“We’ve recently sent more than 66 million localised and personalised in-app messages to relevant customers3 and understand the value this adds to their lives. We regularly contact customers within 24 hours, and sometimes the same day, following any government announcement advising of additional support available.”

Dr McMullan added the bank had contacted 4.7 million customers about government benefits and rebates that they may not have been aware they are eligible for4.

“We’re focussed on offering customers global-best digital experiences and last month customers started more than 180,000 claims using Benefits finder. This is the largest monthly number of claims ever started since we launched the digital feature in 2019 and an uplift of more than 150 per cent when compared to the same period last year5.”

Customers have now commenced more than 1.5 million claims via Benefits finder, up from more than 1 million in February 20216.

Dr McMullan said the bank has seen an increase in the number of claims started across all states.

“Since the start of the year, customers in NSW have accounted for more than 50 per cent of all claims started across the country, followed next by Victoria with nearly 20 per cent, and Queensland with more than 10 per cent7," he said.

“When you compare June 2021 to July 2021, the number of claims started in both Victoria and South Australia has more than doubled, while NSW has a recorded a spike of nearly 60 per cent8.”

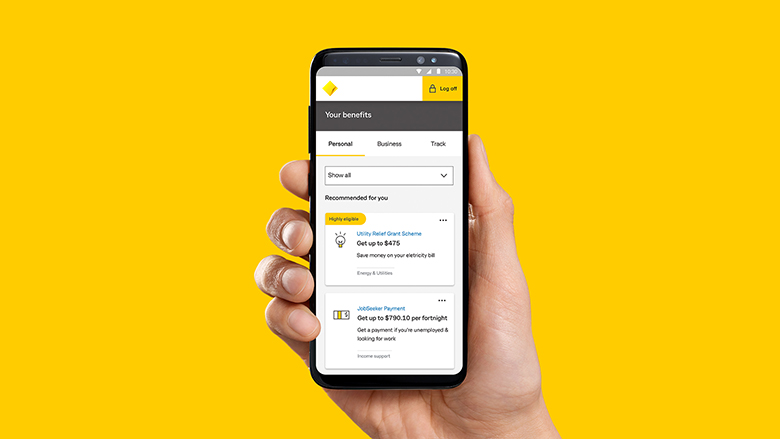

The Benefits finder feature uses the bank’s Customer Engagement Engine and data and decision science expertise to organise, personalise and simplify the claim process for customers.

Dr McMullan said the bank is using technology to deliver real value to its 7.6 digitally active customers.

“We quickly saw the COVID-19 Disaster Payment become one the most popular benefits since it was recently added into Benefits finder. That’s not a surprise to us, given that this particular benefit supports those workers adversely affected by a state public health order.”

The three most popular type of benefits that were started by customers using Benefits finder from January to July 2021 were:

- ASIC and State (e.g. NSW Revenue) unclaimed money (for example, money in bank accounts and life insurance policies not touched or claimed for a certain amount of time) – more than 210,000 claims started

- NSW Dine & Discover (four $25 vouchers to be used by NSW residents to support dining, arts and recreation businesses) – more than 135,000 claims started

- COVID-19 Disaster Payment (a support payment for workers adversely affected by a state public health order) – more than 80,000 claims started

Last month the bank also added 58 additional benefits specifically for businesses to Benefits finder, increasing the number of benefits available for personal and business customers to more than 320.

Benefits finder saved customers more than $481 million across utility bills and additional government payments between July 2019 and August 2020, with many customers standing to benefit from cost savings annually.