CBA Chief Executive Officer, Matt Comyn said that providing temporary loan repayment deferrals on approximately 250,000 home, personal and business loans has been one of the key ways the Bank has helped its customers to manage the challenges of COVID-19.

“We continue to contact customers with a range of options as they approach the end of temporary loan repayment deferral periods, and have been encouraged by the number of customers who have been able to return to making repayments on their loans.

“The Bank remains well placed and committed to supporting our customers and the wider community as the economy begins to recover, while continuing to offer our support to those in need of ongoing assistance.”

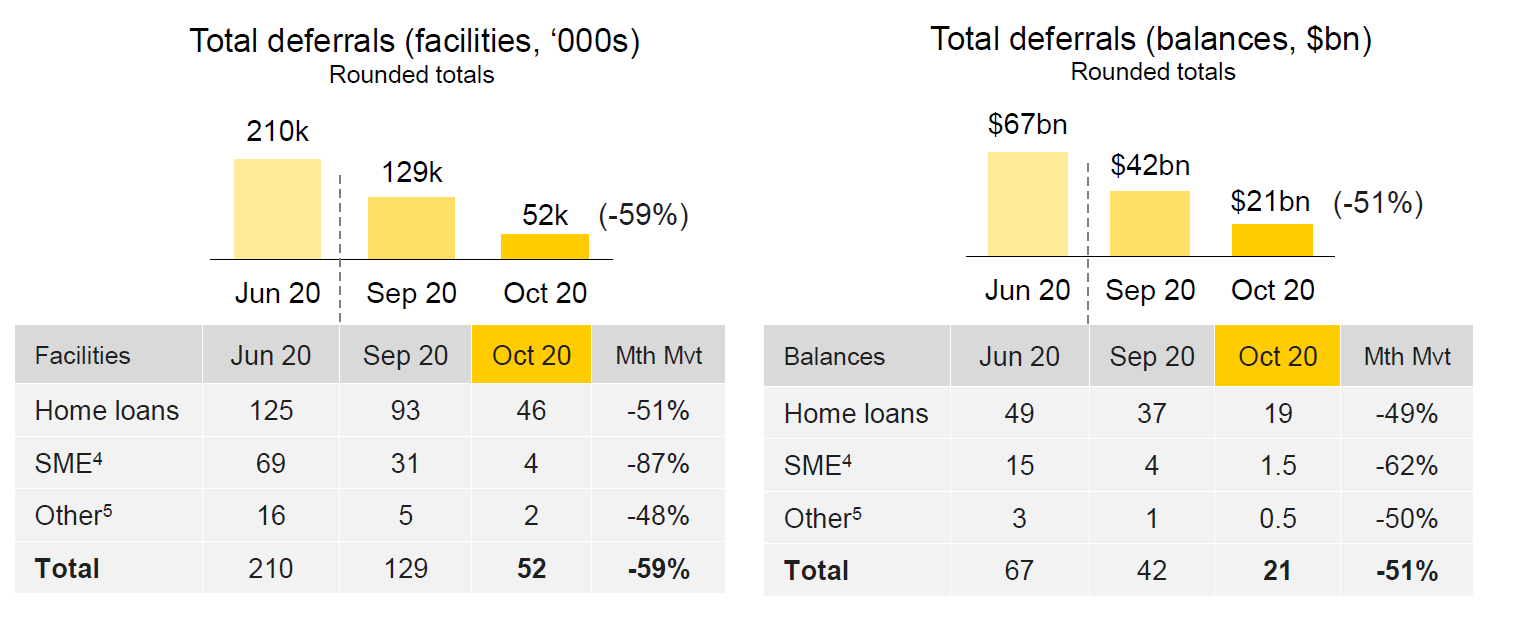

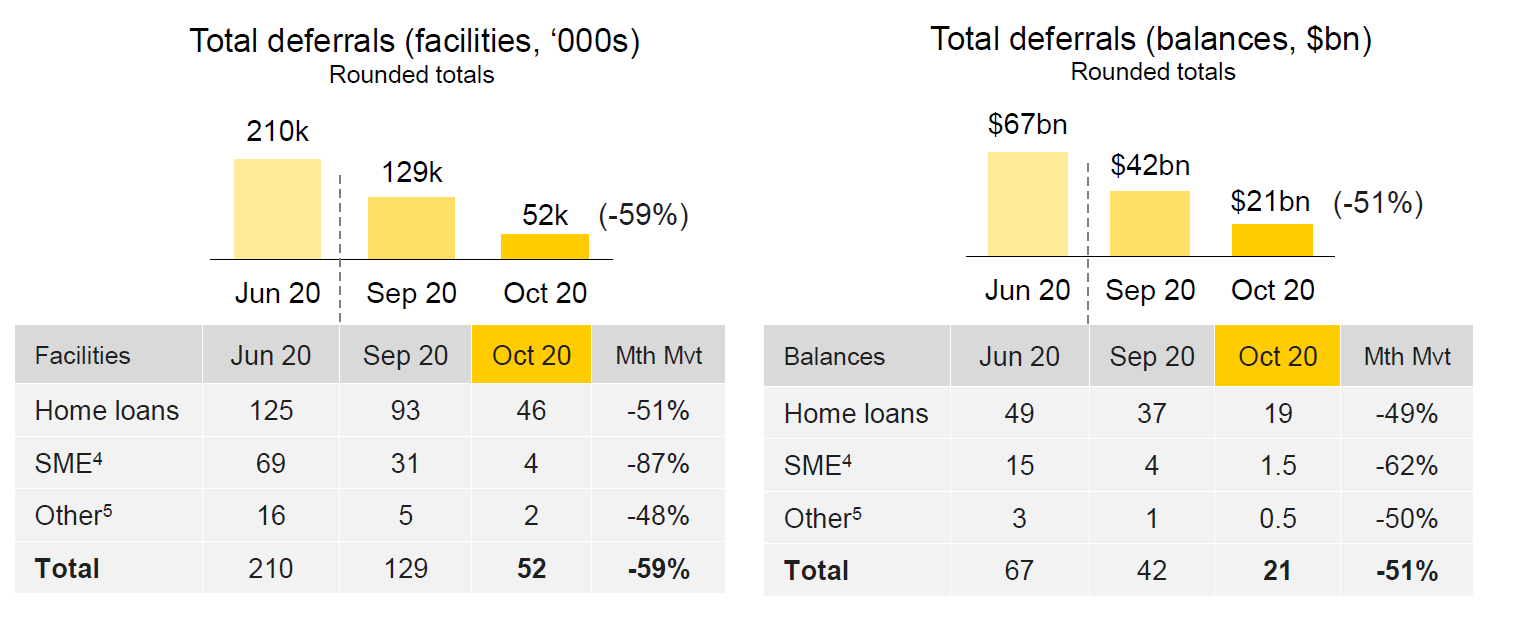

Of the 158,000 total home loan deferrals approved between March 2020 and 31 October 2020, 22,000 remain on their initial deferral arrangements. Of the remainder, 23 per cent have extended their deferral period (for up to 4 months), 73 per cent have returned to making full repayments, 4 per cent have been provided further assistance and <1 per cent have been impaired.

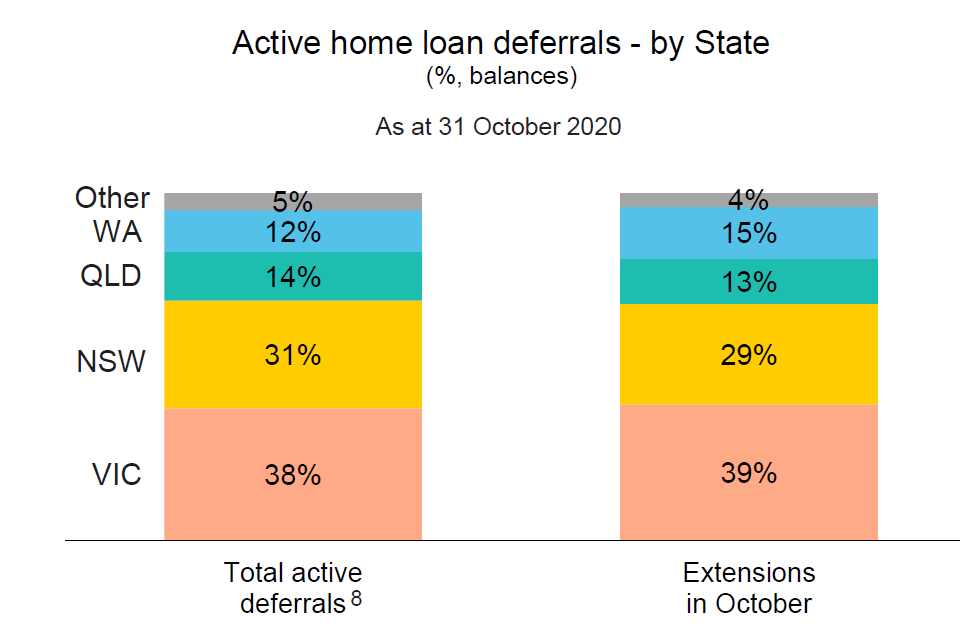

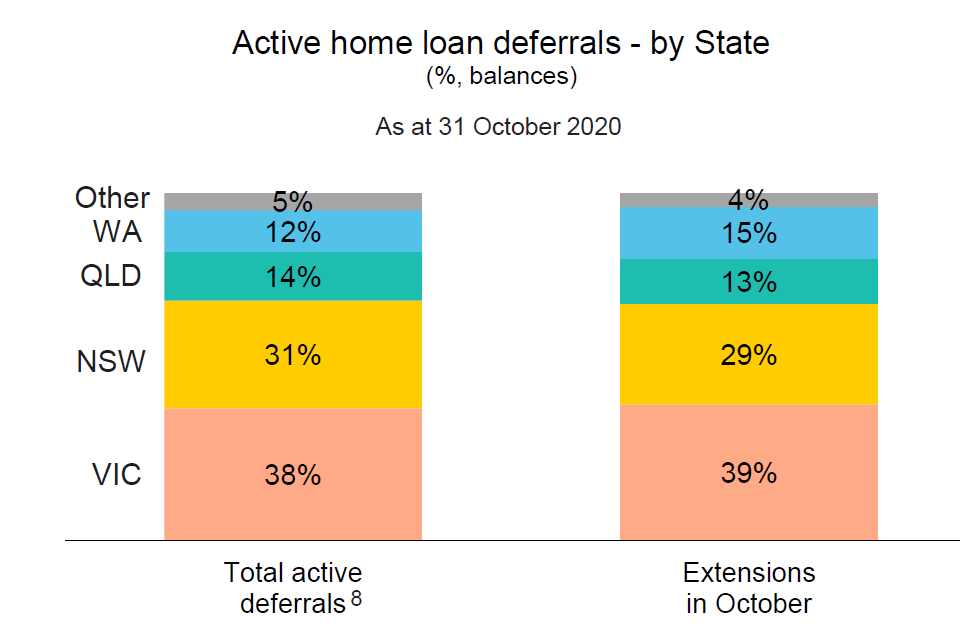

Understandably, of the $19 billion actively deferred home loans at 31 Oct 20, around 38 per cent are for customers residing in Victoria, and about 31 per cent for New South Wales home loan customers. Queensland and Western Australia account for 14 per cent and 12 per cent of deferred home loan balances respectfully, while all other states account for the remaining 5 per cent.

For information on customer support, click here.