Help & support

Through a 12-month research partnership with the University of Melbourne (PDF), we’ve defined financial wellbeing as your ability to:

Knowing your financial wellbeing means you can take steps to improve it. By completing our short survey you’ll discover:

The questions get you thinking about your recent and past financial experiences relating to financial freedom, choice and control. And how you’d respond to those same experiences if you were financially challenged.

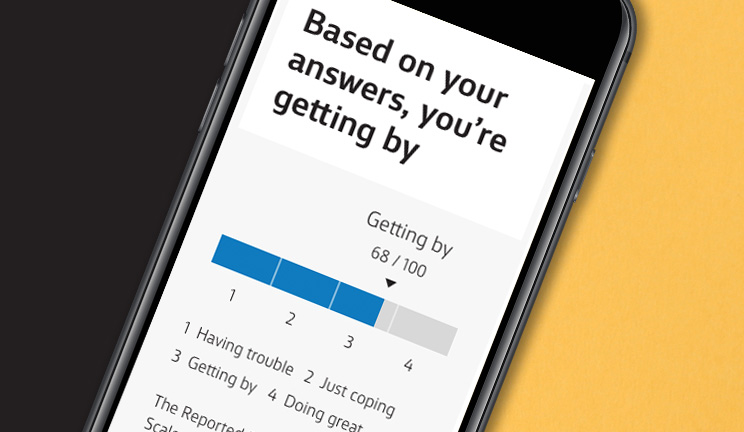

You’ll get a financial wellbeing score of between 1 and 100. This will help you to determine if financially you’re having trouble, simply getting by, comfortable, or in a good position.

You'll also receive some simple steps to improve your financial wellbeing. You must be 18 or over to participate.

The Financial Wellbeing survey was developed in partnership with the Melbourne Institute of Applied Economic and Social Research and the Department of Finance at the University of Melbourne.

Read more on our partnership: