CBA recently started leveraging its CEE and AI capabilities to create a purpose-built data weather model that can provide those customers who have been impacted by natural disasters with same-day tailored support solutions.

The technology solution uses custom-built algorithms to monitor, in real-time, a mix of data points from official emergency sources and weather alert systems to offer same-day 1:1 support to those customers impacted by natural disasters.

“Using the power of our Customer Engagement Engine we can connect with customers who may be impacted and also offer support that aligns to their needs, such as deferring a loan or offering an emergency overdraft,” Dr McMullan said.

“One of the great things about the team at CBA is our people have a connection to the customers and communities we serve. The team are consistently focussed on doing better, doing more, including alerting customers to natural disasters before and as they happen.”

But CBA doesn’t just leverage its CEE to deliver tailored support solutions to those customers who have been impacted by natural disasters.

Also speaking to CBA Newsroom, CBA Chief Decision Scientist, Dan Jermyn, said over the past 24 months alone, the bank had been using its CEE to support its retail customers and small businesses that have been impacted by COVID-19.

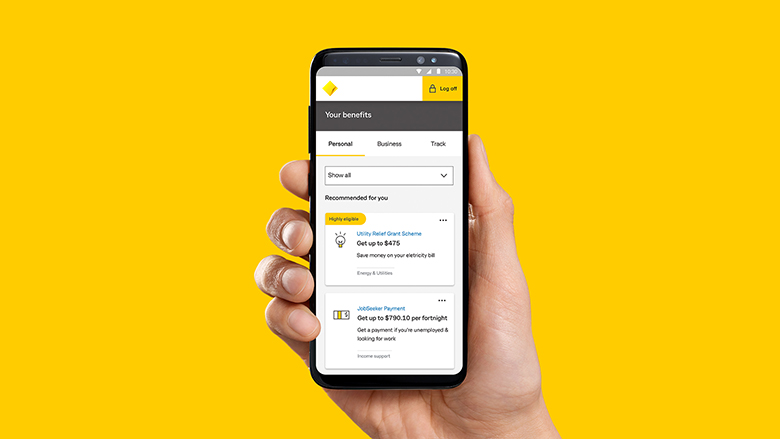

According to Mr Jermyn, the bank is able to leverage its analytics capabilities to understand customers’ financial situation and see where they may need help or assistance – like connecting them with appropriate benefits and rebates through the Benefits finder feature in the CommBank App.

Released nationally in September 2019, Benefits finder connects customers with their share in billions of dollars worth of unclaimed government rebates and benefits.

As at August 2021, more than 1.5 million claims had been commenced through the Benefits finder feature. And, in just over 12 months (July 2019 – August 2020) Benefits finder had saved customers more than $481 million across utility bills and additional government payments, with many customers standing to benefit from cost savings annually.

Looking ahead, Dr McMullan and Mr Jermyn said the bank will continue to look for ways to better harness the CEE and leverage AI to help improve the financial wellbeing of its customers.

The bank’s recent exclusive partnership with H20.ai – a global leader in AI – is just one of the steps the bank is taking to further differentiate and extend its artificial intelligence capabilities to better understand and anticipate customer needs.

“Through this partnership, we will be able to better help customers find personalised and relevant offers to save money while they shop across platforms like Little Birdie, Karta, CommBank Rewards, and Klarna, while at the same time driving sales for merchants. We intend to be one of the highest quality, lowest cost sources of leads to our business customers,” Dr McMullan said.

“H2O.ai will also help us to better predict bills and forecast cash flows for both retail and business customers so they can plan ahead. Customers want to be in control, and through the combination of our award winning app, powered by artificial intelligence, we can deliver products and services in the moment to manage unexpected expenses or irregular incomes.

“We are not just helping customers make better decisions about their finances, but also about how they can reduce and offset their energy usage and carbon emissions. We will be using our AI models to orchestrate a range of services available across the CBA ecosystem for customers, including through our own products like the Green Loan to help homeowners finance solar or a battery, or through recently announced partnerships such as Amber Energy and CoGo.”

Dr McMullan went onto say that CBA and H20.ai share a lot of the same values – including the desire to harness the power of AI to deliver social good.

“At CBA, our people genuinely believe in making a difference to the lives of the communities we serve. This belief encourages the whole bank to rise to the challenge and bust through the walls to really make a difference in the lives of our customers,” he said.

Dr Andrew McMullan and Dan Jermyn presented at the ‘6Degrees.AI – the Future of Tech, Innovation & Work’ Conference, held in Sydney yesterday (1 December 2021).