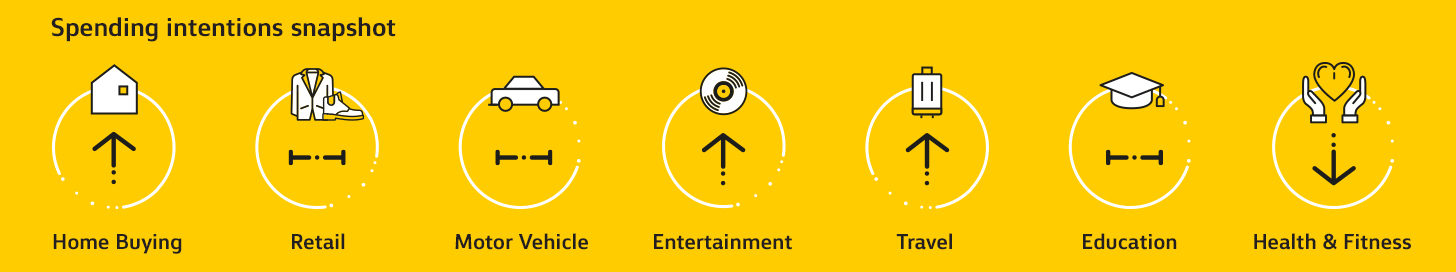

The latest data from the Commonwealth Bank Household Spending Intentions (HSI) Series released today indicates there has been a subdued response to Australia’s economic policy stimulus, with a reluctance by consumers to spend on goods and an upwards trend towards spending on experiences such as travel and entertainment.

CBA Chief Economist Michael Blythe said: “The monthly Commonwealth Bank Household Spending Intentions series, data to end-November, shows a very modest response to the policy stimulus, both monetary and fiscal, that has been applied to the economy through 2019. The weakness in the HSI indicators is centred on spending on ‘goods’, which continues to track sideways at low levels. In contrast, spending on ‘experiences’ is generally trending higher”.

The latest HSI data aligns to research showing that, for subdued consumers, spending on experiences contributes more to happiness than a never-ending accumulation of “stuff”.

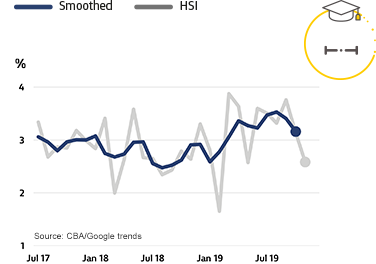

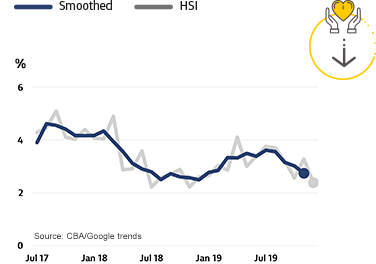

“Entertainment spending intentions are rising quickly. Travel spending intentions are inching higher. Education spending intentions are tracking at an elevated rate of growth. While intentions to spend on health & fitness have levelled out, the levelling is occurring at a solid rate of growth,” Mr Blythe added.

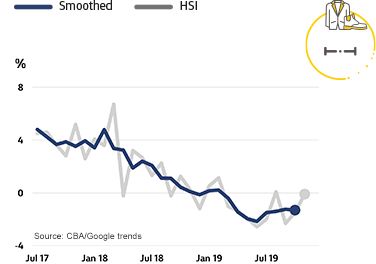

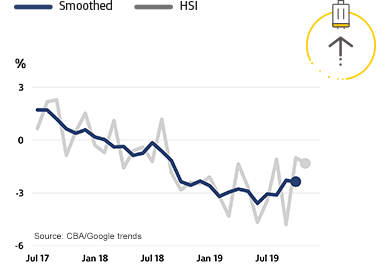

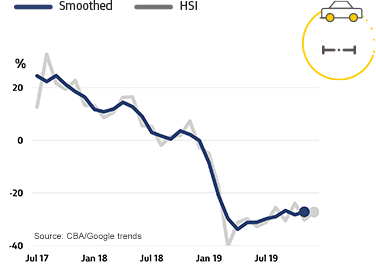

The latest HSI data shows retail and motor vehicle spending intentions are still both below the zero line, having returned negative readings since the end of 2018.

“Retail sales spending intentions are bouncing around at low levels – with the recent increase in disposable income finding its way into savings, rather than spending,” Mr Blythe said.

Although incentives such as the recent Black Friday sales can encourage consumers to spend more on goods, this generally just shifts the timing of when a purchase might take place, not the size of the total spend.

The HSI series offers a forward-looking view by analysing actual customer behaviour from CBA’s transactions data, along with household spending intentions from Google Trends searches. This combination adds to insights on prospective household spending trends in the Australian economy.

Mr Blythe said rising dwelling prices and the subsequent positive wealth effect is one potential trigger that could cause consumers to spend their savings.

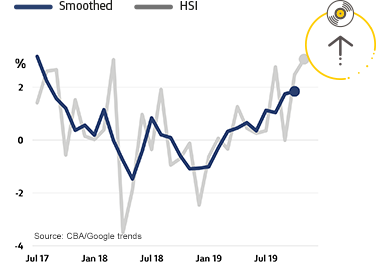

“While data for November showed a pause in the sharp upward trend in home buying intentions, they remain at high levels.

“Dwelling prices have moved far enough that the retail spending HSI should be improving from here. HSI readings point to an ongoing pick up in dwelling prices and the historical experience is that retail spending intentions tend to follow dwelling prices with a two-month lag,” Mr Blythe said.

Household Spending Intentions

CBA obtains an early indication of spending trends across seven key household sectors in Australia. Apart from home buying, the series covers around 55 per cent of Australia’s total consumer spend across; retail, travel, education, entertainment, motor vehicles, and health and fitness.

| Retail Spending Intentions |

|

| Travel Spending Intentions |

|

| Home Buying Spending Intentions |

|

| Education Spending Intentions |

|

| Entertainment Spending Intentions |

|

| Motor Vehicles Spending Intentions |

|

| Health & Fitness Spending Intentions |

|

To find out more about CBA’s Household Spending Intentions Series, visit www.commbank.com.au/spendingintentions.

Notes for Editors:

About the approach

The new approach focuses on Australian households and their spending intentions. Employing near real-time spending readings from CBA’s household transactions data and combining them with relevant search information from Google Trends was used to map the data results on consumer spending.

About Google Trends

Google Trends is a publically available service that enables people to explore search trends around the world. These searches provide insights into what consumers are doing/researching on the Internet and what their spending intentions are.

Research calendar

CBA’s Household Spending Intentions series is published on the third Tuesday of every month.

Disclaimer

This ‘CBA Household Spending Intentions’ series provides general market-related information, and is not intended to be an investment research report. The ‘CBA Household Spending Intentions’ series has been prepared without taking into account your objectives, financial situation (including the capacity to bear loss), knowledge, experience or needs. Before acting on the information in the ‘CBA Household Spending Intentions’ series, you should consider the appropriateness and, if necessary seek appropriate professional or financial advice, including tax and legal advice. The data used in the ‘CBA Household Spending Intentions’ series is a combination of the CBA Data and Google Trends™ data. Google Trends is a trademark of Google LLC. All customer data used or represented in this report is anonymous and aggregated before analysis and is used and disclosed in accordance with the Commonwealth Bank Group’s Privacy Policy Statement.

Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945.