Help & support

The Australian Consumer Financial Wellbeing Report provides a nationally representative view of Australians’ financial wellbeing, and the annual rate of change.

Based on the actual transactional and account data of over five million CommBank customers who do most, or all, of their personal banking with CommBank, the report tracks financial wellbeing outcomes experienced by more than one quarter of the Australian adult population.

The report’s methodology draws on the Melbourne Institute (MI) Observed Financial Wellbeing Scale1, developed by the Melbourne Institute: Applied Economic & Social Research at the University of Melbourne. The scale is not simply a measure of income or wealth, but, more importantly, a measure of the extent to which Australians have;

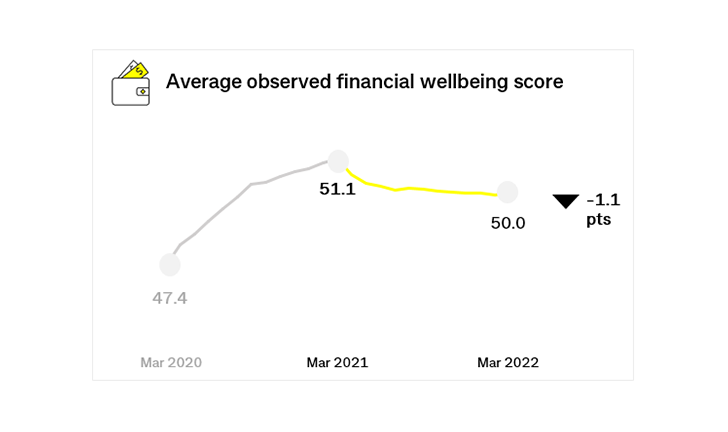

Five major indicators of financial wellbeing are combined to produce a single score, from zero (low) to 100 (high) calculated on 12 months of data.

The information provided comprises the Commonwealth Bank of Australia and its academic partners’ view and findings, and is of a general nature only. The information is available for use by others, however we ask that you cite the initial research publications. In sharing our research findings and insights, we invite others to do the same.

The Commonwealth Bank of Australia and its academic partners shall not be liable for any errors or omissions, misinterpretation or misuse of the material provided. All information is provided “as is”, with no guarantee for completeness, accuracy or currency. It does not take into account your objectives, financial situation or needs, and does not constitute financial advice.

1 Comerton-Forde, Carole, Edwin Ip, David C. Ribar, James Ross, Nicolas Salamanca, Sam Tsiaplias (2018) “Using Survey and Banking Data to Measure Financial Wellbeing”, Commonwealth Bank of Australia and Melbourne Institute, Financial Wellbeing Scales Technical Report No. 1, March 2018 https://melbourneinstitute.unimelb.edu.au/data-tools/tools/financial-wellbeing-scales