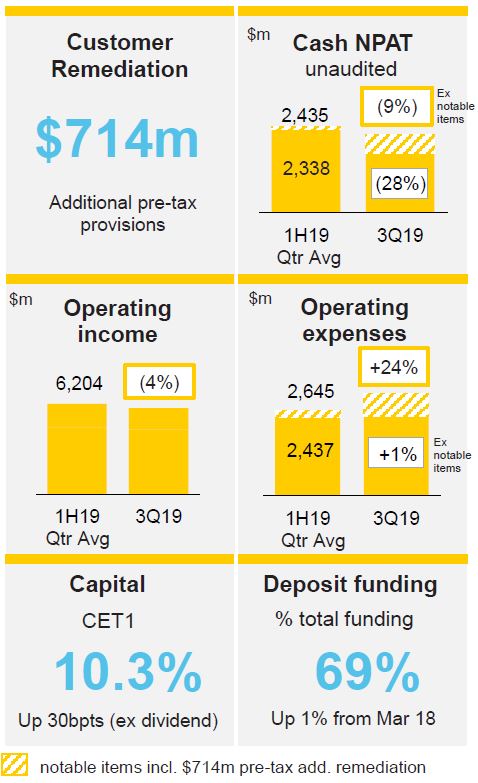

Sound business fundamentals and momentum maintained in a challenging operating environment. Additional customer remediation provisions of $714m.

“We are committed to improving outcomes for our customers, addressing past failings and compensating customers quickly. The additional $714m in pre-tax customer remediation provisions taken in the quarter demonstrates this commitment, and builds on a range of other initiatives to achieve better customer outcomes, including removing and reducing fees for our customers.

We continue to make progress on our strategy to become a simpler, better bank. While headline profitability was impacted by higher remediation provisions, our sound business fundamentals ensure we remain well-placed in a challenging environment, highlighted in this quarter by volume growth in our core businesses, a strong capital position and continued balance sheet strength.” - Chief Executive Officer, Matt Comyn.

Summary

- Sustained volume growth in our core franchise, with home loan growth in line with system and continued growth in household deposits and business lending (BPB).

- Capital and balance sheet strength maintained, with the Common Equity Tier 1 (capital) ratio of 10.3%, up 30bpts excluding the impact of the 2019 interim dividend.

- Headline profit impacted by $714m in pre-tax additional customer remediation provisions ($500m post tax). Unaudited statutory net profit was approximately $1.75bn2,3 in the quarter, with cash net profit from continuing operations approximately $1.70bn2,4. Excluding notable items, cash net profit decreased 9%.

- Operating income 4% lower, reflecting a combination of seasonal impacts, temporary headwinds (incl. unfavourable derivative valuation adjustment and weather events) and rebased fee income driven by the Bank’s Better Customer Outcomes program.

- Operating expenses increased 1% excluding notable items, or 24% including additional customer remediation provisions/notable items. Refer to page 3 for an update on the Bank’s customer remediation program.

- Loan Impairment Expense (LIE) was $314 million in the quarter, equating to 17bpts of GLAA5. Some pockets of stress remain apparent, with higher levels of consumer arrears and corporate troublesome and impaired assets in the quarter.

Further information

Download the PDF of the ASX Announcement.

Download the PDF of the Supporting Materials.

For other documents, visit our Investor Centre.

For the quarter ended 31 March 20191. Reported 13 May 2019. All comparisons are to the average of the two quarters of the first half of FY19 unless noted otherwise. Refer to Appendix for a reconciliation of key financials.

Footnotes

1 Unless otherwise stated, the financial results are presented on a ‘continuing operations’ basis. This excludes the Bank’s Australia and New Zealand life insurance businesses (CommInsure Life and Sovereign), BoComm Life, TymeDigital SA, CFSGAM and PT Commonwealth Life (discontinued operations), consistent with the financial disclosures as at 31 Dec 2018. Note the $714m in pre-tax additional customer remediation provisions includes $704m recognised in operating expenses (continuing operations) and $10m in discontinued operations.

2 Rounded to the nearest $50 million.

3 Including discontinued operations.

4 The cash basis is used by management to present a clear view of the Group’s operating results. It is not a measure based on cash accounting or cash flows. The items excluded from cash profit, such as hedging and IFRS volatility and losses or gains on acquisition, disposal, closure and demerger of businesses are calculated consistently period on period and do not discriminate between positive and negative adjustments. For a more detailed description of these items, please refer to page 4 of the Group’s 31 Dec 2018 Profit Announcement.

5 LIE calculated as a percentage of average Gross Loans and Acceptances (GLAA) annualised. Expressed in basis points (bpts).