Help & support

After completing this module, you should understand

After reading this module, test your understanding in the question and answer section and review the summary of things you should know.

Every day, people invest in a bank in a number of ways.

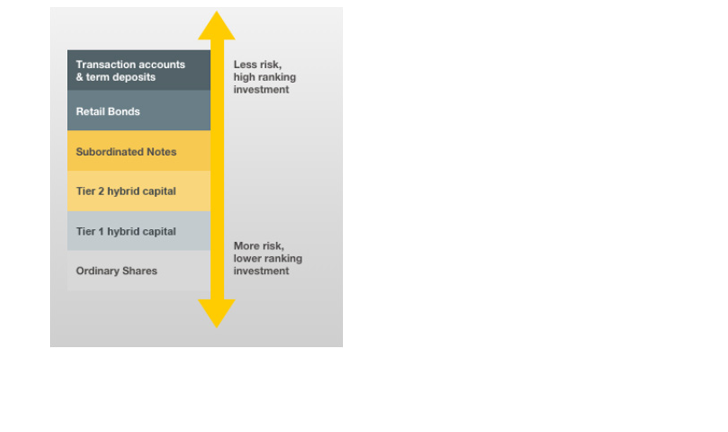

The most common way is by depositing money in a transaction account or term deposit account. Another way is by investing in securities issued by a bank such as retail bonds, Tier 2 hybrid capital, Tier 1 hybrid capital and ordinary shares. Tier 1 hybrid capital securities and Tier 2 hybrid capital securities are together called "bank hybrid securities".

Depending on the type of investment an investor may be exposed to different levels of risks and return. Investors should carefully consider which investments are appropriate depending on their individual circumstances.

Each type of investment has different features. This may result in the following outcomes for investors.

For a description of each type of investment and a comparison of their different features click the link below.

Bank hybrid securities are complex to understand and carry a number of risks for investors.

Distributions

Market and liquidity risk

Redemption and subordination

Non-viability

If a bank experiences financial difficulty (called becoming "non-viable") or breaches a certain capital level, then the bank regulator may require the bank hybrid securities to immediately be exchanged into ordinary shares or written-off completely.

If the bank hybrid securities are exchanged into ordinary shares, the value of the ordinary shares may not be equal to the investors' original investment and the investor is then exposed to the risks of holding equity in the bank.

If for whatever reason the hybrid securities cannot be exchanged into ordinary shares, then investors' rights will be terminated, and investors risk losing some or all of their investment.

Bank hybrid securities are generally less risky for investors to invest in than ordinary shares and can provide a regular and defined income stream in the form of distributions.

Bank hybrid securities provide an opportunity for investors to diversify their investments. Investors should invest in a diversified portfolio.

Banks publish annual reports and other information during the year. You should read this information to understand and monitor a bank’s ongoing financial position.

When banks offer bank hybrid securities, they publish a prospectus. You should read this in full before deciding to invest.

For further details of these financial ratios to monitor a bank’s financial performance click the link below.

There are different ways to measure returns on bank hybrid securities. The most common ways include:

You can find some or all of these measures quoted in broker rate sheets or through a financial or other professional adviser who has access to the relevant information.

The actual method of calculation of each of these measures may differ among sources and may be based on varied assumptions, so you should seek advice from your financial adviser or other professional adviser in interpreting the information.

For details on what each measure means and how it is calculated click the link below.

Test your knowledge and understanding of bank hybrid securities by completing the Q&A section available at the link below.

Before investing in bank hybrid securities you should

The information in this module is not investment advice and has been prepared without taking into account your investment objectives, financial situation or particular needs (including financial and tax issues). If you have any questions, you should seek advice from your financial adviser or other professional adviser.