Help & support

Common trading terms you might come across in your investment journey.

Common terms you may come across when investing in managed funds.

Common terms you may come across that apply to investing in general.

Compare and contrast different investment strategies.

Understand the relationship between risk and return in investing.

Discover how saving and investing can work together in your money plan.

Common fees and costs you may encounter when investing.

Understand the key documents you may come across when investing.

Learn about different types of financial product advice available for investors.

Learn the basics of how shares work with this guide for beginners.

Learn what managed funds are and how they work.

Discover more information about what ETFs are.

Learn about different ways that could help grow your wealth.

Explore micro-investing and how to start investing with small amounts of money.

Learn what the P/E ratio is, how to calculate it, and why it's important for evaluating shares.

Helping investors get started by building understanding and confidence around investing.

Simran Kaur, the founder of Friends That Invest, breaks down investing education and money mindset into easy-to-understand knowledge bites.

This podcast looks to guide new investors through the process of becoming a confident share market investor.

Always wanted to invest, but not sure where to start?

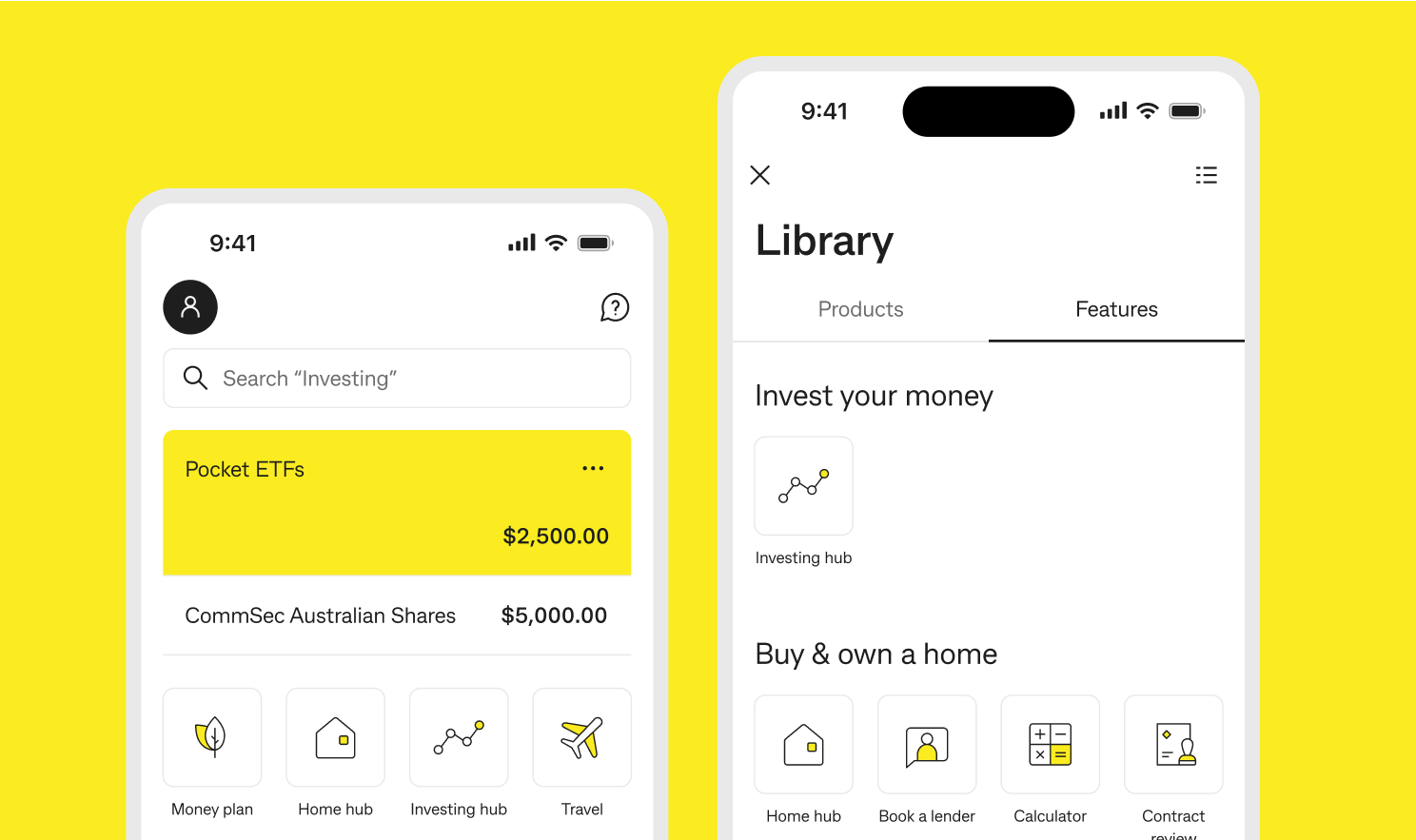

Log in to the CommBank app and tap the ‘Investing hub’ tile from your app dashboard or Library to start exploring.

This page is intended to provide general information of an educational nature only. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice. As the information has been provided without considering your objectives, financial situation or needs, you should, before acting on this information, consider if it is appropriate to your circumstances. You should consider seeking independent financial and/or tax advice before making any decision based on this information.

The information on this page and any opinions, conclusions or recommendations are reasonably held or made, based on the information available at the time of its publication but no representation or warranty, either expressed or implied, is made or provided as to the accuracy, reliability or completeness of any statement made in this article.

The CommBank app is free to download, however your mobile network provider charges you for accessing data on your phone. Find out about the minimum operating system requirements on the CommBank app page. Terms and conditions are available on the app.

Commonwealth Securities Limited ABN 60 067 254 399 AFSL 238814 (CommSec) is a wholly owned but non-guaranteed subsidiary of the Commonwealth Bank of Australia ABN 48 123 123 124 AFSL 234945. CommSec is a Market Participant of ASX Limited and Cboe Australia Pty Limited, a Clearing Participant of ASX Clear Pty Limited and a Settlement Participant of ASX Settlement Pty Limited.

CommSec Invest is created and distributed by Commonwealth Securities Limited. Content is general in nature. Investing carries risk.