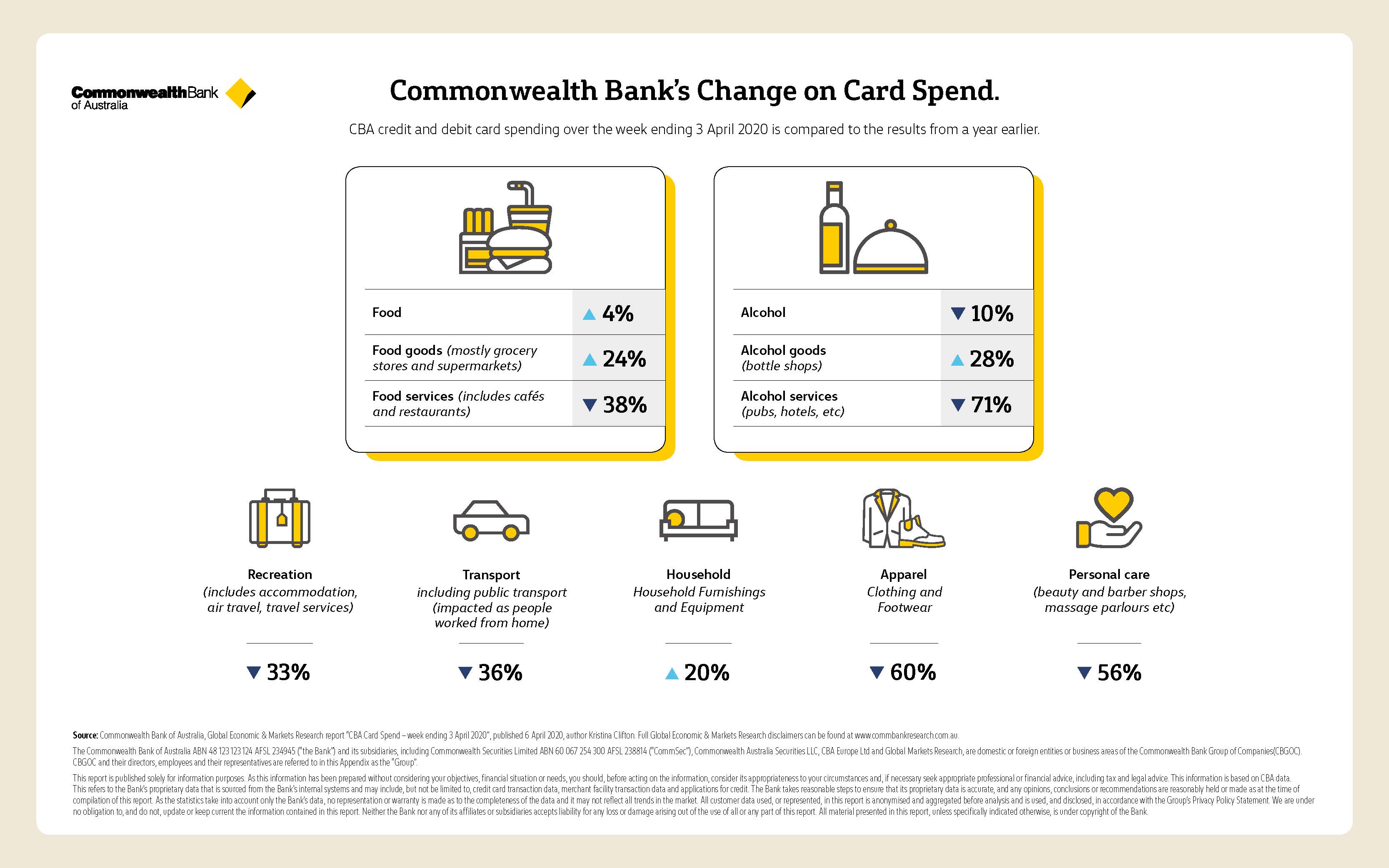

The latest credit and debit card spending analysis from Commonwealth Bank’s Global Economic and Markets Research team shows that while Australians appear to be spending less overall during restrictions and shutdowns, they are spending more on DIY and home improvements. The spending analysis for last week – week ending Friday 3 April – also highlights a continuing sharp fall in spending on services, with both food and alcohol sales declining in the last few weeks.

CBA Senior Economist Kristina Clifton says that some of the spending patterns that emerged early on in the period of restrictions and lockdowns are now reversing.

“While food spending is still up around four per cent compared to a year ago, people may now feel they have enough grocery items in reserve. Spending on food fell by 12 per cent over the week, following a 21 per cent fall from the previous week.”

Spending on alcohol also dropped over the week, down 33 per cent compared to the previous week, following two weeks of very strong spending.

“Consumers may feel like they have enough alcohol stocked up and the fact that many businesses are pivoting to build digital businesses and implementing contactless delivery services may be providing further reassurance. Restrictions on activity have also been ramped up and people are no longer allowed to socialise with those that they don’t live with. There will be fewer barbecues, parties and other social occasions,” said Ms Clifton.

However, Ms Clifton says that spending on DIY and renovations remains strong.

“Although spending on household furnishing and equipment was down seven per cent on the previous week, compared to the same week last year it is up 20 per cent,” said Ms Clifton.

“Some categories of spending seem less affected by the coronavirus. These included education, utilities, communications and household services and operation,” Ms Clifton added.

Additional insights from CBA credit and debit card spend data

- Overall spending was down 13 per cent in the week ending Friday 3 April compared to the previous week and 15 per cent lower than a year ago.

- Spending on household furnishing and equipment fell by 7 per cent in the week ending Friday 3 April compared to the previous week.

- Spending on medical and health was down 27 per cent, transport down 17 per cent and recreation down 10 per cent, in the week ending Friday 3 April compared to the previous week.

Notes for Editors:

Source

Commonwealth Bank of Australia, Global Economic & Markets Research report “CBA Card Spend – week ending 3 April 2020”, published 6 April 2020, author Kristina Clifton. Full Global Economic & Markets Research disclaimers can be found at www.commbankresearch.com.au.

Disclaimer

The Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 (“the Bank”) and its subsidiaries, including Commonwealth Securities Limited ABN 60 067 254 300 AFSL 238814 (“CommSec”), Commonwealth Australia Securities LLC, CBA Europe Ltd and Global Markets Research, are domestic or foreign entities or business areas of the Commonwealth Bank Group of Companies(CBGOC). CBGOC and their directors, employees and their representatives are referred to in this Appendix as the “Group”.

This report is published solely for information purposes. As this information has been prepared without considering your objectives, financial situation or needs, you should, before acting on the information, consider its appropriateness to your circumstances and, if necessary seek appropriate professional or financial advice, including tax and legal advice.

This information is based on CBA data. This refers to the Bank’s proprietary data that is sourced from the Bank’s internal systems and may include, but not be limited to, credit card transaction data, merchant facility transaction data and applications for credit. The Bank takes reasonable steps to ensure that its proprietary data is accurate, and any opinions, conclusions or recommendations are reasonably held or made as at the time of compilation of this report. As the statistics take into account only the Bank’s data, no representation or warranty is made as to the completeness of the data and it may not reflect all trends in the market. All customer data used, or represented, in this report is anonymised and aggregated before analysis and is used, and disclosed, in accordance with the Group’s Privacy Policy Statement. We are under no obligation to, and do not, update or keep current the information contained in this report. Neither the Bank nor any of its affiliates or subsidiaries accepts liability for any loss or damage arising out of the use of all or any part of this report. All material presented in this report, unless specifically indicated otherwise, is under copyright of the Bank.