The Commonwealth Bank Future Business Index1 is based on a detailed quantitative survey of financial decision-makers in Australian companies with turnover of $10-$100 million.

The Index reveals that more businesses are focusing on growth (53 per cent in Q2, up from 50 per cent in Q1) over cost management in the next six months, the third consecutive quarter this figure has risen and the highest reading since inception of the report in September 2011.

Mid-market businesses remained optimistic regarding future performance, with more than 70 per cent of businesses expecting to perform better in 2015 than in the previous year.

The Index also reveals a significant rise in the number of businesses expecting to increase debt facilities to fund both capital investment/expansion (29 per cent in Q2, up from 18 per cent in Q1) and everyday cash flow (21 per cent in Q2, up from 10 per cent in Q1) in the next six months. This increase is more pronounced among businesses focussed on growth initiatives.

The mid-market is generally more prepared in the December quarter, with a lift in the number of businesses indicating they are well equipped to face volatile business conditions (up four per cent to 42 per cent).

Confidence among export businesses has increased substantially, which can be in part attributed to the lower Australian dollar. This was also reflected in the relative confidence levels of export oriented industries such as agriculture, manufacturing and mining.

Confidence levels remain steady for the mid-market despite market volatility still weighing on the financial forecasts of some businesses, said Michael Cant, Executive General Manager Corporate Financial Services, Commonwealth Bank.

“The majority of businesses are expecting to perform better in 2015 than the previous year, and a continued trend towards a focus on growth initiatives over cost management is further evidence of a resilient outlook for 2015,” Mr Cant said.

“Mid-market businesses remain in good shape financially and as a result are looking to selectively fund their growth plans.

“Many businesses are also refining their risk management approach, increasing cash reserves and taking steps to ensure they are better prepared for further volatility. Overall, mid-market organisations are planning for growth, but are prepared for uncertainty. This places them in good stead for the year ahead,” Mr Cant said.

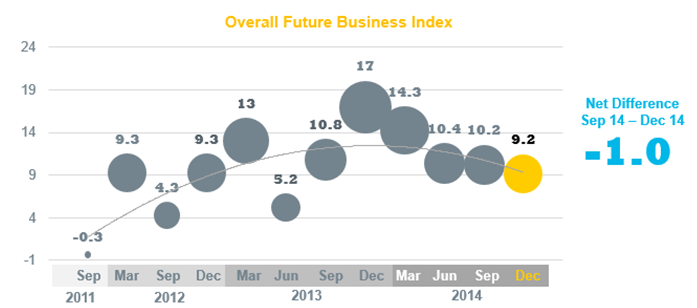

Michael Blythe, Chief Economist, Commonwealth Bank, said, “While the Index retreated in the December quarter, the decline was quite modest given the backdrop of renewed global concerns and rising financial market volatility.

“The rapid realignment of the Aussie dollar, big falls in commodity prices such as oil and iron ore, and some disappointing economic growth figures also weighed on sentiment. The theme of transition from mining to non-mining led economic growth that is central to most economists’ forecasts for 2015 was also evident in mid-market business strategies during 2014. Most notably, the ongoing trend towards growth initiatives that are essential to a successful transition,” Mr Blythe said.

Rising confidence was witnessed in a number of key industry sectors over the December quarter, most notably in Manufacturing (12.3 in Q2 up from 0.3 in Q1), Construction & Property Management (15.2 in Q2 up from 8.5 in Q1) and the Health/Education/Government sector.

Queensland is the most confident state, despite recording a 9.3 decrease in the December quarter to 16.1.New South Wales recorded the biggest increase in confidence (12.1 in Q2 up from 4.9 in Q1 up from 4.9), while Western Australia and South Australia witnessed significant declines this quarter (11.5 and 15.2 respectively), and are now the two least confident states.

About the Future Business Index

The Commonwealth Bank Future Business Index (FBI) is based on a detailed quantitative survey of 441 financial decision-makers in public and private companies throughout Australia with turnover between $10 million and $100 million. The December quarter survey was conducted between the 10th November 2014 and the 1st December 2014.

Conducted by ACA Research, the FBI is an indicator of what the business landscape will look like over the next six months, based on business confidence, predicted future activity and an organisation’s ability to manage fluctuating business conditions. The survey sample includes businesses from a range of sectors including Retail, Business Services, Construction, Health & Education, Information Media & Telecommunications, Manufacturing, Mining, Transport & Logistics and Wholesale Trade. The data has been weighted to reflect the latest Australian Bureau of Statistics Business counts.

The Index seeks to identify:

- The level of confidence in business conditions over the next six months.

- The challenges and threats businesses face over the next six months.

- How prepared businesses are to navigate volatile conditions.

- The use of financial facilities and risk planning.

- Expected sources of growth and opportunities.

How the FBI is calculated

The FBI has been calculated by taking a net balance of future business conditions, net revenue and risk as indicated by businesses with an annual turnover of $10 to $100 million.

- Net Business Conditions is a net balance of those that indicated that business conditions will improve minus those who predict business conditions will decline.

- Net Revenue is calculated by taking those companies that see an increase in revenue over the next six months minus those that foresee a decline.

- Net Well Preparedness is a net balance of those that are ‘well prepared’ minus those that are ‘somewhat’ and ‘not well prepared’.

About ACA Research

ACA Research is a full-service market research consultancy, with particular expertise in customised business-to-business thought leadership, executive research and syndicated multi-client studies throughout Australia, New Zealand and Asia. Through a high level of business and research experience, industry expertise and focus on high-quality outputs, ACA Research effectively supports business thought leaders in their decision-making activities.

For a full copy of the report visit www.commbank.com.au/futurebusinessindex