Commonwealth Bank’s Group Executive Institutional Banking and Markets, Andrew Hinchliff, said sustainability-linked loans would continue to have an important role to play in incentivising clients to run their businesses in such a way that allows them to be sustainable in the long run, not just on the environmental side, but also the social side.

“We regularly partner with large corporate and government clients to innovate and tailor individual transactions and are excited by the possibilities and applications of this kind of finance. All of which will help our clients and CBA to transition to a new, low-carbon global economy and a new world,” he said.

“Pleasingly, corporate Australia is showing a huge appetite for innovative funding and as of last month there has been A$2.45 billion worth of sustainability-linked loans printed in Australia.”

“Commonwealth Bank continues to grow our offering of sustainable finance and has been the most active bank in the sustainability-linked market, having been involved in four of the five Australian sustainability-linked loans and lending a total of A$655 million to date.”

But it’s not just local investors and borrowers who are attracted to sustainability-linked loans.

Globally, there has also been a significant spike in the volume of social bonds issued to raise funds.

As at the end of August, there had already been close to 60% more issuance of social bonds globally than the year prior.

But, it is the Wesfarmers and Commonwealth Bank three year bilateral sustainability-linked loan that has really generated some global interest, with the loan being recognised in the UK-based 2020 Environmental Finance IMPACT Awards.

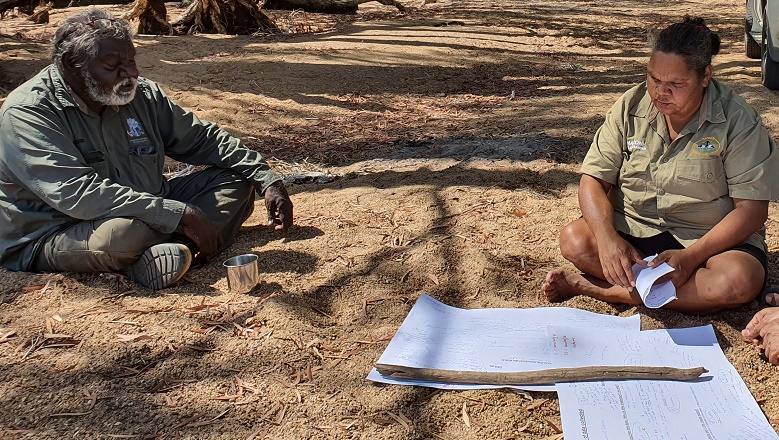

This week the Commonwealth Bank and Wesfarmers sustainability-linked loan took home the Impact project/investment of the year: Social inclusion/community development award.

“We believe that sustainable finance represents an exciting opportunity for Australian companies and broader communities and organisations, and we are proud to be recognised, along with Wesfarmers, for a first of its type loan that is linked to social outcomes,” Mr Hinchliff said.

Read more about the Environmental Finance IMPACT Awards 2020.