Help & support

If you’re a CommBank Yello Diamond customer, you could receive a $10 monthly cashback on each eligible home and landlord insurance policy you hold (up to $120 annually for each eligible policy). Home Insurance and Landlord Insurance are provided by Hollard and distributed by CommBank. Cashbacks are available even if you receive other home insurance or landlord insurance discounts or offers, including the combined policy discount.

Eligible home insurance and landlord insurance cover types provided by Hollard and distributed by CommBank include:

To qualify for the cashback benefit, you must hold an eligible home insurance or landlord insurance policy on the last day of the previous month.

Cashbacks aren’t available for insurance that covers contents as a standalone policy. Cashbacks are available per policy, rather than per customer.

If there are multiple potential recipients of a single cashback benefit (e.g. if there is more than one policyholder eligible for the cashback benefit), we will pay the cashback to:

The cashback will appear as ‘CBA Yello Insur Cashbk' in your transactions.

For further information on program eligibility or details on what account the cashback gets paid into, refer to clause 4.1 and 4.4 in the CommBank Yello Terms and Conditions.

You should consider the potential tax implications of receiving a CommBank Yello cashback on your eligible insurance policy (especially if you’re claiming a tax deduction based on your policy). Please check out our FAQs available at commbank.com.au/commbank-yello/faqs for some further information or seek independent advice from your accountant or tax adviser.

If you’re a CommBank Yello Gold or Diamond customer, you could receive a $4 monthly cashback on your Home Loan Package fee (up to $48 annually). A Home Loan Package is a Wealth Package or Mortgage Advantage (Package). The cashback will be paid per Package rather than per customer.

You must hold a Package on the last day of the previous month to qualify for the cashback benefit in a particular month.

If there are multiple potential recipients of a single cashback benefit (e.g. if there is more than one Package holder eligible for the cashback benefit), we will pay the cashback to:

The cashback will appear as ‘CBA Yello HLPckg' in your transactions.

Cashback is not available where the Package is pending or closed, or from the moment where the Package fee has been fully or partially waived.

You should consider the potential tax implications of receiving a CommBank Yello cashback on fees relating to your home loan (especially if you’re claiming a tax deduction for the fees connected with your loan). Please check out our FAQs available at commbank.com.au/commbank-yello/faqs for some further information or seek independent advice from your accountant or tax adviser.

For further information on program eligibility or details on what account the cashback gets paid into, refer to clause 4.1 and 4.4 in the CommBank Yello Terms and Conditions.

Cashback on Digi Home Loan

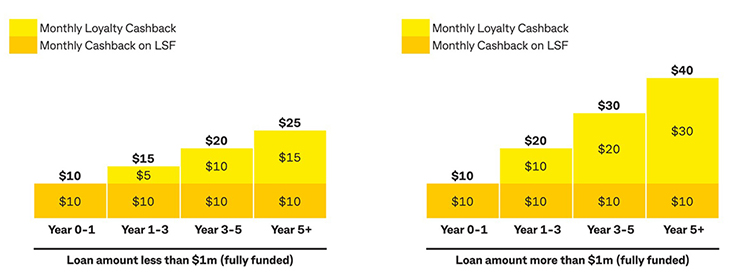

If you’re a CommBank Yello Gold or Diamond customer with a Digi Home Loan, you could receive a $10 monthly cashback on your Loan Service Fee (up to $120 annually). Plus, you could get a loyalty cash reward which increases over time once your loan has been fully funded for a year. Note this benefit is based on the funded loan amount on your Digi Home Loan only.

If you have a Digi Home Loan of less than $1 million for:

If you have a Digi Home Loan of more than $1 million for:

The benefit will be paid per Digi Home Loan, rather than per customer. Your Digi Home Loan must be open on the last day of the previous month to be eligible for the cashback benefits.

If there are multiple potential recipients of a single cashback benefit (e.g. if there is more than one Digi Home Loan account holder eligible for the cashback benefit), we will pay the cashback to:

The cashback for the monthly Loan Service Fee (up to $120 annually) will appear in your statement as ‘CBA Yello Digi CbkXXXX' and the loyalty cashback reward will appear in your statement as 'CBA Yello Digi RwdXXXX', where ‘XXXX’ is the last four digits of your Digi Home Loan account number.

Eligibility is typically assessed monthly and customers must meet the CommBank Yello Gold or Diamond eligibility criteria. Refer to clause 4.1 in the CommBank Yello Terms and Conditions for more information.

You should consider the potential tax implications of receiving a CommBank Yello cashback on fees relating to your home loan (especially if you’re claiming a tax deduction for the fees connected with your loan). Please check out our FAQs available at commbank.com.au/commbank-yello/faqs for some further information or seek independent advice from your accountant or tax adviser.

For further information on program eligibility or details on what account the cashback gets paid into, refer to clause 4.1 and 4.4 in the CommBank Yello Terms and Conditions.

Cashback on Simple Home Loan

If you’re a CommBank Yello Gold customer with a Simple Home Loan, you could receive a $10 monthly cashback on your Loan Service Fee (up to $120 annually). If you’re a CommBank Yello Diamond customer with a Simple Home Loan, you could receive a $15 monthly cashback on your Loan Service Fee (up to $180 annually).

The cashback will be paid per Simple Home Loan, rather than per customer. Your Simple Home Loan must be open on the last day of the previous month to be eligible for the cashback benefits.

If there are multiple potential recipients of a single cashback benefit (e.g. if there is more than one Simple Home Loan account holder eligible for the cashback benefit), we will pay the cashback to:

The cashback will appear as ‘CBA Yello Simp CbkXXXX’ in your transactions, where ‘XXXX’ is the last four digits of your Simple Home Loan account number.

Eligibility is typically assessed monthly and customers must meet the CommBank Yello Gold or Diamond eligibility criteria. Refer to clause 4.1 in the CommBank Yello Terms and Conditions for more information.

You should consider the potential tax implications of receiving a CommBank Yello cashback on fees relating to your home loan (especially if you’re claiming a tax deduction for the fees connected with your loan). Please check out our FAQs available at commbank.com.au/commbank-yello/faqs for some further information or seek independent advice from your accountant or tax adviser.

For further information on program eligibility or details on what account the cashback gets paid into, refer to clause 4.1 and 4.4 in the CommBank Yello Terms and Conditions.

If you’re a CommBank Yello Gold or Diamond customer with a CommBank Home Loan, you could receive a property report generated by our approved service provider. Your property must be classified as residential, defined as dwellings used for domestic occupation; and have a valid and up-to-date address recorded in our system (to allow our service partner to match against their records). Plus, there must be enough information on that address for our service partner to generate a report.

Property reports are generated once you are an eligible CommBank Yello Gold or Diamond customer with a CommBank Home Loan and will be issued through the CommBank app. You’ll be able to view or access each report for six months from the date the report was generated. If we don’t have a record of your full address, you may receive a Suburb Report. A Suburb Report focuses on your suburb, rather than your specific property.

If you close your CommBank home loan, you’ll no longer receive property reports for that property, but you may continue receiving them for other eligible properties.

If you haven’t received a property report, or only received a Suburb Report, please message us in the CommBank app or visit your local branch to provide us with your full address details. This will help ensure you receive a property report when next eligible.

The information contained in each report is general in nature and based on data about your property, the suburb or region your property is situated in or the real estate market that is available to our external data provider. This information is not specific advice and cannot be relied upon for mortgage lending purposes. All information contained in the property report is publicly available.

For further information on program eligibility, refer to clause 4.1 in the CommBank Yello Terms and Conditions.

If you’re a CommBank Yello Gold customer, you could receive a $5 monthly loyalty payment for investing in Australian Shares (including Exchange Traded Funds, ‘ETFs’) with CommSec. If you’re a CommBank Yello Diamond customer, you could receive a $10 monthly loyalty payment for investing in Australian Shares (including ETFs) with CommSec.

You’ll need to settle at least one trade over $1,000 monthly, with an Individual CommSec Share Trading Account into a Commonwealth Direct Investment Account (CDIA). The trade must be settled by the last day of the previous month.

The loyalty payment (payment) will be paid monthly and is limited to one payment per customer a month. We check your eligibility at the start of the month, for your settled trades in the previous month. The payment will appear as ‘CBA Yello Invest Loyal’ in your transactions. No payment will be paid if you do not keep your status as a CommBank Yello Gold or Diamond tier customer when eligibility is assessed.

Additionally, to obtain the payment, trades subject to eligibility assessment must relate to online trades that are CHESS – sponsored by CommSec. The payment is not available to customers with a joint, company or trustee CommSec Australian Share Trading Account, and to customers trading through CommSec Pocket, International Shares, Exchange Traded Options or trades financed by Margin Loans.

For some information on potential tax implications, please check out our FAQs available at commbank.com.au/commbank-yello/faqs or seek independent advice from your accountant or tax adviser.

For further information on program eligibility or details on what account the payment gets paid into, refer to clause 4.1 and 4.4 in the CommBank Yello Terms and Conditions.

If you're a CommBank Yello Gold or Diamond customer, you could get $1,500 Cashback on eligible CommBank home energy Personal Loans. The loan must be funded for the purchase of a Brighte home energy upgrade package.

Eligible home energy loans:

Good to know:

For some information on potential tax implications, please check out our FAQs available at commbank.com.au/commbank-yello/faqs or seek independent advice from your accountant or tax adviser.

For further information on program eligibility or details on what account the cashback payment gets paid into, refer to clause 4.1 and 4.4 in the CommBank Yello Terms and Conditions.

For more information generally, go to Home Energy Upgrades.

If you’re a CommBank Yello customer, you may qualify for a once-off cashback if you purchase a vehicle through Cars for CommBank.

To qualify for the cashback, you must enquire about and purchase a vehicle using the Cars for CommBank platform; and finance the vehicle with an eligible CommBank Secured Fixed Rate Car Loan. You must also be in CommBank Yello, CommBank Yello Plus, CommBank Yello Gold or CommBank Yello Diamond, in the month that your CommBank Secured Fixed Rate Car Loan is funded. The cashback amounts are:

The cashback will be paid to your CommBank Yello cashback account within four weeks of your CommBank Secured Fixed Rate Car Loan being funded. You must also be approved for the loan, accept your contract and complete verification. Loan approval is subject to credit checks and assessment of your application. The cashback will appear as ‘CBA Yello [XXX]’.

We reserve the right to close or vary this offer at any time, including the amount of cashback and the eligible CommBank Yello tiers.

Information contained on this page is a guide only and doesn’t consider your individual objectives, financial situation or needs. Before basing any decisions on this information, consider:

For further information on program eligibility or details on what account the payment gets paid into, refer to clause 4.1 and 4.4 in the CommBank Yello Terms and Conditions.

CommBank Yello Gold customers could receive a $5 cashback on World Debit Mastercard. CommBank Yello Diamond customers could receive a $10 cashback on World Debit Mastercard.

Eligibility is typically assessed at the beginning of each month. To qualify for the cashback benefit, customers must:

Good to know:

For some information on potential tax implications, please check out our FAQs available at commbank.com.au/commbank-yello/faqs or seek independent advice from your accountant or tax adviser.

For further information on program eligibility or details on what account the payment gets paid into, refer to clause 4.1 and 4.4 in the CommBank Yello Terms and Conditions.

As this information has been prepared without considering your objectives, financial situation or needs, you should consider its appropriateness to your circumstances before relying on this information.