“Sorting your super out is one of those things that just sits at the bottom of life’s to-do list, slowly haunting every moment of peace that I get. Each time I give myself a high five for doing something mature, like renewing the rego or getting my tax done, I get that moment of dread knowing that my super account is just sitting there, fully aware that I’m ignoring it because, well, I don’t really know how it works,” he says in the podcast.

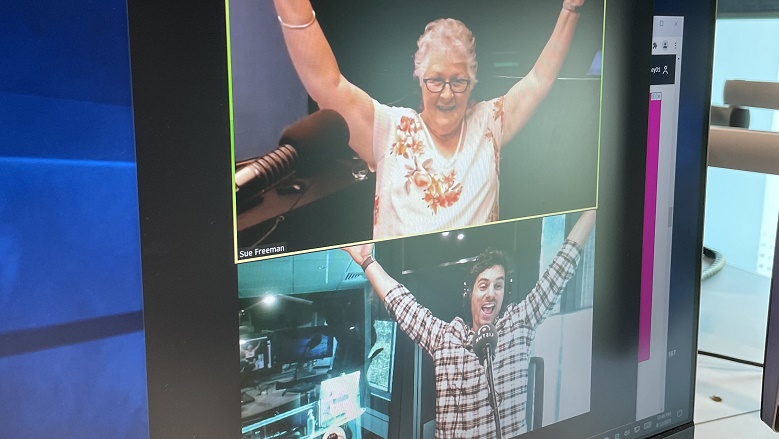

But, before Matty J seeks to enhance his understanding of superannuation, he first chats with Sue and Chris – two Aussies who are 64 and 74 years old respectively and are right now living their best lives.

Sue – a retired bookkeeper – decided to become a DJ 11 years ago and now, at 64 years of age, is still going strong and can frequently be seen ‘behind the decks’ at a club until 2am. Meanwhile, Chris swam the English Channel five years ago at the age of 69. After training for two years, Chris completed his life-long goal, spending 16 hours in the water swimming between England and France.

Both Sue and Chris prove life is what you make it and you are never too old to achieve your dreams and goals.

But, as Matty J says, if he wants to continue living his best life 30 years from now, it is important for him to better understand and consider his superannuation sooner rather than later.

Matty J then speaks with Effie Zahos to understand what superannuation is and what Aussies can do to ensure it is best working for them and their future needs.

According to Matty J and following his chats with Effie, Sue and Chris, he understands that if you fail to plan, you plan to fail. As such, he is going to engage with his super now – and not just take a set and forget attitude towards it.

“I am racing towards retirement faster than I realise. So I’m going to engage with my super now. I’ll take advantage of tax savings by topping up my account whenever I can, and I’ll find all of my lost super at Moneysmart.gov.au and I can’t wait to see how many accounts I actually have, but I’m not going to hold on to those multiple accounts unnecessarily,” he says in the podcast.

Matty J also takes the time to summarise what he has learned across the entire podcast series and how he is planning to change his ways in a raft of areas – from budgeting to investing.

“We’ve worked out our money personalities, figured out why we need a budget and goals, skilled up on how to manage money alongside our relationships. I must say Laura is already thanking me for that. We got one-step closer to being able to officially quote the castle and tell him “he’s dreaming”, by learning exactly what buying a house entails.”

“We stepped up our investing knowhow and finally sorted out our super. To put it simply, we are finance geniuses. Well, look, maybe not, but hopefully I left you better than when I found you.”