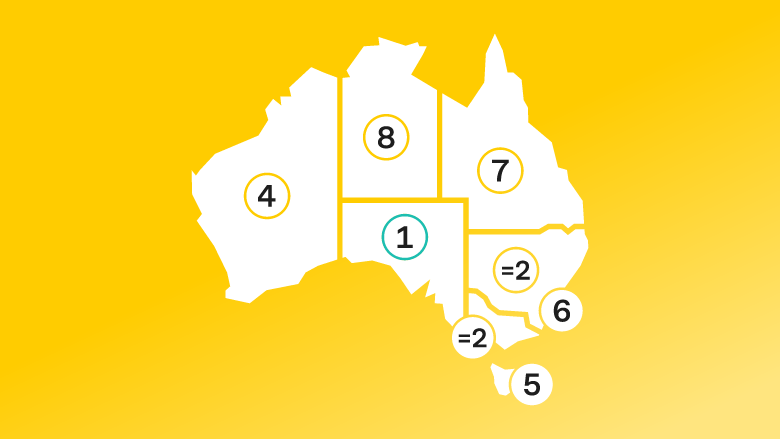

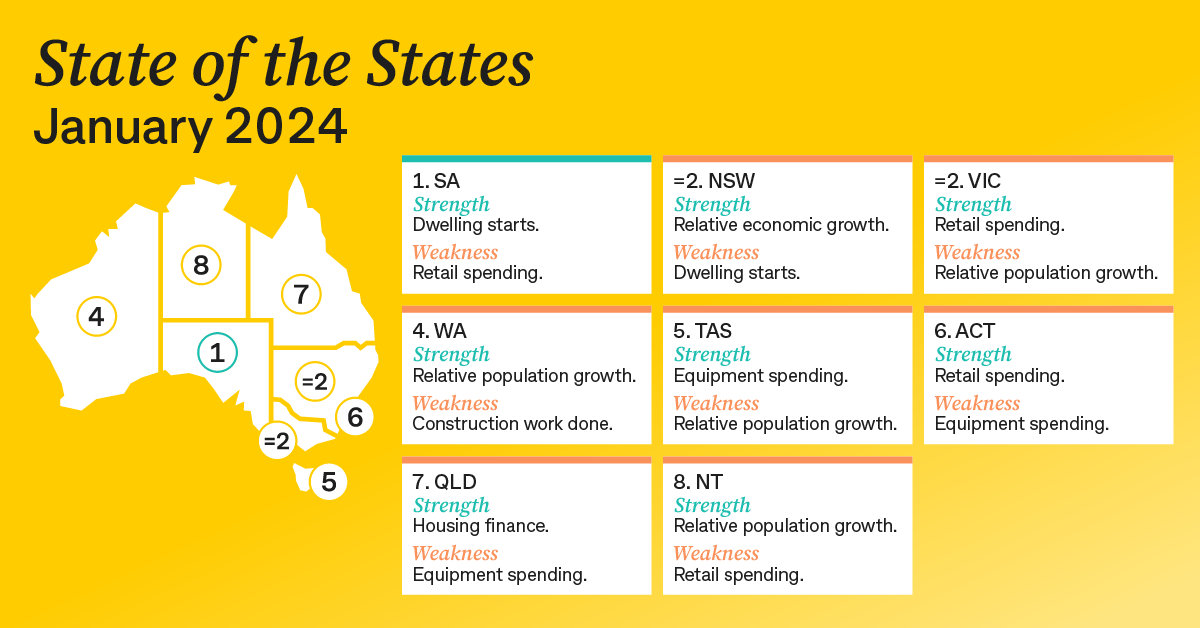

South Australia jumped ahead of Victoria to take first place. Victoria is now equal second with NSW. Western Australia has lifted from fifth to fourth. Tasmania rose from sixth to fifth. The ACT has moved into sixth, ahead of Queensland which has fallen three places from fourth to seventh. The Northern Territory is eighth.

“The economic performance of Australia’s states and territories is being supported by a solid job market and strong population growth however the economies have slowed in response to rising interest rates, higher borrowing costs and price pressures,” CommSec Chief Economist Craig James said

“For the first time in the history of our reports, South Australia has taken the lead. Population growth in South Australia has tripled over the past two years, which is showing up in a strong housing market and overall economic activity.

“However, South Australia can’t rest easily. It is likely the state will face challenges from NSW and Victoria in the period ahead.

“We have also looked at annual changes in economic indicators as a useful measure of economic momentum and the report shows strong economic momentum by Western Australia, with Queensland, Victoria, NSW and South Australia not far behind.”

The CommSec State of the States report uses the latest available information to provide an economic snapshot of each state and territory by comparing eight key indicators: economic growth, retail spending, equipment investment, unemployment, construction, population growth, housing finance and dwelling commencements.

State and territory highlights

- South Australia ranked first on four indicators, including construction work done and unemployment.

- Victoria ranked second or third on three of the eight indicators, including retail spending.

- NSW also ranked second or third on four of the eight indicators, including unemployment.

- Western Australia ranked first on relative population growth.

- Tasmania ranked first on equipment spending.

- The ACT ranked first on retail spending.

- Queensland ranked first on home loans.

- The Northern Territory ranked second on relative population growth.