Full announcement and attachment with detailed comparatives tables viewable here.

1. Update on non-cash items

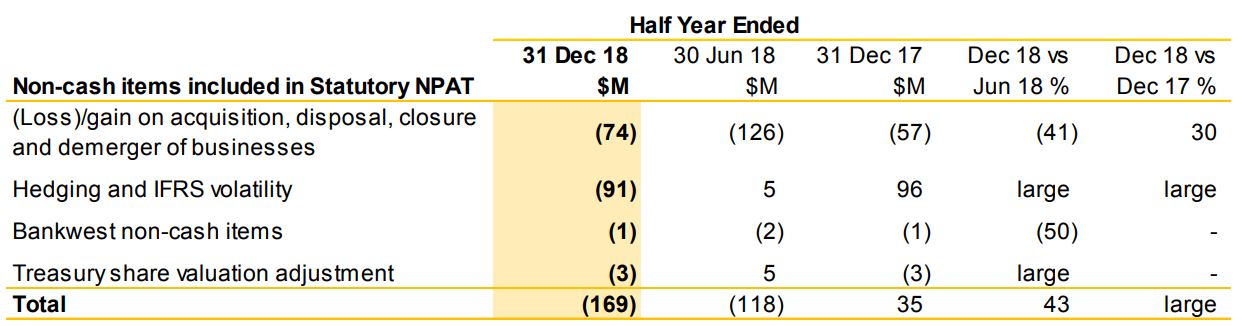

As set out in the table below, non-cash losses totalling $169 million (post-tax) will be included within the Statutory NPAT in the Interim result. This amount has two main components:

- Losses on disposals of businesses of -$74 million (post-tax). This includes previously disclosed transaction and separation costs related to the sale of CFSGAM (-$100 million post-tax) and CommInsure Life (-$38 million post-tax); the gain on disposal of Sovereign (+$113 million post-tax); and other expenses including the loss on disposal of TymeDigital and project costs associated with the demerger of NewCo.

- Hedging and IFRS volatility losses of -$91 million (post-tax) mainly due to the depreciation of the Australian dollar against the New Zealand dollar.

2. Changes to financial reporting arising from the simplification of CBA’s operating model

In line with CBA’s commitment to becoming a simpler, better bank, a number of changes to CBA’s operating model have been made during the current half, which realign businesses across operating segments. These changes have not impacted CBA’s cash net profit after tax (NPAT), but result in changes to the presentation of the Income Statements and Balance Sheets of the affected divisions (Refer pages 3-8).

- In a consolidation of CBA’s Australian retail businesses, Bankwest is now included within the Retail Banking Services (RBS) division. Bankwest will no longer be separately disclosed.

- The small business banking segment has been transferred out of RBS to Business and Private Banking (BPB) in order to consolidate CBA’s business banking.

- Following the announcement of the demerger of NewCo and to consolidate CBA’s retail businesses, Commonwealth Financial Planning has been transferred out of Wealth Management (WM) to RBS.

- General Insurance has been placed under strategic review and transferred out of WM to RBS, while the review is underway.

- Other re-segmentation, cost allocations and reclassifications:

o There have been refinements to the allocation of support unit and other costs.

o Customer loyalty scheme costs in New Zealand (NZ) have been reclassified in the Income Statement to align with industry practice.

3. Changes to the presentation of discontinued operations

In line with accounting standards, the Interim and comparative results of discontinued operations are presented separately as a single line item ‘net profit after tax from discontinued operations’ for both Group and divisional results. Assets and liabilities of discontinued operations are presented separately as held for sale on the Balance Sheet as at 31 December 2018, however in line with accounting standards prior periods remain unadjusted. Group Key Performance Indicators are presented on both a continuing operations and including discontinued operations basis (Refer pages 3-4, 6-7).

In the year ended 30 June 2018, discontinued operations included:

- CBA’s Life insurance businesses in Australia (CommInsure Life) and New Zealand (Sovereign)

- BoComm Life Insurance Company Limited (BoComm Life)

- Commonwealth Bank of South Africa (Holding Company) Limited (TymeDigital)

Additional reclassifications to discontinued operations in the half year ended 31 December 2018 include:

- Colonial First State Global Asset Management (CFSGAM)

- PT Commonwealth Life (PTCL) and its subsidiary

The demerger of CBA’s wealth management and mortgage broking businesses (NewCo) is subject to shareholder approvals and will remain classified within continuing operations.

4. Interim results announcement

Commonwealth Bank of Australia (CBA) is scheduled to announce its Interim results on 6 February 2019. A results briefing will be hosted by the Chief Executive Officer, Matt Comyn, and Chief Financial Officer, Alan Docherty, at 11:00am (Australian Eastern Daylight Savings Time) on 6 February 2019. This briefing will be available via webcast on the Commonwealth Bank Investor Centre (www.commbank.com.au/investors).

In addition to the Interim results release, an Excel template populated with the current period financial results and comparatives will be published on the website.

Furthermore, to assist users in analysing CBA’s financial information, the financial comparative tables for the 2019 Interim results are also now available in user-friendly Excel format on the Investor Centre at: