The top everyday items / essential expenses that millennials are forgoing or ‘sidestepping’ are:

- New shoes when needed (59 per cent)

- Household items (43 per cent)

- Fixing their cracked phone screen (41 per cent)

- Getting their car serviced (27 per cent)

And while 65 per cent of young Aussies admitted to putting their essential expenses on pause, 44 per cent said they put these expenses on hold in order to make a more ‘exciting purchase’.

These exciting purchases included:

- New technology (52 per cent)

- Experiences such as concerts and festivals (44 per cent)

- New or repairs to existing household items / furniture (40 per cent)

- Clothing, shoes and accessories (39 per cent)

- Socialising / dining out (35 per cent)

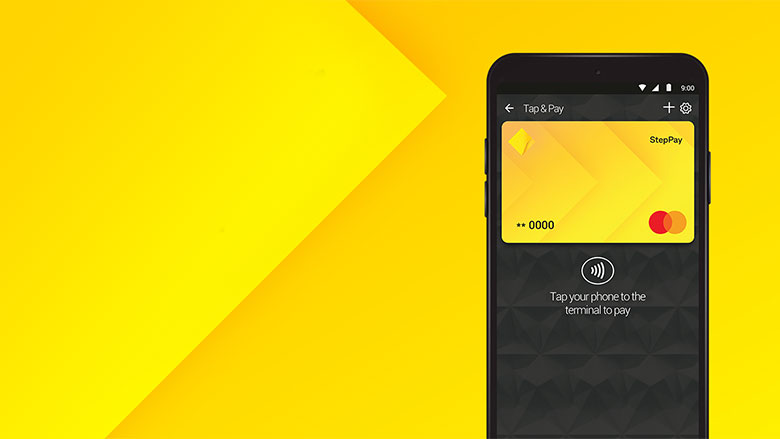

To help provide Aussies with extra cashflow so that they don’t have to put essential expenses on hold, CommBank has introduced StepPay - its buy now, pay later offering. StepPay can help eligible customers access cashflow, smooth payments and avoid sidestepping.

With StepPay, Australians can access up to $1,000 credit. StepPay has no interest or ongoing fees and can be used anywhere CBA cards are accepted.

“We’ll always need to juggle payments and expenses, but there are options available to provide extra cashflow and better manage payments,” Mr Reeves says.

Detailed findings of Millennials surveyed includes:

- Almost nine in ten (88 per cent) young Australians 25-35 years of age say they make sacrifices to their lifestyle in order to afford large purchases of up to $1,000.

- For four in ten (39 per cent) young Australians 25-35 say these sacrifices occur monthly or more often, with almost one in five (18 per cent) doing this every week. A further one in five (22 per cent) make these sacrifices for larger purchases every 2-6 months; 7 per cent every 7-12 months; 4 per cent every 1-5 years; and 16 per cent less often.

- Men (42 per cent) are more likely than women (35 per cent) to make sacrifices to their lifestyle in order to afford a large purchase of up to $1,000 monthly or more often.

- Young Australians are most likely to prioritise groceries (79 per cent), paying their electricity bill (71 per cent) and getting their car serviced (46 per cent) amongst their everyday expenses.

- Those aged 30-35 years (48 per cent) are more likely than those 25-29 years (38 per cent) to say they are happy to sidestep buying an everyday item so they can afford a more exciting purchase.