Federal Treasurer Scott Morrison has handed down the government’s sixth budget.

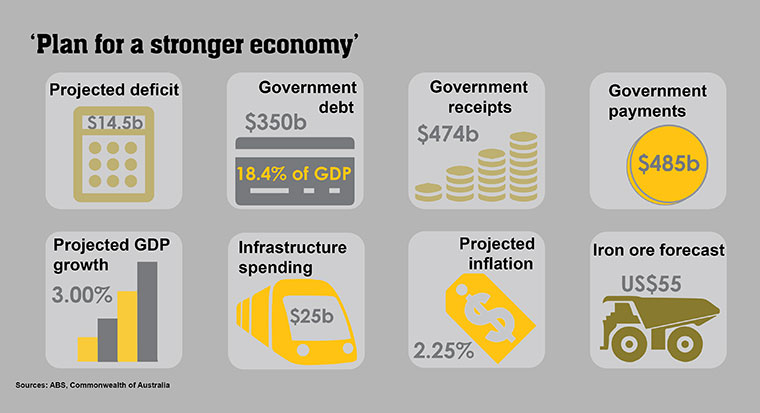

Mr Morrison said the underlying cash deficit was expected to be $14.5 billion in 2018-19, which would improve over the forward estimates to a projected surplus of $2.2 billion in 2019-20. Real GDP growth was expected to be 3 per cent in 2018-19 and remain steady in 2019-20 while unemployment was predicted to drop to 5.25 per cent in 2018-19 and remain at that level in 2021-2022, he said.

Commonwealth Bank's Head of Global Markets Research Stephen Halmarick, Director of FX Strategy and International Economics, Elias Haddad, and CommSec Senior Economist Ryan Felsman analysed the budget and its implications for the economy and markets in a discussion hosted by CommSec's Tom Piotrowski.

Read more from Commonwealth Bank on the 2018 Federal Budget

Key Budget measures

- Income tax cuts introduced in three stages:

- In 2018-19, the top income threshold of the 32.5 per cent tax bracket will be increased from $87,000 to $90,000.

- In 2022-23, the top threshold of the 19 per cent tax bracket will be increased from $37,000 to $41,000 and the top threshold of the 32.5 per cent bracket will be again increased, from $90,000 to $120,000.

- In 2024-25, the 37 per cent tax bracket will be abolished and the top threshold for the 32.5 per cent bracket increased again, from $120,000 to $200,000.

- In addition, a new low income tax offset will provide up to $530 a year for 10 million Australians.

- $75 billion in infrastructure over the next decade, including $9.3 billion in equity and grant funding for the Inland Rail.

- $20,000 instant asset write-off for small business extended a further 12 months to 1 July 2019.

- The R&D tax offset will be targeted to levels of investment intensity, delivering nets savings of $2.5 billion over the next four years.

- The government announced its response to the Black Economy Taskforce

- cash transactions greater than $10,000 to be outlawed;

- ATO surveillance and audits to deliver an extra $2.5 billion over four years;

- an additional $3.6 billion over four years to be raised by cracking down on the illicit tobacco trade.

- The 0.5 per cent increase in the Medicare Levy planned to be implemented on 1 July this year will not go ahead.

- An additional $90 million to accelerate the launch of the Trusted Digital Identity Framework (TDIF) and to allow people to fully digitise the application process for Tax File Numbers.

- States and Territories are projected to receive $5 billion in additional GST funding over four years by improving the integrity of GST on property transactions and applying the GST to digital products and services and to low-value goods imported to Australia.

- A policy change to increase the amount beverage companies can claim back on their excise and extend the concessional draught beer excise rate to smaller kegs commonly used by craft brewers.

Keep in mind

Any changes outlined in the Federal Budget must be passed by both the House of Representatives, which is controlled by the government, and the Senate, where proposed expenditures are subject to examination within Senate estimates hearings. This means any proposed cuts or changes outlined above may not necessarily become law.

Taxation considerations are general and based on present taxation laws and may be subject to change. You should seek independent, professional tax advice before making any decision based on this information.