Help & support

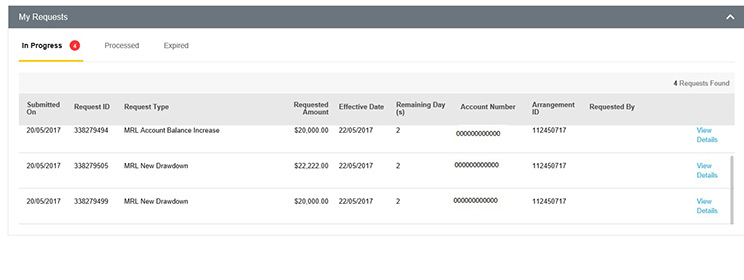

Any event that's scheduled for your loan was created with a request. To view the status of each request, go to the Market Rate Loan dashboard. Select In Progress, Processed or Expired, then select View details for more information.

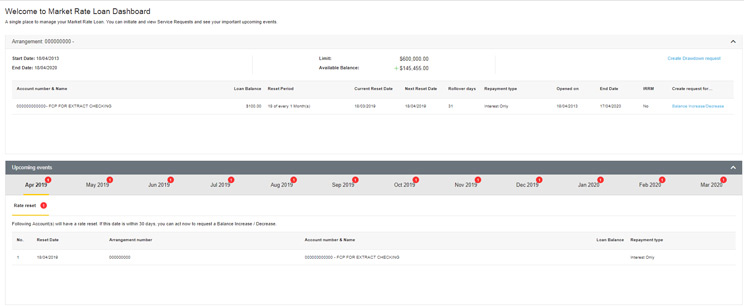

Anything scheduled to happen to your arrangement is called an event. You can view these, up to 12 months in advance, on the Market Rate Loan dashboard.

Select the month to view the number of scheduled events. These are also displayed in red circles above each month.

Was this user guide helpful?

This guide is published solely for information purposes. As this guide has been prepared without considering your objectives, financial situation or needs, you should consider its appropriateness to your circumstances and if necessary seek the appropriate professional advice before acting on the information in this guide. Where this guide is inconsistent with the Current Terms and Conditions for Business Finance or the CommBiz Terms and Conditions, the Current Terms and Conditions for Business Finance and the CommBiz Terms and Conditions prevail to the extent of such inconsistency.