Commonwealth Bank today released new figures showing a significant uptick in digital wallet usage over the last 12 months. The figures highlight the growing popularity of digital wallets and the likelihood for them to become the most popular contactless1 way to pay in-store by the end of the year, if current trends continue.

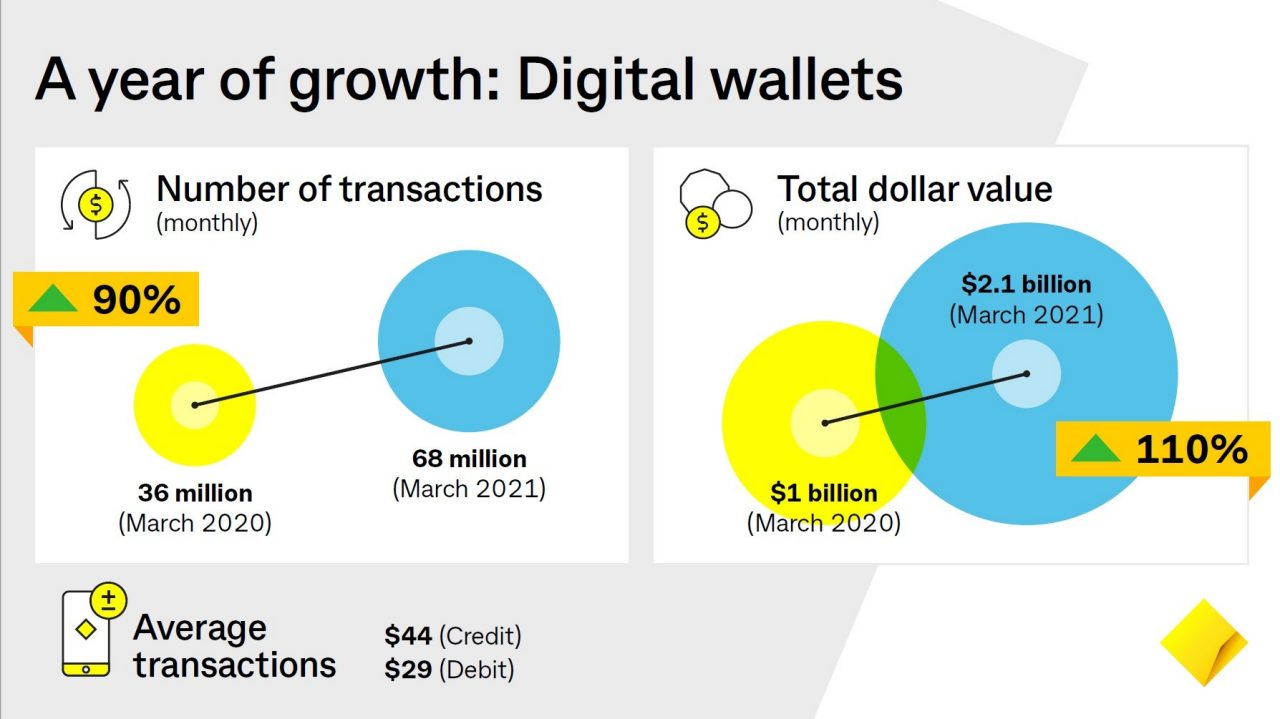

Between March 2020 and March 2021 the number of monthly digital wallet transactions increased 90 per cent, with the number of transactions rising from 36 million to 68 million2.

Over the same period, the total dollar value of digital wallet transactions more than doubled, with the value of monthly transactions rising to $2.1 billion, up from $1 billion3.