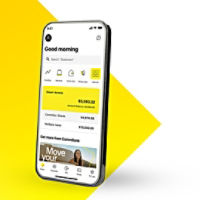

Launch of CommBank app 5.0, offering business customer account switching

Launching next month, each of the app’s 7.7 million active customers will be presented with an individually tailored home-screen, services and product information when logging on, compared with the current version. On average, customers accessing the app make combined payments of $63 billion a month. The new and simpler navigation features will make it easier to make transactions, book appointments, find and access services, and utilise money management tools.

The 800,000 business banking customers who are active users of the app will now be able to switch seamlessly from their business accounts to their personal ones. The challenges of account switching has been one of the main friction points for business customers. This change allows customers to better manage their personal and business lives.

CommSec share trading through app 5.0

Customers will be able to buy, sell and hold Australian shares and exchange traded funds through the app from next month. This will be available to CBA retail customers and existing customers of CommSec, the country’s leading online broker. Around one in five CBA customers have a CommSec account and recent research has shown that 45 per cent of customers would value the opportunity to invest in the stock market through their banking app1. CommSec has seen an inflow of more than one million new customers over the past three years as the COVID-19 pandemic drove an acceleration in retail investing.

“CommSec share trading through the CommBank app is a distinct proposition which is not offered by any other bank in Australia,” said Mr Comyn.

New services for business customers

As well as being able to manage their funds more easily by switching between their business and personal accounts in the CommBank app, business customers can now take advantage of a new range of merchant and deposit products. These include the Smart family of payment terminals which can now be accessed in branches and online, as well as the Powerboard e-commerce offering that simplifies the integration of a company’s multiple technological services through one single application.

Today also sees the launch of the new Capital Growth Account, that allows business customers to earn higher interest and offers an access period as short as 48 hours.

“CBA banks more business customers than any other bank and these innovations form part of our strategy to be the leader in business banking with a focus on the best in-person and digital services Australia-wide,” said Mr Comyn.

1Survey conducted between 4 and 11 April 2023, amongst sample of n=1047

Things you should know

This content was prepared without considering an individual reader’s objectives, financial situation or needs. Readers should consider the appropriateness to their circumstances. Visit Important Information to access Product Disclosure Statements or Terms and Conditions which are currently available electronically for products of the Commonwealth Bank Group, along with the relevant Financial Services Guide. Target Market Determinations are available here. Fees, charges and eligibility criteria may apply.