Spending on innovation by professional services firms is delivering a return on investment almost double the national average for less outlay compared to other sectors, according to the latest CommBank Professional Services Business Insights Report.

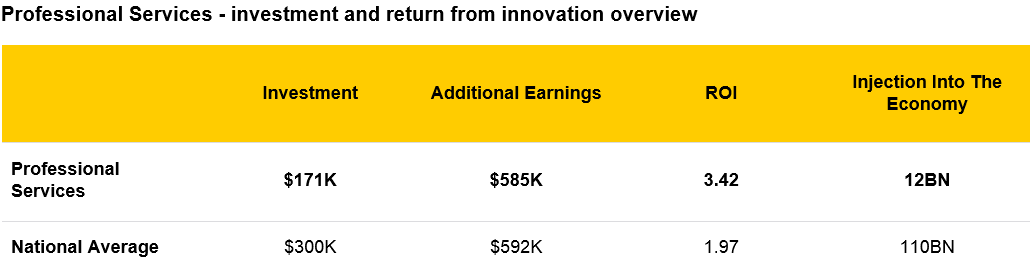

On average, Australian firms across accounting, legal, IT services, management consulting, and engineering invested $171,000 on innovations in the year to date, far less than the national average spend of $300,000 across all Australian businesses.

Despite the lower investment outlay, professional services firms are seeing revenue gains and cost reduction deliver an average uplift of $585,000 per firm, representing a return on investment multiple of 3.42 - far exceeding the national average of 1.97.

In addition to the financial return, almost half of innovation-active professional services firms surveyed rated better client outcomes (48 per cent) and greater efficiencies (46 per cent) as the top benefits of their innovation activity.

Overall, the Australian professional services industry has recorded a significant jump in innovation activity over the past 12 months, ranking well above the national average. The research shows that 56 per cent of firms are now actively innovating – up from just 44 per cent in 2016, outstripping the national average across all business (47 per cent).

These firms are also taking a proactive approach to innovation, driven by improving productivity (51 per cent of firms), while 45 per cent of firms pointed to increasing the quality of their client offering. Taking advantage of emerging technology was also a top reason for the innovation push by 35 per cent of firms. This compares to only one in ten firms responding to declining revenues or the changing workforce, and just 12 per cent reacting to the need to protect their firm against disruption.

National Manager, Professional Services, at Commonwealth Bank, Marc Totaro said: “It’s encouraging to see firms taking control as the market for professional services continues to undergo immense change. We are seeing firms adapt their internal processes and service delivery models in a range of different ways, but no matter which sector they operate in there is one striking commonality – adjusting to changing client needs.”

The top ranked areas for investment among innovation active firms included technology (53 per cent), staff training and expertise (47 per cent) and operational efficiencies (35 per cent).

When extrapolating the average increase in value from innovation across the broader professional services market in Australia, the research suggests that innovation has injected $12bn into the national economy over the past year.

“While factors such as a lack of time, budget and skills are still inhibiting innovation for some firms, it’s clear that innovation is delivering tremendous value. Firms are realising a commercial return on their investment in innovation of almost three and a half dollars for every dollar invested, and they are more efficient at deploying their available capital compared to the average business,” Mr Totaro said.

“Businesses are also investing in streamlining internal processes and ultimately driving more value for clients. As the top investment area, technology can play a significant role in supporting internal processes, and freeing up staff to focus on the client.”

The research also shows that professional services firms are more patient than the average Australian business when considering the expected timeframes to realise a return from their investment in innovation. While 65 per cent of firms are seeing a return on their investment within 12 months (compared to a national average of 73 per cent), more than one in five firms expect a pay-back from their spend within one to two years.

Innovation within the professional services industry also varies widely. Of the professional services firms surveyed, IT services firms make up the greatest proportion of innovation-active businesses (66 per cent) followed by accounting firms (65 per cent) and management consultants (60 per cent).

While more than one in two legal services firms (55 per cent) are actively innovating, this falls to just 45 per cent for architectural and engineering firms, while only a third of scientific research groups say they are pursuing innovation.

Focus areas for new investment include technology, with 66 per cent of accounting firms and 64 per cent of law firms investing in new IT capabilities such as software, cloud technology or data and analytics. Accounting firms are also responding to a need to improve efficiencies (46 per cent) while law firms are wanting to take greater advantage of emerging technologies and solutions (53 per cent).

Management consultants are the least likely to invest in technology (41 per cent) compared to other sectors, however they topped the rankings for investment in sales and marketing (36 per cent), customer centricity (26 per cent) and domestic or overseas expansion (23 per cent). Consultants said these areas support the drivers of innovation, with 48 per cent responding to a desire to improve the quality of their offering and just over a third seeking to distinguish themselves from competitors (36 per cent).

ENDS.

The CommBank Professional Services Business Insights Report can be downloaded here.

Notes

About the CommBank Professional Services Insights Report

Now in its second year, the annual CommBank Professional Services Business Insights Report is the leading study of innovation within the professional services sector. The report is based on responses from 331 firms within the management consulting, legal, accounting, scientific and technical services sectors. Firms surveyed are decision makers within organisations with an annual turnover of more than $500,000 and more than two employees. The survey was conducted by DBM consultants between August and September 2017, with data analysis undertaken by ACA Research and CBA in February 2018.