Business Innovation has delivered almost $70 billion to the Australian economy but has the potential to generate much more, according to Commonwealth Bank research launched today.

The Commonwealth Business Insights Report – Unlocking Everyday Innovation, measures the innovation performance of Australian businesses across a range of demographic categories and quantifies the value of a firm’s innovation through productivity gains and additional revenue.

The report found that businesses that had implemented an innovation generated an estimated average return of $405,000, which equates to a total realised value of $69 billion for the Australian economy.

If that same return were to be achieved by all Australian businesses*, it would contribute a staggering $215bn to the economy, which is more than 10 per cent of the value of Australian Gross Domestic Product in 2015.

The report also plots the innovation status of Australian businesses across 15 core elements that comprise an ‘innovation index’, with performance ranging from innovation restrictive (at minus 100), through to being innovation disruptive (at 100).

The analysis for the report was conducted in accordance with the Oslo Manual, an OECD recognised framework for defining and categorising innovation. Under these guidelines, innovation is defined as introducing something new or making a significant improvement in one or more of four areas: business processes, products and services, organisational structure, and marketing practices.

In releasing the report, Adam Bennett, Group Executive, Business & Private Banking, Commonwealth Bank, said: “We found that nationally Australian businesses are achieving an innovation index score of 24, which means that on the whole we are on the verge of moving into the arena of true innovation.

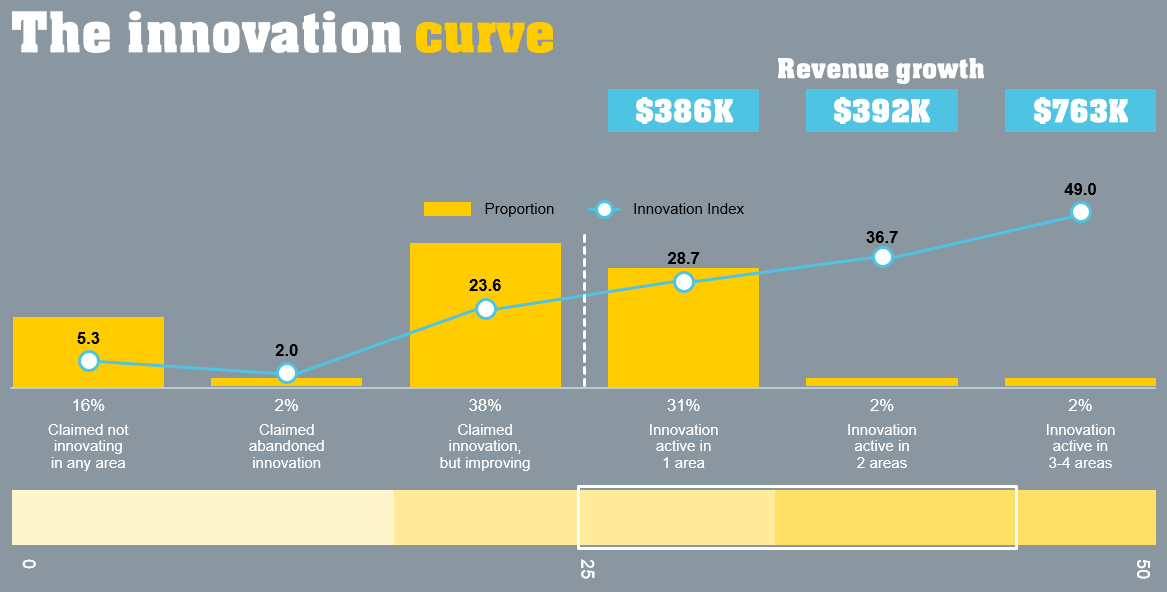

“Most businesses that are innovating are doing so in just one of the four areas where innovation can take place, with most businesses focussing on their products and services. The innovation index score for these firms is 28.7 and this innovation activity is delivering an extra estimated value of $386,000 per firm.

“But for those that are innovating in three or more areas, their innovation index scores jump to around 50 and the extra revenue generated is much higher too, at an estimated average of $763,000 per firm. It’s clear from our research that there’s a strong correlation between how innovation active a firm is and the level of revenue or savings generated.

Mr Bennett said: “This research demonstrates that innovation within Australian businesses delivers significant financial return for individual firms and the broader economy, but true innovation remains elusive for many. This presents an unprecedented commercial opportunity for most Australian businesses, which is why we have conducted this research; to demystify innovation and show there is an achievable pathway to becoming truly innovation active.”

The innovation index** is calculated by testing 15 key attributes relating to a series of management capabilities and entrepreneurial behaviours.

While the CommBank Innovation Index stands at 24 nationally, which is on the boundary between improvement and true innovation (25), some businesses scored in the upper ranges of the scale, although only 24 per cent scored above 50.

The report also reveals that of the 15 elements of innovation comprising the index, there are clear gaps between those who are innovation active and those who are not. The top three traits include:

- Process - encouraging employees to ask questions that challenge (13 per cent)

- Adapting – adapting your products and services to make the most of opportunities (13 per cent)

- Philosophy – expecting employees to offer creative ideas for improvement (11 per cent).

“It’s evident that innovative businesses share common characteristics. We found commonalities amongst innovation active businesses such as experimentation, listening to staff, and adapting to take advantage of opportunities as they emerge. What’s interesting is that these are not radical disruptive changes, but rather simple ways businesses can seek to move up the innovation curve, and realise value,” Mr Bennett added.

When looking at innovation activity by industry, the report reveals that the most innovation active industries are manufacturing (61 per cent), wholesale trade (59 per cent).

“We also found some industry sectors have much higher scores than others. The motivation to innovate, such as capitalising on emerging growth opportunities or the need to survive in light of industry disruption, are very strong drivers. This is where key attributes around management capabilities and entrepreneurial behaviours are needed to kick start genuine innovation.”

To view the full Business Insights Report, visit https://www.commbank.com.au/business/can/move-forward.html

ENDS

Notes to editor:

* These figures are based on a total Australian market of 530,937 businesses with more than two employees and annual turnover of more than $500,000

** The index combines the results into a single numerical indicator, enabling us to rank businesses on a scale from –100 (innovation restrictive) to +100 (disruptive innovation), thus creating the concept of an innovation curve or spectrum

About the Business Insights Report

This Commonwealth Bank research involved speaking with 2,195 business owners or a primary executive/decision maker with annual turnover of $500,000 to $500 million and at least two employees. Respondents were asked whether their business had implemented a new or significant change or changes and the responses were assessed in accordance with the OECD-used criteria for identifying innovation known as the Oslo Manual. For the Innovation Index, respondents were also asked about their views on 15 statements to assess the business’s management capabilities and entrepreneurship behaviour, which were also used to identify the key drivers and practices that most influence innovation performance, and they were also asked about the value of their innovations in terms of revenue and cost savings.