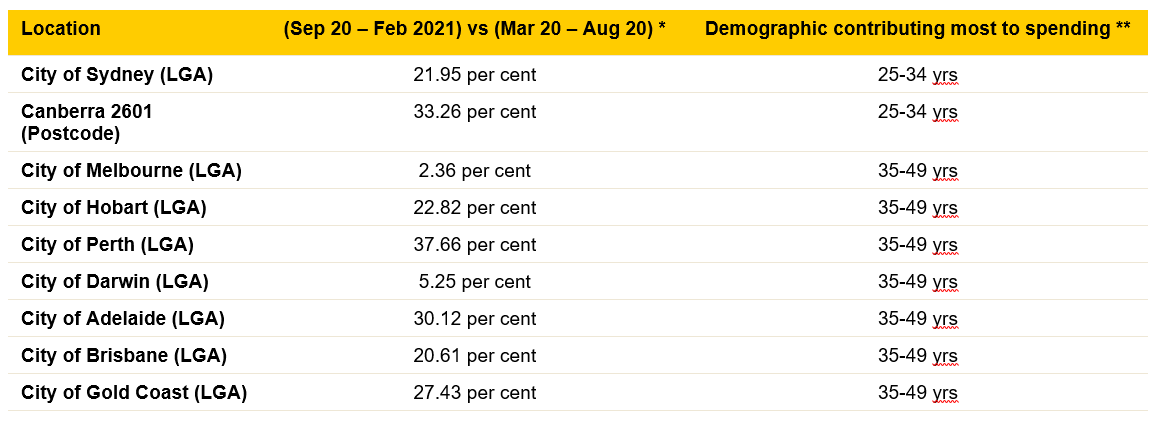

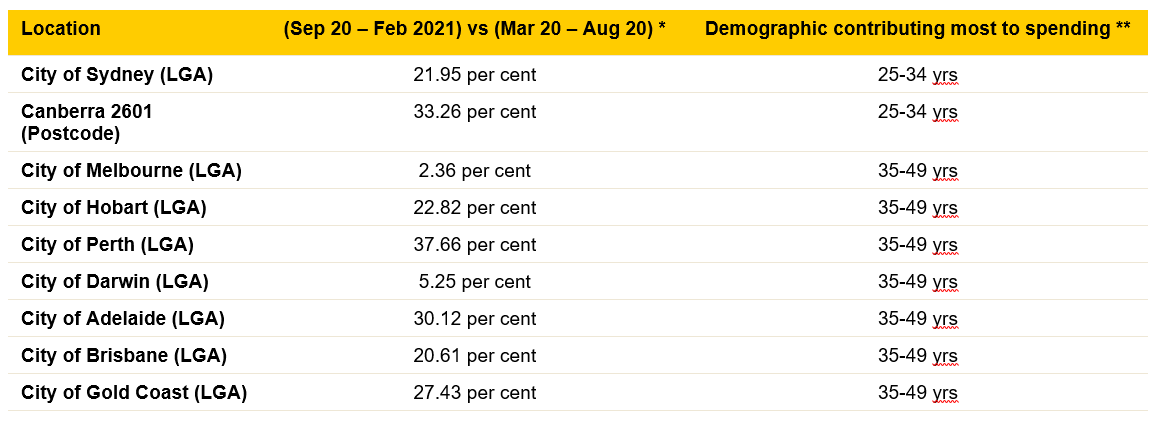

The strongest spending growth in CBDs across the country over the last six months occurred in Perth (up 33.7 per cent), closely followed by Canberra (33.3 per cent) and Adelaide (30.1 per cent). Not far behind was the Gold Coast (27.4 per cent), Hobart (22.8 per cent), Sydney (21.5 per cent) and Brisbane (20.5 per cent). While also showing positive movement, Darwin (5.25 per cent) and Melbourne (2.36 per cent) recorded the smallest growth over the last 6 months.

“We’re encouraged to see spending in our CBDs on the up and we hope to see this trend continue as more people start coming back into city centres more regularly,” Claire Roberts, Executive General Manager of Small Business at the Commonwealth Bank said.

“Small businesses in CBD areas have had it really tough over the past year but we’re seeing encouraging signs of recovery,” Ms Roberts said.

“We’re continuing to support our customers who are still getting back on their feet and I’m encouraged by the business activity we’re seeing across metro areas.

“We also know that many suburban businesses have experienced a boost over the past year thanks to people working from home and changes in consumer spending behaviour, and we want to help these businesses retain and grow their customer base,” she said.

To assist small business customers on their continued road to recovery, CBA is launching a tailored business insights program. The program delivers tailored information about a business’s customer demographics and spending patterns in their local areas – direct to their inbox and through the CommBank App. As part of the program, CBA business customers will also receive tips for increasing sales and driving repeat business.

“Our data expertise and scale allows us to give business owners an objective view of customer spending in their own suburbs as well as detailed information about their own customers’ demographics and spending patterns,” Ms Roberts said.

The tailored business insights program uses data from Daily IQ - a free insights tool available to CommBank business customers.

“Finding the time to access those insights and then knowing what to do with them can be challenging for time-poor business owners. That’s why we’ve launched the tailored business insights program, to proactively surface useful information to help businesses on the road to recovery,” Ms Roberts said.

Graham Greenhalgh, owner operator of the Australian Meat Emporium in Sydney’s inner south said the insights he has gathered through Daily IQ have helped his business to weather the economic storm of COVID-19.

Graham started using Daily IQ in April last year – the height of Sydney restrictions – and said the data and information ultimately helped give his business an advantage during a mixed year.

“After a quieter than expected December in 2019, and a further downturn when we had the bushfires that summer, we actually saw an increase in sales when the pandemic hit,” Mr Greenhalgh said.

“The problem was seeing a lot of numbers but we didn’t really understand the demographics until we started using Daily IQ. For us, it’s all about what makes the customer tick. Using Daily IQ has given us insights into who they really are and how they behave,” he said.

“The age and location of where our customers come from was really useful to us and has meant we can be more targeted with our marketing so we’re not wasting money.”

“To be able to get insights to help you deliver something that doesn’t annoy anybody, but makes the customer experience better, well that’s what everyone in business is trying to do.”

*Data based on card transactions via CommBank merchant facilities in the cities’ CBDs.

** Data based on CommBank card transactions via CommBank merchant facilities in the capital cities’ CBDs.