Highlights of the 2014 Interim Result

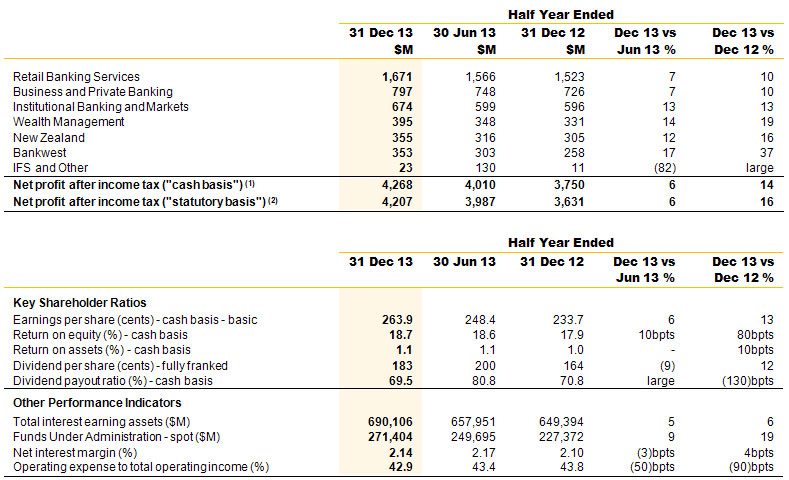

- Statutory NPAT of $4,207 million – up 16 per cent;(1,2,3)

- Cash NPAT of $4,268 million – up 14 per cent;

- Fully franked interim dividend of $1.83 declared – up 12 per cent on 2013 interim dividend;

- Continued revenue momentum – up 8 per cent in subdued market conditions;

- Return on Equity (cash basis) of 18.7 per cent – up 80 basis points;

- Group cost to income ratio improves 90 basis points to 42.9 per cent as productivity initiatives deliver tangible outcomes;

- Strong organic capital growth – Basel III Common Equity Tier 1 (Internationally Harmonised) up 80 basis points to 11.4 per cent;

- Customer deposits up $40 billion to $426 billion, which represents 63 per cent of funding; and

- Group well positioned with customer-focused business franchise operating off a conservative financial base and leading technology platform.

(1) Except where otherwise stated, all figures relate to the half year ended 31 December 2013. The term "prior comparative period" refers to the half year ended 31 December 2012, while the term "prior half" refers to the half year ended 30 June 2013. Unless otherwise indicated, all comparisons are to "prior comparative period".

(2) For an explanation of, and reconciliation between, Statutory and Cash NPAT refer to pages 2, 3 and 15 of the Group’s Profit Announcement for the half-year ended 31 December 2013, which is available at www.commbank.com.au/shareholders.

(3) Comparative information has been restated to conform to presentation in the current period.

The Commonwealth Bank of Australia’s (the Group’s) statutory net profit after tax (NPAT) for the half year ended 31 December 2013 was $4,207 million, which represents a 16 per cent increase on the prior comparative period. Cash NPAT for the half was $4,268 million, an increase of 14 per cent.

Cash Return on Equity increased by 80 basis points to 18.7 per cent.

The Board declared an interim dividend of $1.83 per share – an increase of 12 per cent on the 2013 interim dividend. The dividend payout ratio (cash basis) of approximately 70 per cent is consistent with the Board’s revised dividend policy, announced in August 2012, which increased the payout ratio for the interim dividend.

The interim dividend, which will be fully franked, will be paid on 3 April 2014. The ex-dividend date is 17 February 2014. The Group’s Dividend Reinvestment Plan will continue to operate, but no discount will be applied to shares issued under the plan for this dividend.

Commenting on the result, Group Chief Executive Officer, Ian Narev said: "This result again demonstrates the benefits of our long term strategic priorities – people, technology, strength and productivity. All of our businesses have performed well. We have strengthened our focus on enhancing the financial well-being of our customers and have used our leading technology platform to deliver innovative products and services to business and personal customers."

"The results show that our customer focus creates value for all our shareholders, including the 800,000 Australian households who own our shares directly, and the millions more who own them through their superannuation. The strong revenue growth we have achieved, in what has been a period of relatively subdued economic activity, demonstrates the success of our commitment to meeting the needs of our customers. Our on-going productivity initiatives have helped us maintain our expense discipline and, at the same time, deliver revenue growth. So, we have again been able to invest for the long term benefit of the business, with nearly $600m of investment in this half."

Key components of the result include:

- Continuing success of the customer focus strategy, with the Group retaining (for a period of 12 months) its position as the number one in customer satisfaction (relative to peers) in its Australian retail banking business, while maintaining its leadership position in business customer satisfaction;

- Group net interest income and other banking income up 8 and 6 per cent respectively in the banking businesses, with average interest earning assets up $41 billion to $690 billion and retail and business average interest bearing deposits([1]) _ up $29 billion to $405 billion;

- Net interest margin (NIM) declined 3 basis points (to 2.14 per cent) on the prior half primarily as a result of continued funding and liquidity pressure;

- Growth in Wealth Management’s earnings as average Funds Under Administration grew by 22 per cent and 89 per cent of funds performed above benchmark;

- Cash earnings growth in New Zealand (including ASB Bank) and Bankwest of 16 and 37 per cent respectively;

- Continuing progress in Indonesia and China;

- An improvement of 90 basis points in the Group’s cost to income ratio, achieved in large part through the Group-wide productivity focus, which delivered savings of $234 million over the past twelve months;

- The ratio of cash loan impairment expense (LIE) to gross loans and acceptances improved 6 basis points (to 16 basis points) compared with the prior comparative period and was flat compared with the prior half, reflecting a benign credit environment;

- Investment of $589 million in long term growth through a tightly managed set of initiatives that focused on technology, productivity and risk;

- Continuing conservative provisioning, with total provisions of $4.3 billion, and the ratio of provisions to credit risk weighted assets at a sector-leading 1.52 per cent. Collective provisions include a management overlay of almost $900 million and an unchanged economic overlay;

- On-going organic capital generation leading to Basel III Common Equity Tier 1 (CET1) (Internationally Harmonised) ratio of 11.4 per cent, up 80 basis points. CET 1 (APRA) increased 40 basis points to 8.5 per cent; and

- Continuation of the Group’s position as one of only a limited number of global banks in the ‘AA’ ratings category.

(1) Includes transactions, savings and investment average interest bearing deposits.

Strong deposit growth during the period has seen the Group satisfy a significant proportion of its funding requirements from customer deposits, with deposits remaining at 63 per cent of total Group funding. However, competition for domestic deposits remained strong and continued to have a negative impact on margins. During the period the Group took advantage of improving conditions in wholesale markets, issuing $17 billion of long term debt in multiple currencies.

While some of the Group’s customers are facing challenges, this is not translating into a deterioration of credit quality. However, given the uncertain outlook for both the global and domestic economies, the Group remains cautious, maintaining a strong balance sheet with high levels of capital and provisioning. Liquidity was $137 billion as at 31 December 2013.

On the outlook for the 2014 calendar year, Ian Narev said: "We remain cautiously optimistic about the economic environment for this year. We have seen, in recent weeks, that there is still volatility in global markets. The risks presented by that volatility continue to supress business confidence. As a result, there is little real evidence, so far, of a meaningful increase in investment in the rest of the non-resource sector of the Australian economy, other than in housing."

"However, growth forecasts for developed economies have improved, consumer spending over the holiday season was generally higher than last year, corporate balance sheets remain strong, there is positive activity in the housing sector, and the Australian dollar has become more competitive."

"So all in all, we continue to assume that any improvements in economic activity in the next year will be gradual rather than dramatic. We will stick to our proven strategy, and maintain business settings that reflect both the risks and the opportunities of this economic environment."

(1) Net profit after income tax ("cash basis") - represents net profit after tax and non-controlling interests before Bankwest non-cash items, the gain on sale of management rights, treasury shares valuation adjustment, Count Financial acquisition costs, Bell Group litigation expenses and unrealised gains and losses related to hedging and IFRS volatility. This is Management's preferred measure of the Group's financial performance.

(2) Net profit after income tax ("statutory basis") - represents net profit after tax and non-controlling interests, including Bankwest non-cash items, the gain on sale of management rights, treasury shares valuation adjustment, Count Financial acquisition costs, Bell Group litigation expenses and unrealised gains and losses related to hedging and IFRS volatility. This is equivalent to the statutory item "Net profit attributable to Equity holders of the Bank".