Given the impacts of coronavirus on businesses across a broad range of sectors, a widespread take-up of loan deferral options from banks was to be expected. Indeed, media attention has focused predominantly on distressed businesses seeking loan repayment deferrals.

However, the results from a recent CommBank survey of more than 900 businesses paint a very different – and surprising – picture.

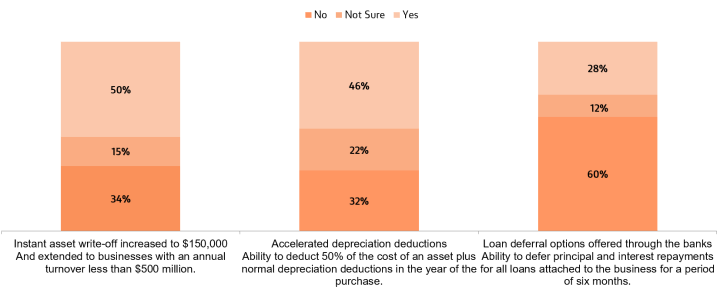

While around 28% had deferred or planned to defer their principal and interest repayments for a six-month period, government incentives aimed at boosting growth were proving more popular. Around half of the surveyed companies said they planned to take advantage of the increased instant asset write-off (50%) or accelerated depreciation deductions (46%), if they hadn’t already.

Whilst 28% of companies have deferred or plan to defer their principal and interest repayments for a six-month period, a greater proportion are opting for other forms of government financial support, designed to fuel business growth.

Below, we take a look at the ways your business can benefit from the existing government initiatives and ensure you’re taking the steps to strengthen your business during a stagnant economic environment.

Taking advantage of tax deductions

As an alternative to flexible loan payment arrangements, the government is offering stimulus measures, such as increasing the instant asset write-off to $150,000 for all businesses with an annual turnover of less than $500 million. They have also made it possible to accelerate depreciation deductions, to 50% of the cost of an asset on installation, in addition to normal depreciation deductions, in the year of purchase.

These initiatives have proven to be remarkably popular with Australian businesses. 50% are taking advantage of the instant asset write-off and 46% are using accelerated depreciation deductions.

Notably, the construction sector has been most active in leveraging these tax benefits, with almost three in four using the instant asset write-off. However, the uptake has been significant even in industries that were severely impacted by the pandemic. For example, more than two in five businesses in the retail and hospitality and health and education sectors have accessed accelerated depreciation deductions. With these strategic decisions, Australian businesses are continuing to persevere during the difficult times.