“It’s exactly what the first phase of the SME scheme was designed to do – to give businesses the support and peace of mind with extra funds in their accounts to help them stay afloat.

“Not surprisingly, given the uncertainty about the timing and trajectory of the recovery, demand for credit has been somewhat modest but I expect we will see an increase in demand with the expansion of the scheme terms.

“This next phase of the scheme will allow some businesses to continue to trade through ongoing challenges, and others to make important investment decisions that will set them up for the future.

“The flow of credit into the economy will underpin the country’s economic recovery and small businesses play a very big part in this.

“Certainly in the wake of the business measures announced in the Federal Budget this week, we’ve seen customer interest in funding through the scheme and our teams are ready to help.”

Through Phase 2 of the Scheme, the loan term has been extended to five years and the maximum loan amount to $1 million. The purpose of these loans now extends beyond working capital, to include business and investment purposes.

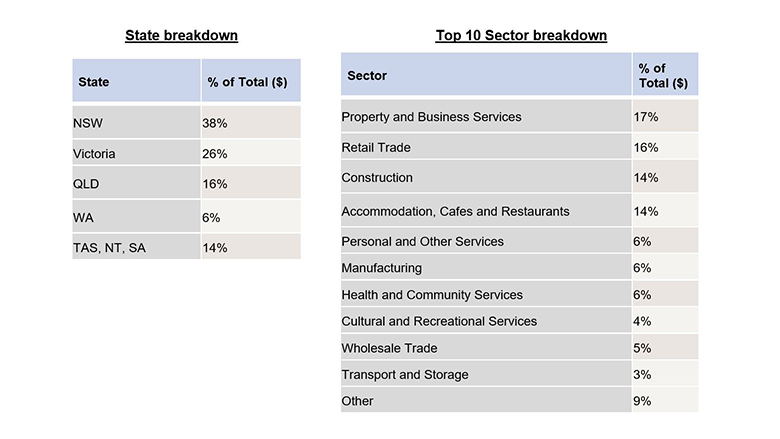

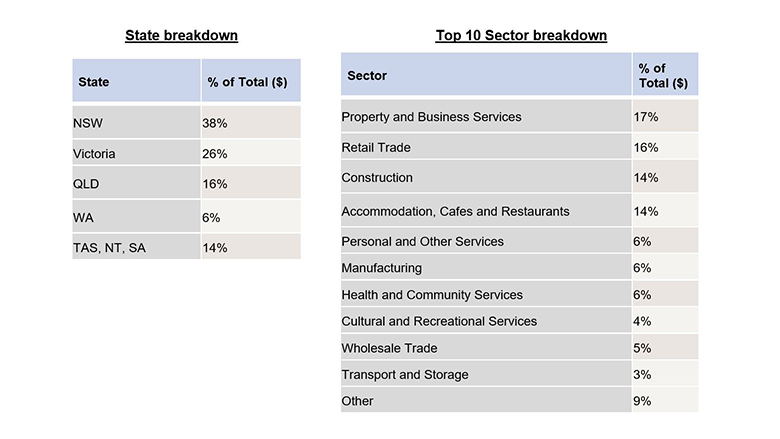

CBA approved more than $875 million in loans to 9,400 small and medium businesses through the first phase of the scheme. Of the loans funded, 38 per cent were for NSW businesses, followed by Victoria (26 per cent) and Queensland (16 per cent). Almost one in five of these customers were in property and business services (17 per cent) with retail trade (16 per cent), accommodation, cafes and restaurants (14 per cent) and construction (14 per cent) also represented.

One of these customers is Janet Kapor who owns and operates ZanKap, a Sydney based wholesaler of commercial and residential security systems, providing specialist security and home automation equipment.

“We sell our products to tradespeople who then go and install it at homes or workplaces and commercial sites across all of Sydney, Newcastle, Central Coast and also more regionally like Bathurst and Dubbo.

“You can imagine how scary it was when coronavirus hit, being a small family business and having two little kids. When everything started happening with the pandemic I started to get worried about business.

“The extra cash flow through the SME loan pretty much saved us and now that we are doing well, the money is going to help us go out and employee more staff because our business and our team are growing – even during the pandemic – so I have been incredibly lucky.

“For us, while our bigger commercial jobs slowed down, our residential side of the business has picked up – partly because more home owners have been working from home so they are home to get tradespeople around, and have started doing things that they didn’t have time to do before, and that’s included home security installation."

The business of three is now looking to double in size, recruiting for three new staff members.

“I’d tell any business considering getting out a loan [through the scheme] to do it. The loan has not only given us peace of mind, it’s helped us survive and now we can look to grow for the future.”

Through Phase 2 of the Scheme, CBA is supporting both new and existing customers with unsecured loans up to $250,000 and secured loans up to $1 million, for up to a five year period. Businesses and not-for-profits with annual turnovers up to $50 million are eligible to apply. These loans will be available until June 2021.

To find out more about this second phase of the SME Guarantee Scheme, customers can visit

https://www.commbank.com.au/latest/coronavirus/business-support. Customers can also call CBA’s Australian based business banking contact centre 24/7 on 13 19 98.

To view all of the coronavirus support measures available for CBA customers visit www.commbank.com.au/coronavirus.