Choose a specific financial goal – whether that be saving, spending, or budgeting (Goal Tracker can help you with this). The three most essential money basics to remember, include:

Spending. Staying on track of your spending can help keep it under control. It’s as simple as:

- Checking your balance regularly to ensure you’re living within your means

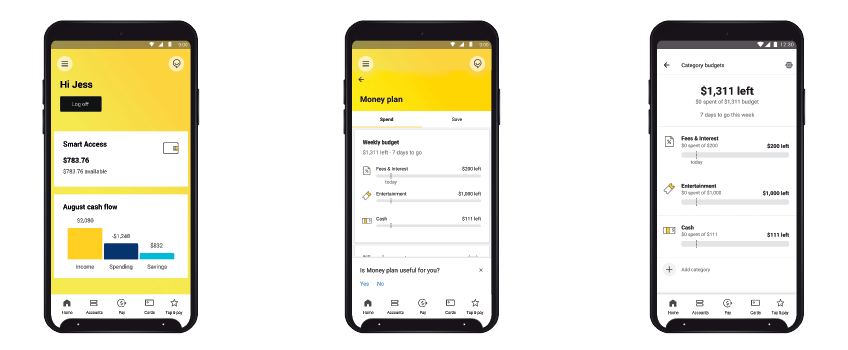

- Reviewing what you spend your money on (for example, via Spend Tracker)

- Turning on transaction notifications to alert you to when you spend and get paid