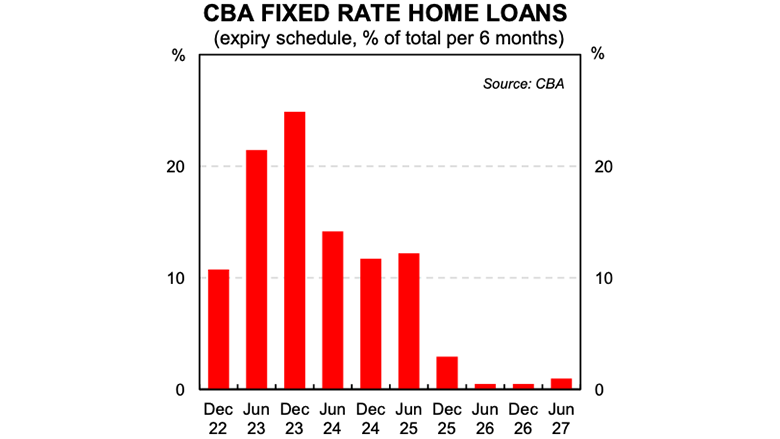

But with weaker than expected recent employment data, ABS retail sales for December down 3.9 per cent, house prices still falling and large volumes of fixed rate mortgages set to expire this year, CBA economists believe the RBA will pause its tightening cycle thereafter.

“Inflation once again surged in Australia over the December quarter 2022. Headline CPI came in stronger than market expectations and although it was a little below the RBA’s forecast, the underlying inflation rate printed stronger than they predicted at 6.9 per cent,” comments CBA’s Head of Australian Economics Gareth Aird.

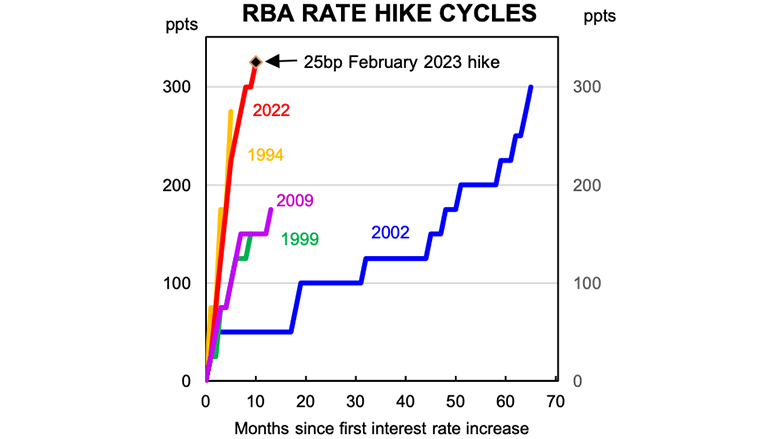

“The RBA maintained a hiking bias in December and with inflation still strong we expect them to deliver on this at their February Board meeting. We’re maintaining our forecast that they will raise the cash rate by 25bp to 3.35 per cent, before pausing the tightening cycle. However a larger hike of 40bp coupled with a stated intention to pause could also be on the table.