Fast facts

- 51% of surveyed businesses are focusing on energy efficiency

- Key business drivers include cost and regulation benefits

- 44% would like to see a standardised ratings system

Fast facts

More than a year on from the start of the COVID-19 pandemic, there’s a sense of cautious optimism as many businesses shift into a phase of consolidation. And as businesses gain greater confidence in their survival and growth, the issue of sustainability is slowly being put back on the agenda.

This was a key finding from our CommBank report, which seeks to examine the impact of COVID-19 on business revenue and asset finance. This report was informed by a survey of over 900 business decision-makers, which was conducted by ACA Research.

While only 13% of the businesses surveyed had a sustainability policy in place, around a third (33%) were planning to implement one in the next 12 months. More than half (51%) will also be focusing on the energy efficiency of their plant and equipment.

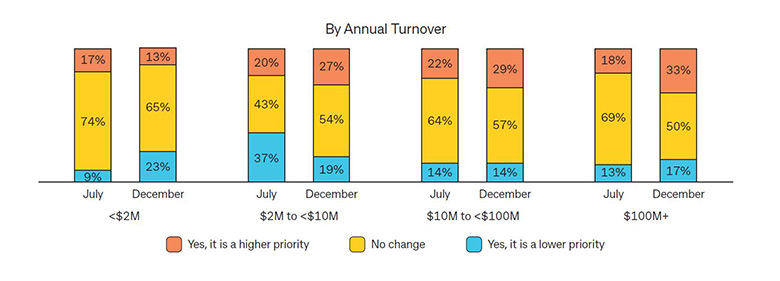

The survey suggested that higher turnover organisations, in particular, had the biggest focus on making sure their equipment was energy efficient.

And while this took a backseat during the pandemic-induced downturn last year, the graph below shows that at the time of the survey, businesses were once again considering efficiency in their asset purchasing plans.

The research highlighted that the main drivers for businesses to prioritise sustainability and energy efficiency were cost and regulation benefits, and the desire to be a better corporate citizen.

Some said that price and scalability generally came before energy efficiency when investing in an asset, while others saw the longer-term cost benefits of moving towards energy-efficient machinery and products.

For many, the federal government’s instant asset write-off provisions have provided an opportunity to invest in newer and more efficient assets. According to the Energy Efficiency Council’s October 2020 Energy Briefing, pandemic-related financial support represented an “unprecedented opportunity to make strategic investments in assets that drive major energy productivity improvements”.1

One finding that emerged from the research was an apparent appetite for a standardised rating system to help businesses with their equipment purchasing decisions.

Most of us are familiar with the energy efficiency ratings system used on household appliances (the more stars, the more cost savings), and the star rating on commercial buildings. However, there’s no standardised system in Australia to measure the energy output of business machinery and equipment.

But perhaps there should be. Almost half (44%) of those surveyed for our report said it would be useful to have a standardised ratings system so they could make more informed decisions about the assets they lease or purchase.

Interest was particularly high among larger businesses with a turnover of $10 million or more, especially in the distribution (63%) and retail and hospitality (55%) sectors.

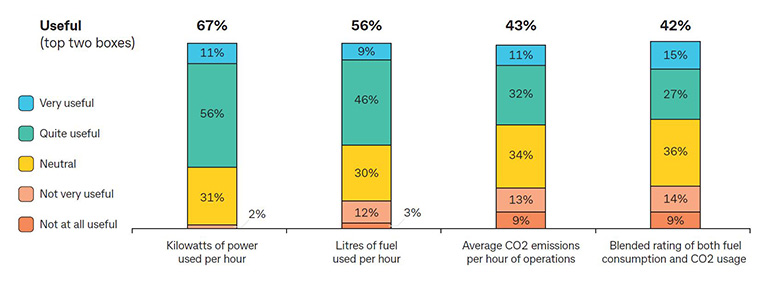

More than two-thirds of business decision-makers (67%) who were interested in the idea of a standardised ratings system agreed that kilowatts of power used per hour would be the preferred measurement. This was followed by litres of fuel used per hour (54%) as a way to compare the energy efficiency of assets.

How useful would the following criteria be to compare energy efficiency when evaluating and selecting assets for your business?

The National GreenPower Accreditation Program is an interesting initiative to watch, and could set a precedent for how a ratings system could work. It’s an independent test offered by providers of GreenPower renewable energy to set criteria and a benchmark for consumers and businesses that have implemented the GreenPower product2.

For businesses looking to invest in energy-efficient assets, the federal government’s instant asset write-off provides a key opportunity. This stimulus measure, designed to get businesses to invest, has been extended until June 2023.*

It applies to both new and used assets and provides businesses with help to make upgrades to more energy-efficient equipment and machinery.

CommBank also offers discounted financing to help businesses fund energy-efficient vehicles, equipment and projects.**

Find out more about our asset finance solutions, or call 1800 ASSETS to speak with your local, Australian-based asset finance specialist.

Things you should know

1 Energy Efficiency Council, Navigating a dynamic energy landscape, October 2020.

2 GreenPower, About GreenPower, accessed March 2021.

The CommBank survey statistics used in this article are based on a survey of 911 business decision-makers, conducted by ACA Research for CommBank between 25 November to 17 December 2020, entitled Equip: Issue 13 Asset Finance Thought Leadership Research. All statistics used are from this research unless otherwise stated.

*Tax law is subject to change. For the latest information, please check the ATO website. Commonwealth Bank is not a registered tax (financial) adviser under the Tax Agent Services Act 2009 and you should seek tax advice from a registered tax (financial) adviser.

**Credit provided by the Commonwealth Bank of Australia. These products are only available to approved business customers and for business purposes only. Applications for finance are subject to the Bank’s eligibility and suitability criteria and normal credit approval processes. You should view our current Terms and Conditions for Asset Finance and consider them before making any decision about these products. Rates are subject to change. Fees, charges and Terms & Conditions apply. Commonwealth Bank of Australia ABN 48 123 123 124, Australian credit licence 234945.