Highlights of the 2015 Interim Result

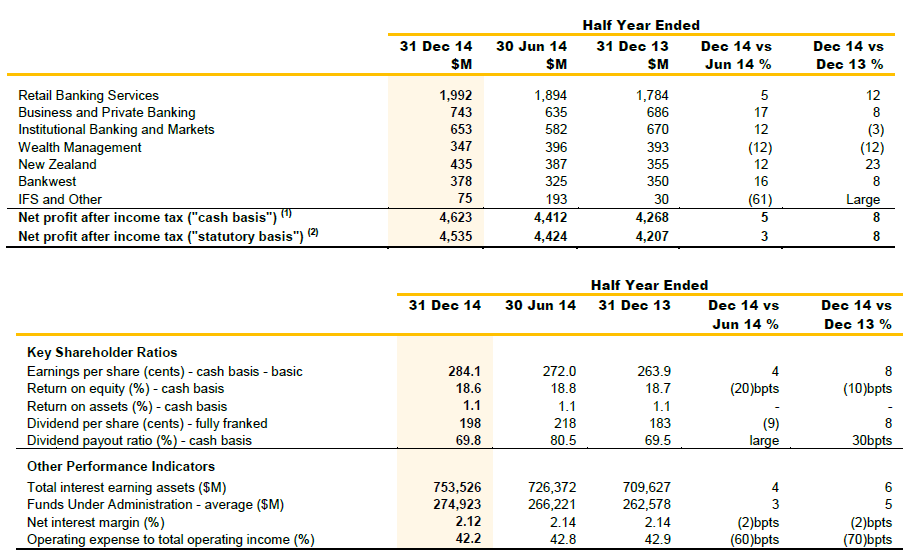

- Statutory NPAT of $4,535 million – up 8 per cent1,2,3;

- Cash NPAT of $4,623 million – up 8 per cent;

- Fully franked interim dividend of $1.98 declared – up 8 per cent on 2014 interim dividend;

- Revenue up 5 per cent in subdued market conditions;

- Cost to income ratio improved 70 basis points to 42.2 per cent as productivity initiatives continue;

- Return on Equity (cash basis) of 18.6 per cent;

- Maintenance of strong capital position – Basel III Common Equity Tier 1 (CET1) (Internationally Comparable)4 of 13.3 per cent; and

- Customer deposits up $32 billion to $458 billion, which represents 63 per cent of funding.

1 Except where otherwise stated, all figures relate to the half year ended 31 December 2014. The term "prior comparative period" refers to the half year ended 31 December 2013, while the term "prior half" refers to the half year ended 30 June 2014. Unless otherwise indicated, all comparisons are to "prior comparative period".

2 For an explanation of, and reconciliation between, Statutory and Cash NPAT refer to pages 2, 3 and 15 of the Group’s Profit Announcement for the half-year ended 31 December 2014, which is available at www.commbank.com.au/shareholders.

3 Comparative information has been restated to conform to presentation in the current period.

4 The Group has revised its international measure of CET1 at 31 December 2014 with the methodology consistent with that detailed in the August 2014 PwC Australia report commissioned by the Australian Bankers Association (ABA).

The Commonwealth Bank of Australia (The Group) statutory net profit after tax (NPAT) for the half year ended 31 December 2014 was $4,535 million, an 8 per cent increase on the prior comparative period. Cash NPAT for the half was $4,623 million, also an increase of 8 per cent.

The Board declared an interim dividend of $1.98 per share – an increase of 8 per cent on the 2014 interim dividend. The dividend payout ratio (cash basis) of approximately 70 per cent of cash NPAT is in line with the prior year and consistent with the Board’s full year target of paying out between 70 and 80 per cent of cash NPAT.

The interim dividend, which will be fully franked, will be paid on 2 April 2015. The ex-dividend date is 17 February 2015. The Dividend Reinvestment Plan (DRP) will continue to operate, but no discount will be applied to shares issued under the plan for this dividend. The Board has decided not to neutralise the impact of the DRP through on-market share purchases.

Commenting on the result, Group Chief Executive Officer, Ian Narev said: “This result again demonstrates the benefits of sticking to a consistent strategy for a high quality franchise. Our ongoing focus on long term strategic priorities – people, technology, strength and productivity – continues to benefit our customers, our shareholders, our people and other key stakeholders. The Group’s revenue momentum has continued, while our focus on productivity has delivered a further $300 million of cost savings over the last 12 months. We have also maintained the strength of the Group’s balance sheet in terms of capital, liquidity, deposit funding and provisioning.

The strength of our business enables us to invest for the long term. In this period, we invested in innovation within the business, with highlights including the establishment of a Group Innovation Lab, digital property settlement (PEXA) and the "Temporary Lock" functionality. We also bought new capability, through the acquisition of TYME, a South African based global leader in designing, building and operating digital banking systems. TYME gives us new opportunities in our emerging markets footprint, as well as providing capability to enhance innovation in our core markets."

Key components of the result include:

- Net interest income and other banking income both grew 6 per cent, with average interest earning assets up $49 billion to $739 billion and retail and business average interest bearing deposits(1) up $27 billion to $432 billion;

- Net interest margin (NIM) declined 2 basis points (to 2.12 per cent) on the prior half, reflecting competitive asset pricing, partially offset by lower wholesale funding costs;

- Strong growth in net interest income and other banking income and a disciplined approach to expenses contributed to Retail Banking Services cash earnings growth of 12 per cent;

- Wealth Management’s average Funds Under Administration grew by 11 per cent with 85 per cent of funds outperforming their respective three year benchmarks;

- Cash earnings in New Zealand (excluding the impact of lower losses associated with the New Zealand earnings hedge) grew 15 per cent and in Bankwest grew 8 per cent respectively;

- The Group’s cost to income ratio improved by 70 basis points, in large part due to the on-going productivity focus, which delivered savings of $312 million over the past twelve months;

- The annualised ratio of loan impairment expense (LIE) to average gross loans and acceptances improved 2 basis points and 3 basis points (to 14 basis points) compared with the prior comparative period and the prior half respectively;

- Investment in long term growth continued, with $595 million invested in a set of initiatives, including $167 million for risk and compliance related projects, with the balance invested against on-going strategic priorities;

- Provisioning remained conservative, with total provisions of $3.9 billion, and the ratio of provisions to credit risk weighted assets at 1.25 per cent. Collective provisions included a management overlay of almost $800 million and an unchanged economic overlay;

- CET1 (Internationally Comparable basis) was 13.3 per cent. CET 1 (APRA basis) increased 70 basis points (on the prior twelve months) to 9.2 per cent; and

- The Group remained one of a limited number of global banks in the ‘AA’ ratings category.

Strong deposit growth during the period has seen the Group satisfy a significant proportion of its funding requirements from customer deposits, with deposits remaining at 63 per cent of total funding. During the period the Group took advantage of improving conditions in wholesale markets, issuing $18 billion of long term debt in multiple currencies.

While some of the Group’s customers are facing challenges, this is not translating into a deterioration of credit quality. However, the Group is maintaining a strong balance sheet with high levels of capital and provisioning. Liquidity was $151 billion as at 31 December 2014.

On the outlook for the 2015 calendar year, Ian Narev said: “The Australian economy has many of the foundations necessary to make a successful transition from its dependence on resource investment. Population growth, a vibrant construction sector, some signs of increased business investment, greater trade access supported by a lower Australian dollar and a strong banking sector are all contributing to an economy that remains the envy of most developed markets. However, the volatility of the global economy continues to undermine confidence, particularly the impact of lower commodity prices on national revenue.”

“Weak confidence is a significant economic threat. Businesses need the certainty to invest to create jobs, and households need a greater feeling of security. That requires implementation of a coherent long term plan that clearly addresses target government debt levels and timeframes, infrastructure priorities, foreign investment, business competitiveness policies and, above all, job creation.”

“In terms of the Group specifically, we will continue to invest in our current strategy. We believe that if we continue to work hard in an increasingly competitive environment, our strategy will continue to benefit our 15 million customers, our 52,000 employees, the 800,000 Australia households who own our shares, and the broader communities in which we operate.”

(1) Net profit after income tax (“cash basis”) - represents net profit after tax and non-controlling interests before Bankwest non-cash items, the gain on sale of management rights, treasury shares valuation adjustment, Bell Group litigation expenses and unrealised gains and losses related to hedging and IFRS volatility. This is Management's preferred measure of the Group's financial performance.

(2) Net profit after income tax (“statutory basis”) - represents net profit after tax and non-controlling interests, including Bankwest non-cash items, the gain on sale of management rights, treasury shares valuation adjustment, Bell Group litigation expenses and unrealised gains and losses related to hedging and IFRS volatility. This is equivalent to the statutory item "Net profit attributable to Equity holders of the Bank".