Through Benefits finder, CommBank customers have access to more than 270 benefits and rebates. Many of these benefits are pandemic-related including the Pandemic Leave Disaster Payment, Dine & Discover NSW, COVID Land Tax Relief and SME government guaranteed loans.

“Digital adoption is accelerating and we want to build really deep, trusted personal relationships with customers by differentiating and offering global best digital experiences and technology. The Benefits finder feature in the CommBank app and NetBank uses personalised and relevant alerts, making it really simple and easy for customers to make a claim. This more readily helps customers find benefits and rebates that they may be eligible for – ultimately to help put more money back into budgets for households and businesses,” Mr Lindström said.

The most popular type of claim using the Benefits finder feature include [iii]:

- Unclaimed money (506,972 on a federal and state level)

- Unclaimed super (67,228)

- Power saver bonus (58,124)

- Jobseeker related payments (31,256)

- Family tax benefit (26,587)

- Rent assistance (29,863)

- Family energy rebate (26,038)

“We are focused on re-imagining the digital experiences we offer customers to help them better understand and manage their finances. This includes tapping into our customer engagement engine and using Artificial Intelligence and machine learning to drive highly relevant and personalised content straight into the palms of our customers’ hands – including via the personalised feed of content we are now offering customers through our new For You feature, with no customer feed being the same.”

Benefits finder was extended to business customers in May 2020 with government and Bank-led benefits to help our customers throughout the pandemic. In the coming months, CBA will be adding additional business benefits to help time-poor business owners access the support they could be eligible for.

Over the next five years, CBA plans to invest more than AU$5 billion in technology to keep improving its systems and services, and to not only help keep customers safe and secure, but to serve them better.

“We want to be known as the best in digital. Not only the best digital bank, but the best in digital compared to anyone else. It’s something the bank is putting a lot of focus on.”

About Benefits finder

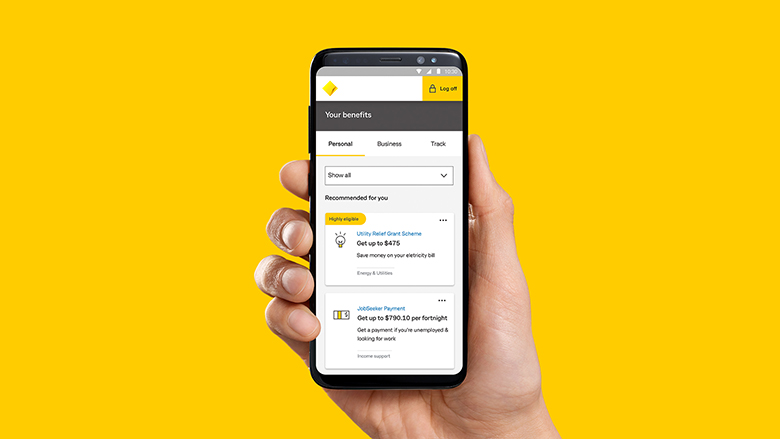

The Benefits finder feature can be accessed via the CommBank app and NetBank. Customers are asked to answer four simple questions, with answers determining what benefits or rebates they may be eligible to claim. Customers are provided with details on each benefit or rebate, including how much they may be able to claim and instructions on how to claim, and are then directed to the relevant website to start the claim.

The Benefits finder feature was developed as part of the ongoing collaboration between CBA and Harvard University’s STAR (Sustainability, Transparency and Accountability Research) Lab.

Find out more at www.commbank.com.au/digital-banking/benefits-finder.

Notes for editors

[i] More than $481 million was saved by CBA customers in utility bills and additional government payments between July 2019 and August 2020. Customers saved more than $127 million in utility bills and generated $354 million in additional income on a recurring annual basis. CBA designed the evaluation in partnership with Harvard University’s STAR Lab.

[ii] Between launch in September 2019 and February 2021, more than 1 million claims have been started, with 695,000 claims started since the start of the coronavirus pandemic in March 2020.

The state breakdown of the number of claims started include:

- NSW (397,290)

- Victoria (291,121)

- Queensland (206,301)

- Western Australia (105,450)

- South Australia (76,830)

- Australian Capital Territory (21,736)

- Tasmania (17,158)

- Northern Territory (8,741)

[iii] The most popular type of claims are measured by the number of claims started. They are ordered by the number of claims started from September 2019 to February 2021 inclusive.