Help & support

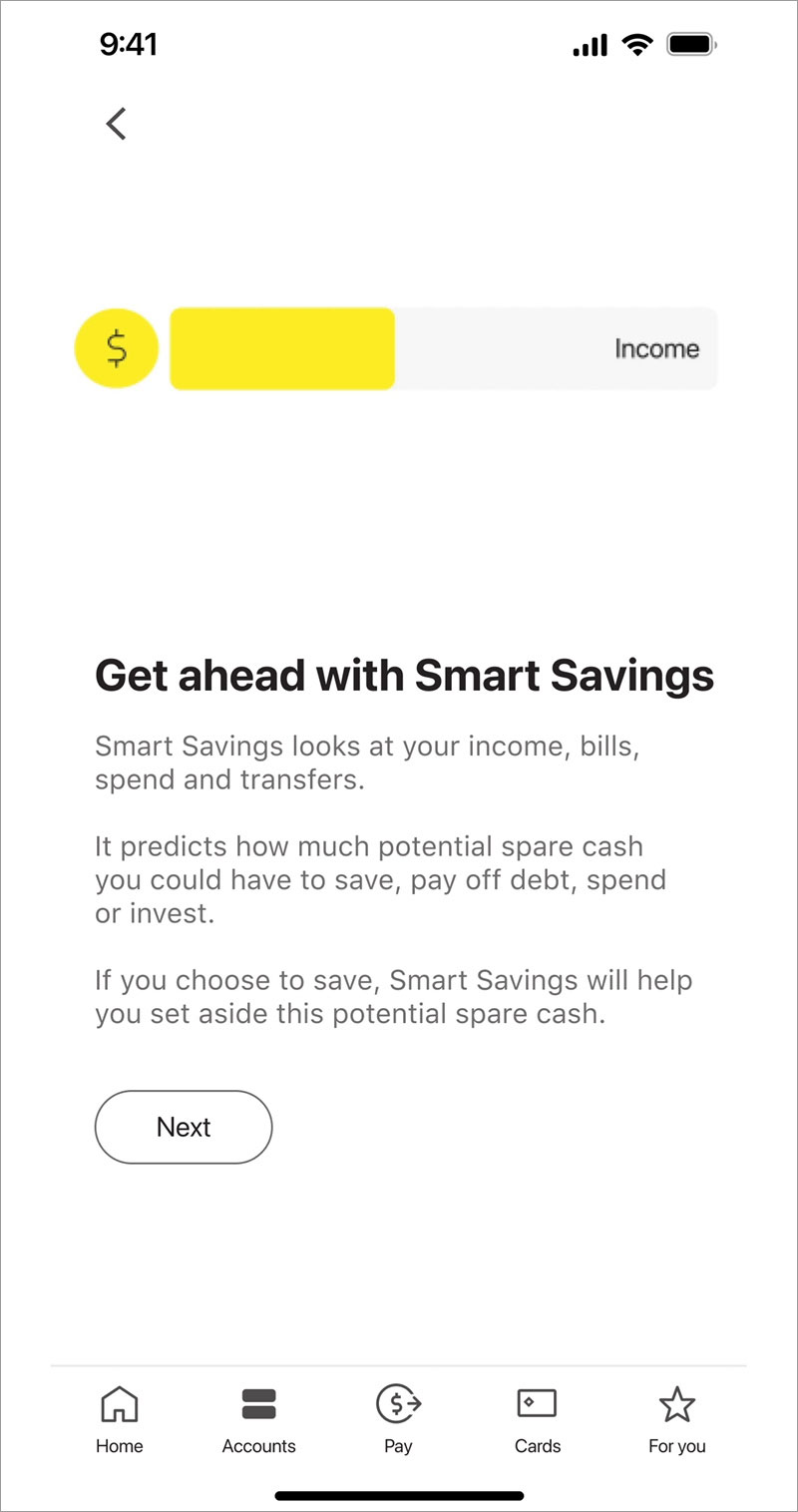

Smart Savings looks at your income, bills, spending and transfers to predict how much potential spare cash you may have each pay cycle to save, pay off debt, spend or invest. It uses other CommBank app features such as Bill Sense and Cash Flow View to make these predictions.

If you choose to save, Smart Savings will help you set aside this money.

Getting started is easy. During the set-up process, you’ll decide if you want your potential spare cash to be transferred automatically, or if you want to confirm the transfers yourself. You’ll also get to decide which account you’d like to transfer from and to. You’re able to change and update your preferences any time in the CommBank app.

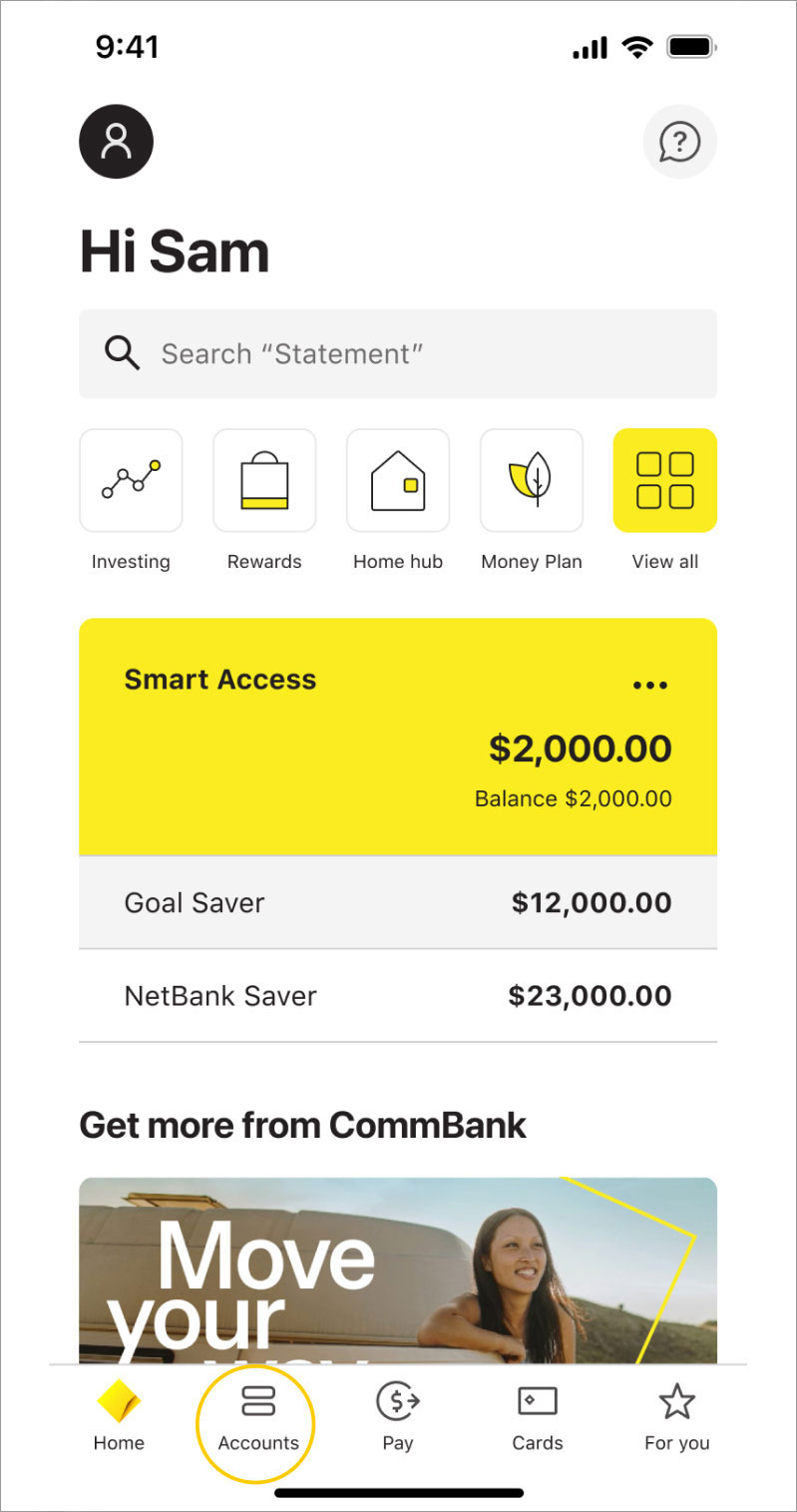

Tap ‘Money Plan’

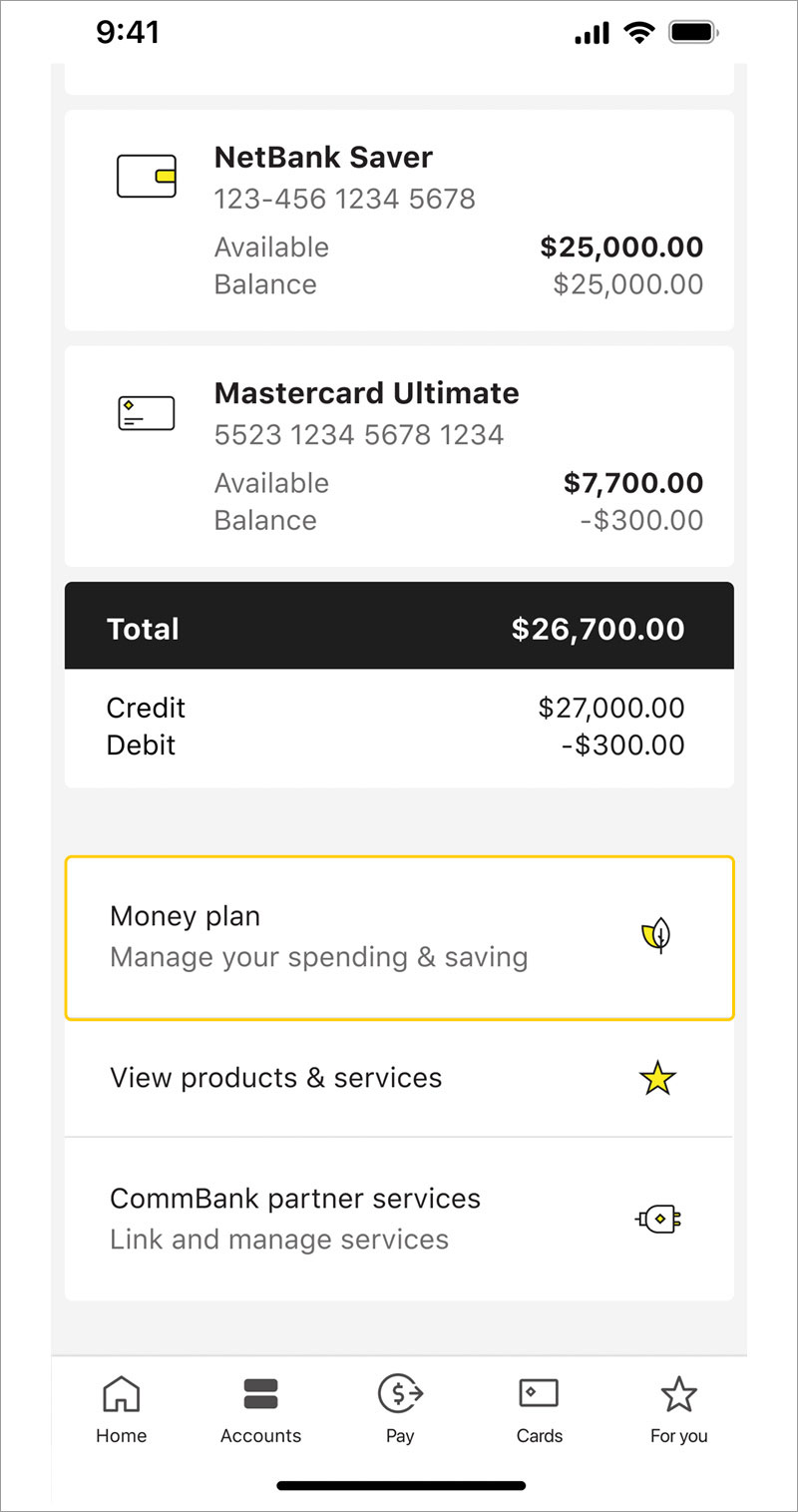

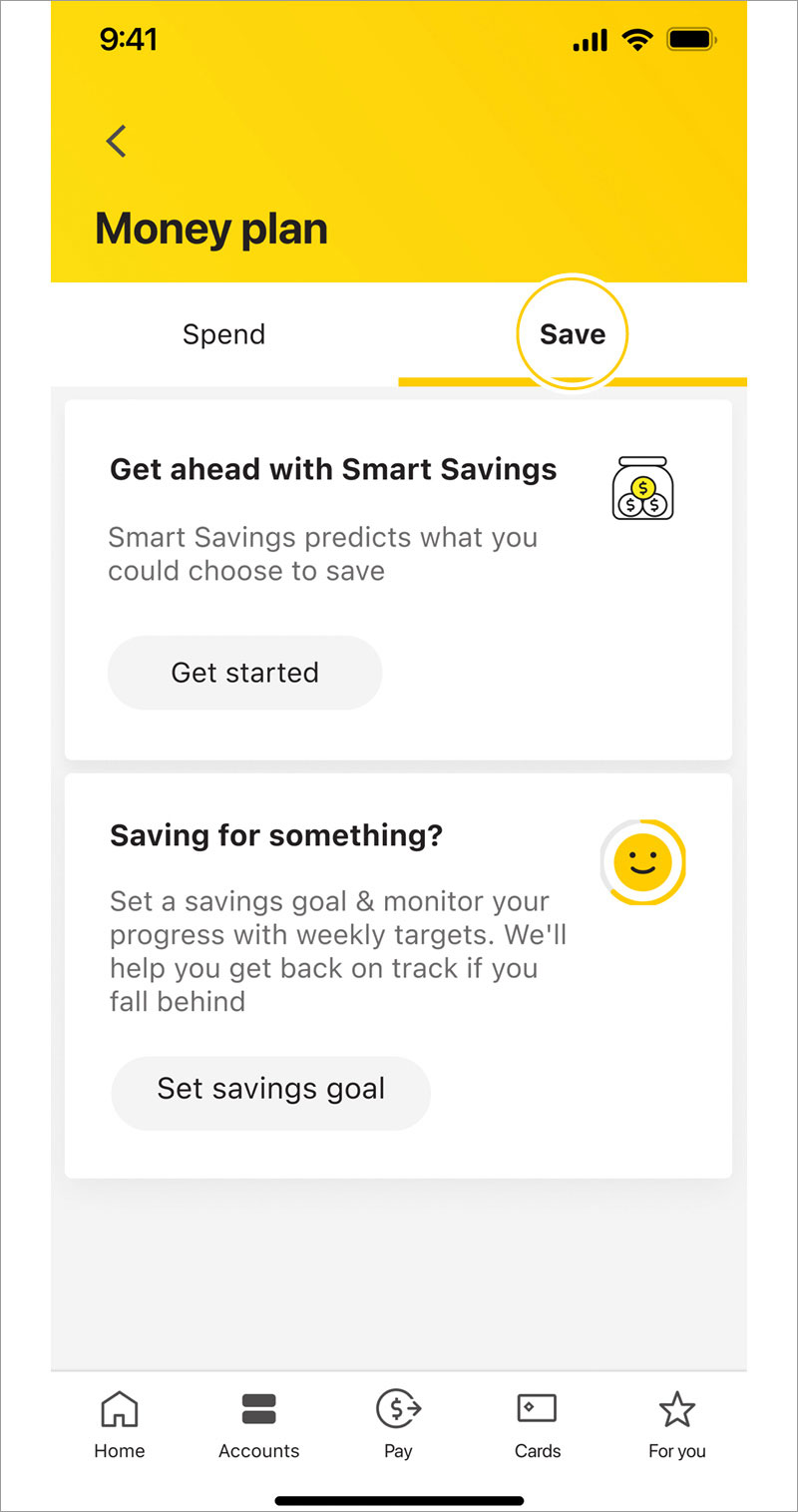

Tap on the ‘Save’ tab

Tap ‘Get ahead with Smart Savings’ and you’ll be taken through the set-up process

Smart Savings can help you to set aside small amounts of potential spare cash to use how you want.

Your predicted amount of potential spare cash will be a combination of leftover money after your bills, spending and transfers are complete, plus up to 10% of your usual non-essential spending.

We identify your non-essential spending based on categories such as ‘eating out’, ‘entertainment’ and ‘shopping’. ‘Shopping’ is spend at retail stores, both in-store and online.

As an example, if your expected income is $1,000 a fortnight and we see that you usually:

We’ll predict you’ll have $100 left over.

We’ll then add between 5% to 10% of your $500 usual non-essential spending to your leftover funds to calculate your total potential spare cash for that fortnightly pay cycle.

In this example, your potential spare cash amount for the pay cycle would work out to be:

$100 leftover + $50 non-essential spend = $150.

The potential spare cash amount for the pay cycle can be up to $150 based on your usual activity. This may be split into smaller amounts and notified to you across the pay cycle.

This means you’ll need to forego up to 10% of what you regularly spend on non-essential items if you want to use the total potential spare cash amount in the pay cycle to save, pay off debt, spend or invest.

After you’ve set up Smart Savings, you can set up a maximum transfer amount – Smart Savings won’t transfer more than this amount.

If you know you have larger expenses than usual coming up (for example, if you're going on holiday, or just want a break from Smart Savings), you can pause the Smart Savings feature anytime.

If you want to stop using the Smart Savings feature altogether, you can easily do so:

If you choose to save your potential spare cash, you’ll need to choose an eligible account which your Smart Savings amount will be transferred between.

Eligible accounts that potential spare cash can be transferred from are:

Eligible accounts that potential spare cash can be transferred to are:

When selecting from and to accounts, consider where your income and bills are linked and any interest rates associated with this account.

If you don’t have an eligible account, you’ll need to open one to use the feature.

If either of your chosen accounts switch from an eligible to an ineligible account, the feature will no longer work. If your account switches to another eligible account, the feature will continue to work as normal.

You’ll need access to the CommBank app to set up Smart Savings.

If you have a joint account with a two-to-sign method of operation, you won’t be able to use this feature.

If you have a joint account with a one-to-sign method of operation, only one party will be able to use the feature. This means that if one party sets up the feature, the other party won’t be able to:

Depending on your income and spending habits, Smart Savings transfers can be made up to twice a week.

If you don’t have any income coming into your selected Smart Savings account, you may not receive Smart Savings amounts.

You can only set up Smart Savings with one account to transfer from and one account to transfer to. These must both be eligible CommBank accounts.

If your account is overdrawn, Smart Savings won’t make any transfers. Before Smart Savings makes a transfer, a balance check will occur to make sure the transfer amount won’t take your account to less than $0. You should make sure your account has sufficient funds to meet your bills, scheduled payments, and any other spend.

Only account holders can set up Smart Savings. If you’re an Authorised Operator or Power of Attorney for any eligible account, you won’t be eligible to use this feature for those accounts.

You can access the Smart Savings feature through the CommBank app to see your notifications at any time.

If you’ve chosen to manually approve transfers, you’ll be able to go to your dashboard, view and approve any transfers you may have missed.

If you’ve chosen automatic transfers, you’ll also be able to view those transfers through your Smart Savings dashboard.

Smart Savings is progressively rolling out over the coming weeks.