New research from Commonwealth Bank shows there’s no one-size-fits all approach to enticing shoppers via price promotions, and some may even be turned off by discounting – depending on which consumer personality they are.

Most (81 per cent) ‘bargain hunters’ say price is the main influence when purchasing whereas almost all connoisseurs (95 per cent) say quality is more important than price. The majority (84 per cent) of ‘researchers’ plan their purchases around sales. And half of all ‘brand loyalists’, the fourth shopper personality, say brands lose their allure by offering discounts too often.

Michael Cant, Executive General Manager, Corporate Financial Services, Commonwealth Bank said: “For shoppers, the price they pay for an item often reinforces their perception of themselves – whether as a savvy bargain hunter, or as a discerning consumer of quality goods whose buying decisions help them stand out from the crowd. The bottom line is, the lowest price is not always the most attractive.

“Understanding the broad types of consumer is an important starting point for price strategy. Savvy retailers are very clear on the subtleties of their target market.”

Some never pay full price

The research also shows while most shoppers (68 per cent) consider quality more important than price, they also believe it’s easy to buy at a discount, with a significant minority (46 per cent) now unwilling to pay full price on any occasion.

More than three quarters of shoppers (77 per cent) also admitted to making impulse purchases, and a 25 per cent discount is the average trigger point to entice them to purchase.

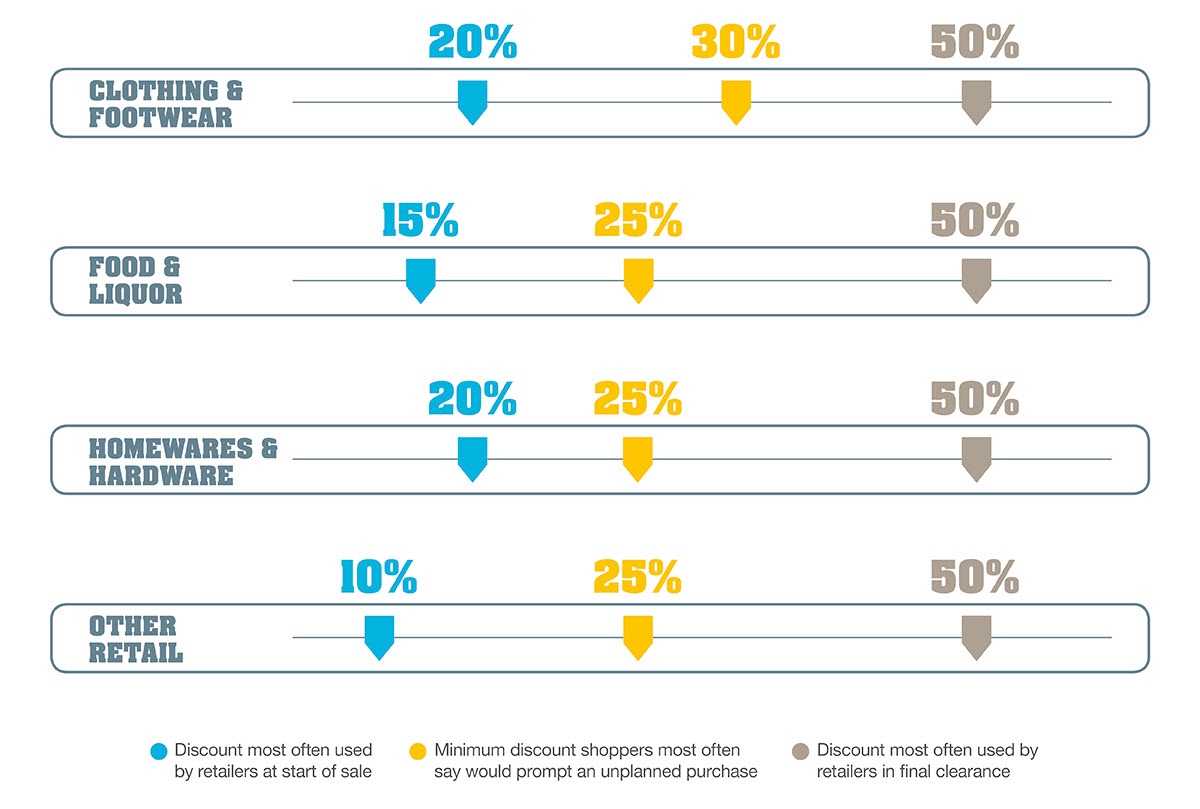

Jerry Macey, National Manager Retail, Commonwealth Bank said: “It’s interesting that consumers typically need a 25 per cent discount to make an unplanned purchase whereas retailers generally start their promotions at 20 per cent. It gives retailers room to move over time while using the initial discount as a form of advertising.

“Pricing clearly plays an important role in both driving sales and prompting purchase, but its important retailers remember shopper behaviour can vary widely and consider the type of consumers they are seeking to attract,” said Mr Macey.

Percentage discounts – retailer practices and consumer responses

The report also finds:

- 71 per cent of consumers plan purchases ahead of sales periods.

- 25 per cent of retailers are increasing the frequency of sales compared with 12 months ago.

- 59 per cent of retailers agree their category is price sensitive.

- 61 per cent of shoppers said price is the main influence on their buying decisions.

- 75 per cent of shoppers said brands do not lose their allure by offering discounts too often.

- 23 per cent of shoppers preferred blanket discounts across the entire range; only 8 per cent of retailers viewed this as popular with their customers.

- Twice as many shoppers (18 per cent) nominated free shipping as the most appealing discount, compared with 9 per cent of retailers.

The research also suggests group sales such as Click Frenzy attract a lot of shopper interest, but are not overly effective given low conversion rates. Forty-four per cent of retailers participated in events such as Black Friday, Cyber Monday or Click Frenzy but only 16 per cent of shoppers indicated they made a purchase.

ENDS

More detail on the four general types of shopper

The researcher – 23 per cent of all survey respondents

- 90 per cent compare prices online before buying;

- 85 per cent spend time researching before they buy;

- 79 per cent visit multiple stores to seek lower prices;

- Likely to be female, aged from 18 to 39 years, with an annual household income of more than $100,000.

The bargain hunter – 23 per cent of all survey respondents

- 90 per cent buy products when they are on sale;

- 89 per cent say retailers are becoming more price competitive;

- 81 per cent say price is the main influence in buying decisions;

- Likely to be female, are found in all age groups, and have an annual household income of less than $100,000.

The brand loyalist – 31 per cent of all survey respondents

- 50 per cent say brands lose their allure by offering discounts too often;

- 47 per cent say full priced products and services are better quality than discounted ones;

- Likely to be male, under 60 years and are found in all income groups.

The connoisseur – 23 per cent of all survey respondents

- 95 per cent say quality is more important than price and this is their top shopping driver;

- 75 per cent are prepared to pay more for products tailored to their needs;

- 74 per cent buy products when they are on sale;

- Likely to be male, older than 40 years and have an annual household income of more than $100,000.

About the Retail Insights Report

The data shown above comes from the Commonwealth Bank Retail Insights Report edition three.

The report is based on a quantitative survey conducted by ACA research in August of 500 senior retail business decision makers from small, medium and large retail businesses. The report also includes a survey of 1,001 shoppers.