The latest CBA credit and debit card spending analysis from Commonwealth Bank’s Global Economic and Markets Research team indicates spending momentum has improved over the last two weeks but total spending is still well down on a year ago.

The analysis for the fortnight ending Friday, 1 May 2020 shows the improved spending momentum was across a range of goods and services and all states and territories. Importantly, online sales have lifted sharply – particularly for online retail items, which are up by 110 per cent compared to the same period a year earlier.

Head of Australian Economics Gareth Aird said: “Our analysis offers a glimmer of hope that we may be past the lowest point in terms of people spending less. Although people are continuing to spend less, the rate of decline is slowing. It looks to be the case that households have stepped up their rate of expenditure over the second half of April compared with the first half of the month.”

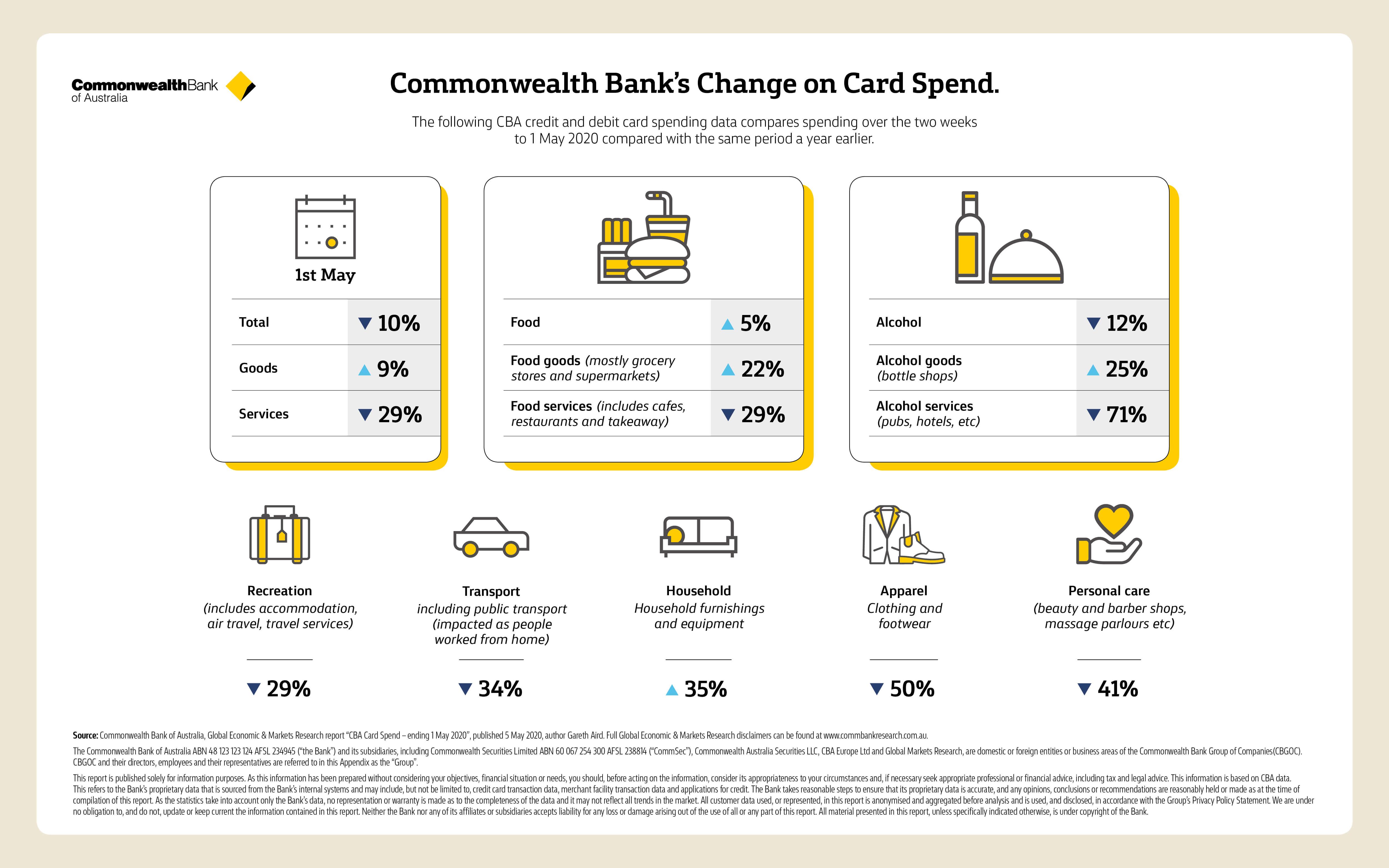

Mr Aird says while total spending over the fortnight to 1 May is still down – by 10 per cent on year ago levels – it is better than total spending to mid-April which was down by almost 20 per cent compared to the same time last year.

“Our latest data comes before any easing of restrictions, so it may be that households are feeling more confident to spend at businesses that have not had to shut their doors. It also looks like households have been more eager to get online, click the mouse and fill up the virtual shopping basket,” Mr Aird added.

Although spending is down sharply across most categories, the level of spending growth has improved. Spending is still up strongly on household goods and furniture, up 35 per cent on the fortnight ending 1 May 2020.

Spending remains down on non-retail goods and services, such as travel, recreation and personal care, however the rate of decline for non-retail goods and services has eased over the past fortnight.

“The spending pulse looks to have picked up in all states and territories over the past fortnight. Tasmania is the outperformer with spending down two per cent on year ago levels, NSW and Victoria continue to see large falls in spending levels against the other states, with their overall spending down by 10 per cent and 14 per cent respectively on the same time last year. Spending in the ACT is now down 15 per cent over the year,” Mr Aird said.

“Queensland, Western Australia, South Australia and the Northerm Territory have all done better than the national rate,” Mr Aird added.

Notes for Editors:

Source

Commonwealth Bank of Australia, Global Economic & Markets Research report “CBA Card Spend – fortnight ending 1 May 2020”, published 5 May 2020, author Gareth Aird. Full Global Economic & Markets Research disclaimers can be found at www.commbankresearch.com.au.

About our weekly/fortnightly CBA credit and debit card data

Our Global Economic & Markets Research team analyses CBA credit and debit card spending on a weekly/fortnightly basis. The following table has been developed by the team and shows the latest credit and debit card spending, compared to weekly/fortnightly results from a year earlier.

| Week ending 27 March | Week ending 3 April | Week ending 10 April | Week ending 17 April | Fortnight ending 1 May | |

|---|---|---|---|---|---|

| Overall spending | -4% | -15% | -20% | -18% | -10% |

| Food | +18% | +4% | +6% | -5% | +5% |

| Food goods (mostly grocery stores and supermarkets) | +40% | +24% | +28% | +12% | +22% |

| Food services (includes cafes and restaurants) | -28% | -38% | -38% | -40% | -29% |

| Alcohol | +34% | -10% | -13% | -24% | -12% |

| Alcohol good (bottle shops) | +86% | +28% | +23% | +4% | +25% |

| Alcohol services (pubs, hotels, etc) | -49% | -71% | -72% | -73% | -71% |

| Recreation (includes accomodation, air, travel travel services) | -26% | -33% | -37% | -37% | -29% |

| Transport (includes public transport) | -24% | -36% | -44% | -46% | -34% |

| Household furnishing & equipment | +26% | +20% | +10% | +34% | +35% |

| Apparel (clothing & footwear) | -44% | -60% | -58% | -58% | -50% |

Source: CBA Global Economic & Markets Research notes ‘CBA card spend – week ending 27 March, 3 April, 10 April, 17 April and fortnight ending 1 May 2020’.

Disclaimer

The Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945 (“the Bank”) and its subsidiaries, including Commonwealth Securities Limited ABN 60 067 254 300 AFSL 238814 (“CommSec”), Commonwealth Australia Securities LLC, CBA Europe Ltd and Global Markets Research, are domestic or foreign entities or business areas of the Commonwealth Bank Group of Companies(CBGOC).

CBGOC and their directors, employees and their representatives are referred to in this Appendix as the “Group”.

This report is published solely for information purposes. As this information has been prepared without considering your objectives, financial situation or needs, you should, before acting on the information, consider its appropriateness to your circumstances and, if necessary seek appropriate professional or financial advice, including tax and legal advice.

This information is based on CBA data.

This refers to the Bank’s proprietary data that is sourced from the Bank’s internal systems and may include, but not be limited to, credit card transaction data, merchant facility transaction data and applications for credit. The Bank takes reasonable steps to ensure that its proprietary data is accurate, and any opinions, conclusions or recommendations are reasonably held or made as at the time of compilation of this report. As the statistics take into account only the Bank’s data, no representation or warranty is made as to the completeness of the data and it may not reflect all trends in the market. All customer data used, or represented, in this report is anonymised and aggregated before analysis and is used, and disclosed, in accordance with the Group’s Privacy Policy Statement. We are under

no obligation to, and do not, update or keep current the information contained in this report. Neither the Bank nor any of its affiliates or subsidiaries accepts liability for any loss or damage arising out of the use of all or any part of this report. All material presented in this report, unless specifically indicated otherwise, is under copyright of the Bank.