- Total returns on Australian shares (All Ordinaries Accumulation Index) rose by 5.7 per cent in 2014/15.

- The Australian economy is estimated to have grown by 2.5 per cent in 2014/15 and CommSec expects further growth of 3 per cent in 2015/16.

- The Australian dollar fell by around 23 per cent over 2014/2015.

As a new financial year begins, analysis by CommSec indicates the financial year from July 2014 to June 2015 was largely a year of consolidation. Overall, the economy is likely to have posted below-average growth of 2.5 per cent in 2014/15 but CommSec expects the record economic expansion to continue in 2015/16 with growth lifting to around 3.0 per cent.

For the second consecutive year, bonds, residential property and shares all lifted over 2014/15 – a relatively rare event. Returns on dwellings grew by around 13.3 per cent while returns on government bonds lifted by 5.8 per cent and returns on shares grew by 5.7 per cent. The cash rate fell to a record low of 2.0 per cent, down from 2.5 per cent at the end of June 2014, following two separate quarter per cent rate cuts in February and May 2015.

“Overall, the outlook for the economy is encouraging, notwithstanding global challenges. Interest rates are super low and business does appear to be responding to a stimulatory Federal Budget,” said Craig James, CommSec Chief Economist.

Mr James noted global challenges such as the Greek debt crisis, rebalancing of the Chinese economy, the prospect of higher US interest rates and “normalisation” of bond yields all posed potential headwinds for the Australian economy and sharemarket.

In early July 2014, the Australian dollar was around US95 cents and ended 2014/15 at US76.80 cents. CommSec has calculated that the Australian dollar was the 18th weakest against the US dollar of 117 currencies tracked1. The high for the Australian dollar in 2014/15 was US95.04 cents on 1 July 2014 and the low was US75.30 cents on 2 April 2015. CommSec expects the Australian dollar to largely remain between US75-80 cents through to mid-2016.

Total returns on Australian shares rose by 5.7 per cent in 2014/15 (20-year average +10.3 per cent). However, back in late April the total return index was at record highs and on track for 14.5 per cent annual gains. The Australian sharemarket began 2014/15 with the ASX200 at 5,396 and ended the year at 5,459 (up 1.2 per cent). While daily volatility picked up late in the year with the Greek debt crisis, the range for the ASX 200 over 2014/15 was the smallest in percentage terms in 14 years.

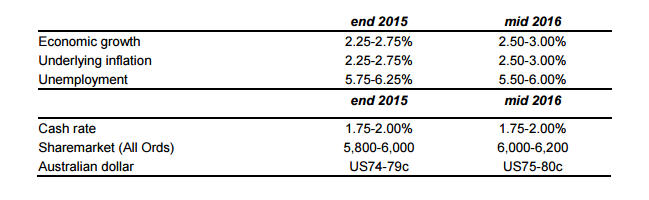

Looking ahead, CommSec expects the ASX 200 index to be between 5,800-6,000 points at the end of December 2015 and tips further growth to 6,000-6,200 points for the ASX 200 by June 2016.

Paul Rayson, Managing Director, CommSec, commented on equity returns for investors.

“The Australian sharemarket again delivered returns for investors in 2014/2015 with total returns on shares having only fallen once in the past six years, posting average gains of 10.5 per cent over that period. Diversification rewarded investors over the past year and we’re also seeing business confidence levels slightly improving which bodes well for investor sentiment,” said Mr Rayson.

Looking ahead, CommSec predicts slightly firmer economic growth for 2015/16 with unemployment expected to ease slightly while inflation is likely to lift modestly, although still within the Reserve Bank of Australia’s 2-3 per cent target. These indicators suggest that the new financial year will further build on 2014/15 and continue to strongly position Australia both domestically and globally.

CommSec predictions at a glance

If you would like to view further analysis you can visit the CommSec website with a full end of financial year summary, graphs and videos at commsec.com.au/financialyearwrap.

--ENDS--

Reference:

[1] Source: “Thomson Reuters data, country breakdown, June 2015"

For further media enquiries please contact:

Amanda Boswell

Commonwealth Bank

Ph: 0455 070 027

[email protected]

Disclaimer

This media release is approved and distributed in Australia by Commonwealth Securities Limited ABN 60 067 254 399, AFSL 238814 (CommSec) a wholly owned but non-guaranteed subsidiary of Commonwealth Bank of Australia ABN 48 123 123 124, AFSL 234945 (the Bank). This economic report does not provide a recommendation to buy, sell or hold any securities, property, real estate or financial products, and has been prepared without taking account of the objectives, financial or taxation situation or needs of any particular individual. For this reason, any individual should, before acting on the information in this report, consider the appropriateness of the information, having regard to the individual's objectives, financial or taxation situation and needs and, if necessary, seek appropriate professional advice. Past performance, economic or otherwise, is not a reliable indicator of future performance. This report is produced by Commonwealth Securities Limited based on information available at the time of publishing. We believe that the information in this correspondence is correct and any opinions, conclusions or recommendations are reasonably held or made as at the time of its compilation, but no warranty is made as to accuracy, reliability or completeness. To the extent permitted by law, neither the Bank nor any of its subsidiaries accept liability to any person for loss or damage arising from the use of this media release.