Help & support

Innovation is valued more by smaller Australian businesses than larger ones, according to Commonwealth Bank research findings released today.

The Commonwealth Bank Business and Innovation Study also shows that roadblocks to innovation include a lack of time and resources, business partners who are all talk and no action, and a lack of data to help them make better business decisions.

The majority (70 per cent) of Australian businesses surveyed say innovation is critical to the future of the Australian economy. However, close to one-in-ten (7 per cent) have declared that innovation is not important to the success of their business.

Adam Bennett, Group Executive, Business and Private Banking, Commonwealth Bank, said the findings show a need for mid-size businesses to think more like start-ups when it comes to innovation.

“Innovation starts with asking questions about how to do things simpler and more efficiently. While business owners often think of innovation as involving the use of technology, more often it involves thinking critically to better understand business challenges and opportunities.” he said.

“These findings show an interesting change in priorities from small to medium enterprises. It is vital that as businesses grow, they continue to think like a start-up or the small challenger that they once were. This means constantly questioning the norm, and reflecting on how they can better meet the needs of their customers and even be a disruptive force in their industry."

"The survey also found that 80 per cent of businesses expect their partners such as their bank to provide them with innovative thinking and tools. This is very much an area Commonwealth Bank has been investing in including our DailyIQ data analytics service, leading edge Albert point of sale device and deep business and industry expertise and advice.”

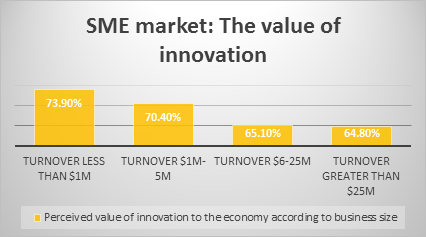

Almost three quarters (74 per cent) of businesses with a turnover of less than $1 million (m) cited innovation as critical to the Australian economy. This figure decreases as business size grows, landing at 65 per cent for businesses with a turnover of more than $25m.

Big data: big challenge

Access to data is valued highly by Australian businesses, with one-in-five (20 per cent) respondents saying they characterise ideal innovation as data driven insights that help their business innovate.

It’s unsurprising that a lack of access to data has emerged as a significant concern. Just under one-in-three (30 per cent) businesses with a turnover of $1m-$5m and 37 per cent of businesses with a turnover of $6m-$25m say they don’t have the data required to plan ahead or support strategic business decisions.

Some businesses believe the cost of accessing data is holding them back. Fifteen per cent of all businesses surveyed say they cannot afford to access the data and insights they need to better run their business. This sentiment is shared across multiple industries with one quarter (25 per cent) of small to medium enterprises (SMEs) in the Information, Media & Telecommunications sector and more than one-in-five (22 per cent) in Manufacturing, saying not being able to afford access to data is a significant challenge to their business.

Innovation unpacked

Businesses look to banks for innovation

“Australian businesses know they need to be innovative but are unsure of where to turn,” Mr Bennett said.

“Innovation usually involves a form of partnership and advice. Our view on innovation extends beyond the use of technology, to asking informed questions to better understand customer needs and using data and insights to help businesses deliver truly innovative solutions for long-term success.”

- ENDS -

About the Commonwealth Bank Business Innovation Study

The Commonwealth Bank Business and Innovation Study is a quantitative survey of 902 financial decision makers in public and private companies throughout Australia with a turnover of up to $100m. It investigates business decision makers’ attitudes towards the current business landscape and innovation. The study was carried out between 29 July and 15 September 2015 by Acuity Research and Insights, a specialist in customer and business opinion research. The sample includes financial decision makers from a wide range of industries, business size and turnover.

Media contact:

Stuart Snell

Commonwealth Bank

P: 02 9118 5921 / 0455 096 639

[email protected]

Nichole Willson

Commonwealth Bank

P: 02 9117 2947

E: [email protected]

Commonwealth Bank Media

P: 02 9118 6919

E: [email protected]