How finance needs are changing

While careful not to overextend, nearly one third (28%) of those surveyed believed their finance needs would increase, albeit slightly, over the next 12 months. The majority of business leaders (51%) said they would take a cautious approach to debt finance, despite recognising the opportunity that current low interest rates represent.

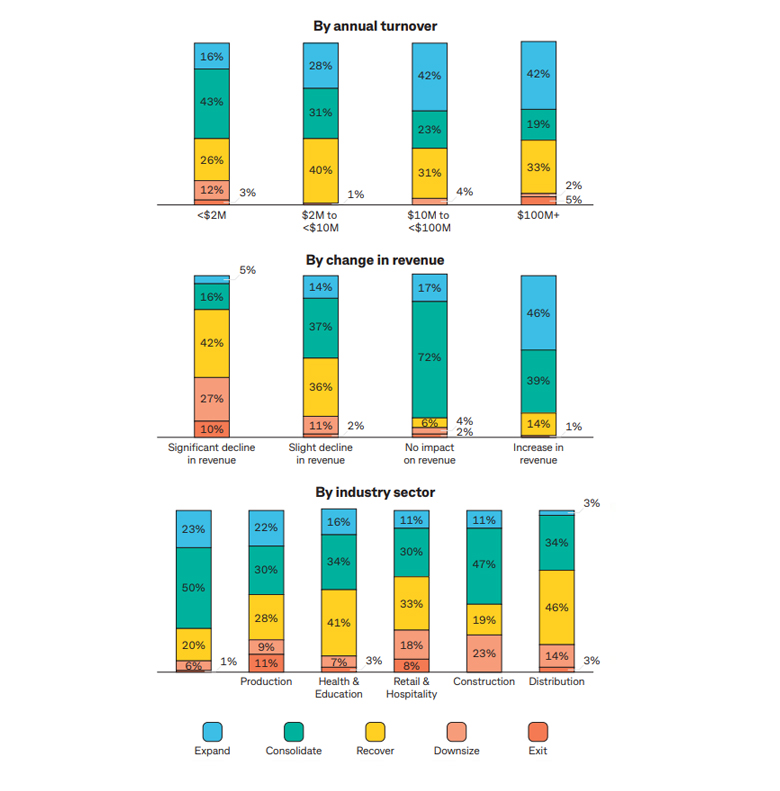

Higher turnover organisations were more bullish in their approach, most likely because they tend to be less volatile in times of economic uncertainty and can typically borrow more easily. A large construction company said that increasing debt to build up working capital and boost its safety stock levels during COVID-19 made obvious sense. Meanwhile, a retail/wholesale business said that with interest rates so low, it was a good time to borrow to purchase equipment and take advantage of the federal government's instant asset write-off*.

However, organisations with a lower turnover – under $2 million – were more bearish in their approach. They were also the businesses most likely to stretch the lifespan of the assets they already have, or to reduce their working equipment needs. Having said this, the overall proportion of businesses stretching their assets had declined by 10% since July 2020.

Government provisions to support asset investment

Government stimulus has helped provide incentives for businesses to purchase new assets. For example, instant asset write-downs have been a catalyst for many businesses to invest in equipment and technologies which will help future-proof their business and create longer term efficiency and growth. The federal government recently extended its instant asset write-off* initiative to June 2023.1 The provision can be used for both new and second-hand assets and is available to 99% of businesses across the country.

Others have made use of low cost and tax effective funding enabled by the Reserve Bank Term Funding Facility (TFF).** This initiative has contributed to lower borrowing rates across the market.2

Asset finance in 2021

While optimism is returning, business confidence in investment over the next 12 months is heavily dependent on the removal of current COVID-19 restrictions and the roll out of vaccines.

More than a third (39%) of those surveyed said the complete removal of lockdowns and restrictions would give them more confidence to increase their capital investment. This was followed closely by the vaccine rollout (38%), domestic borders reopening (30%), and business revenues returning to pre-COVID levels (30%).

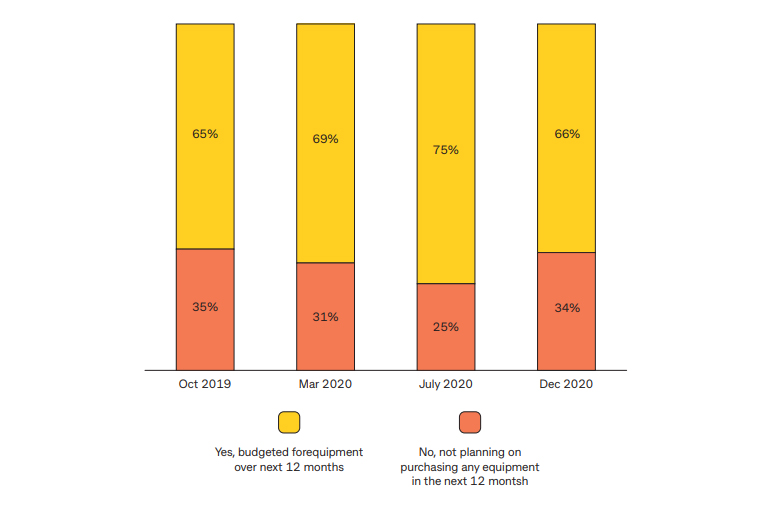

Two-thirds (66%) of survey respondents said they had budgeted for assets over the next 12 months. While this was lower than in the previous survey conducted in the midst of the pandemic, it is roughly on par with pre-COVID purchasing intentions. This indicates that while businesses remain wary, they are also optimistic – and planning for better times ahead.

Purchasing plans over the next 12 months: